In terms of transaction details, the group’s three member funds, KB Vietnam Focus Balanced Fund, Vietnam Enterprise Investments Limited, and Wareham Group Limited, purchased 25,000, 100,000, and 100,000 shares, respectively.

Based on IDC’s closing price of VND 59,200 per share on August 8, Dragon Capital’s group is estimated to have spent more than VND 13 billion on this transaction.

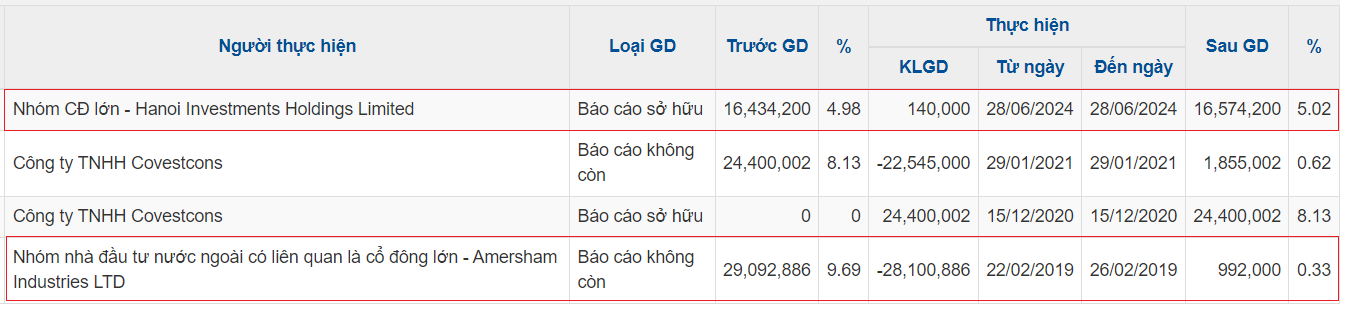

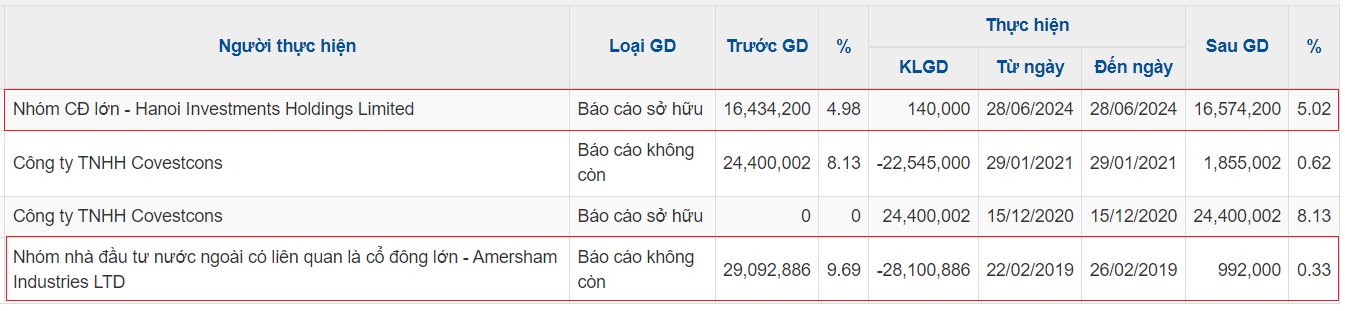

Prior to this, on June 28, Dragon Capital returned to being a major shareholder of IDC after more than 5 years (since February 2019) by net buying 140,000 shares, increasing its ownership from 4.98% to 5.0225%.

Source: VietstockFinance

|

Recently, Dragon Capital has been consistently buying IDC shares as the industrial park (IP) giant, IDICO, was approved for investment in the Tan Phuoc 1 IP in Tien Giang province, with a scale of 470 hectares, in late May 2024. The company expects to start leasing the land by the end of 2025.

Additionally, IDICO is one of the few enterprises granted permission by the Ministry of Industry and Trade to build a 110kV transformer station to directly distribute electricity to tenants in the IP.

Moreover, the company’s consistent high cash dividend payout of 30-40% over the years, and the expected continuation of this policy in the coming years, has also made IDC stock more attractive to investors.

Regarding financial performance, in the first half of 2024, IDICO recorded consolidated net revenue and net profit of nearly VND 4,616 billion and VND 1,128 billion, respectively, up 30% and 65% over the same period last year.

For the full year 2024, the industrial park giant set consolidated revenue and pre-tax profit targets of VND 8,466 billion and VND 2,502 billion, up 13% and 22% year-on-year, respectively. The company has achieved 56% and 69% of these targets in the first half of the year. IDICO also plans to lease out 145 hectares of industrial land this year.

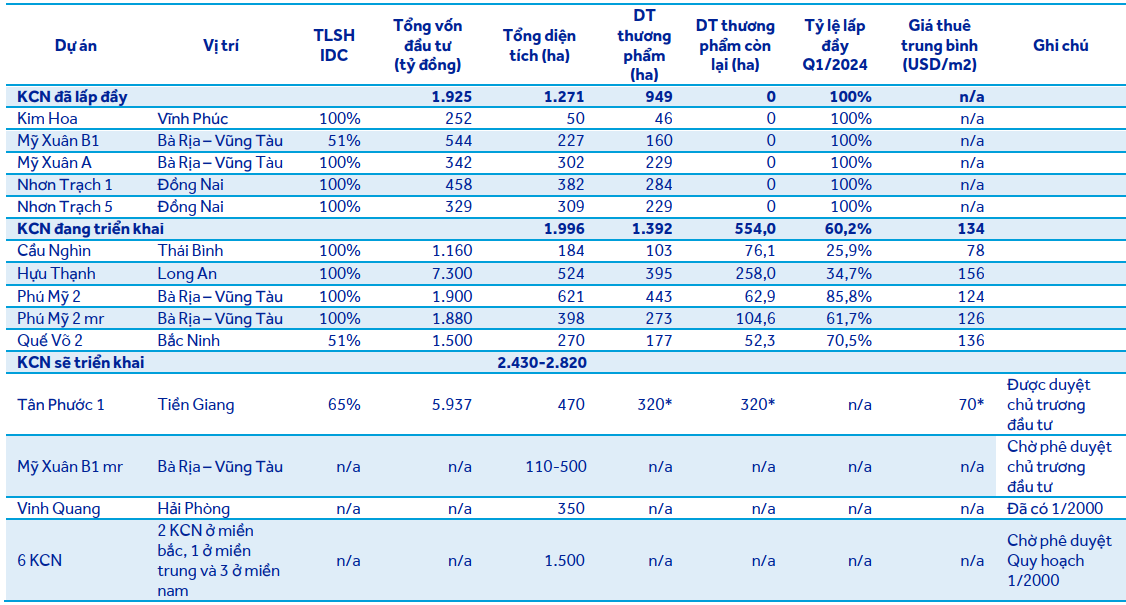

According to ACBS, IDICO has over 550 hectares of remaining commercial land, with a significant portion located in Hựu Thạnh IP (Long An) at over 258 hectares, and Phú Mỹ 2 expanded IP (Bà Rịa – Vũng Tàu) at nearly 105 hectares.

In addition to the newly approved Tan Phuoc 1 IP, IDC is also awaiting approval for the expansion of Mỹ Xuân B1 IP (Bà Rịa – Vũng Tàu) from 110 to 500 hectares, and the planning of 6 other IPs with a total area of 1,500 hectares.

Source: ACBS

|