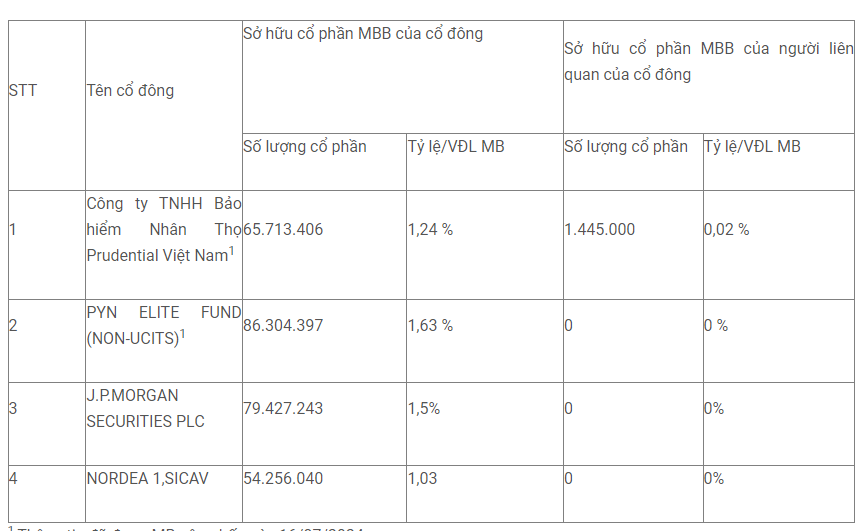

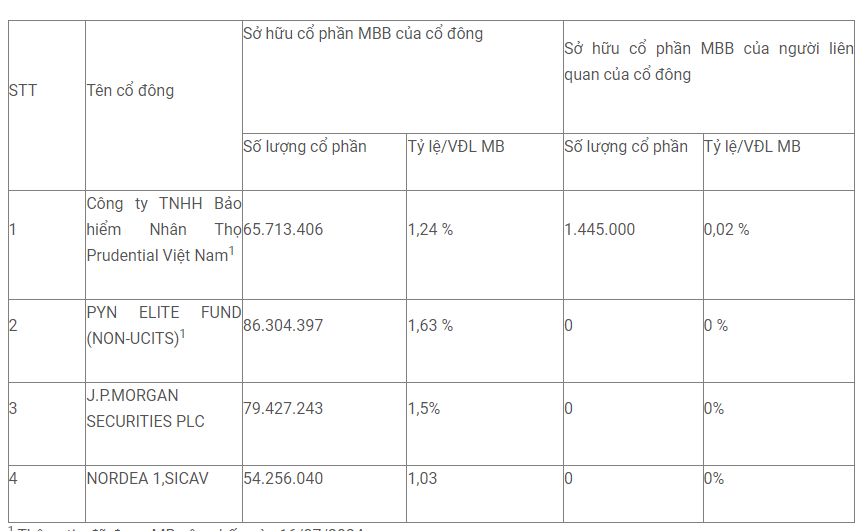

On August 13, Military Commercial Joint Stock Bank (MB – HoSE: MBB) updated its list of shareholders owning 1% or more of its charter capital. Compared to the list published on July 15, two new shareholders were revealed: J.P.Morgan Securities and Nordea 1, SICAV. These two shareholders hold a total of 133 million MBB shares, equivalent to 2.53% of the bank’s charter capital.

Specifically, J.P.Morgan Securities holds 79.4 million MBB shares, representing 1.5% of MB’s capital, and has no related parties owning MBB shares. Nordea 1, SICAV owns 54.2 million MBB shares, equivalent to a holding percentage of 1.03%, and also has no related parties holding MBB shares.

Based on the market price of MBB on the stock exchange, the value of the MBB shares held by J.P.Morgan Securities is over VND 1,800 billion, and that of Nordea1, SICAV is VND 1,273 billion.

The ownership ratio of the other two shareholders, Prudential Vietnam Life Insurance Company Limited and Pyn Elite Fund, remained unchanged.

Prudential Vietnam Life Insurance Company Limited holds more than 65.7 million MBB shares, equivalent to 1.24% of the bank’s charter capital. In addition, related parties of Prudential Insurance also own nearly 1.5 million MBB shares, or 0.02% of the capital.

The foreign fund Pyn Elite Fund (NON-UCITS) holds 86.3 million MBB shares, equivalent to 1.63% of the capital. Related parties of this fund do not own any MBB shares.

The declaration of ownership of 1% or more of the charter capital is made in accordance with Clause 5, Article 49 of the Law on Credit Institutions 2024. According to the amended Law on Credit Institutions, which took effect on July 1, shareholders owning 1% or more of the charter capital of a credit institution must provide the institution with their information and that of their related parties, including: Full name; individual identification number; nationality, passport number, date and place of issue for foreign shareholders; business registration certificate or equivalent legal document for organizational shareholders; date and place of issue of this document. In addition, shareholders owning 1% or more of the charter capital must also provide information on the number and proportion of shares owned by themselves and their related parties in the credit institution.

Shareholders owning 1% or more of the charter capital must submit a written declaration to the credit institution providing this information initially and whenever there are changes to this information within seven working days from the date of occurrence or change of information. Regarding the ownership ratio, shareholders owning more than 1% of the charter capital are only required to disclose information when there is a change in the ownership ratio of shares by themselves and their related parties from 1% of the charter capital compared to the previous declaration.

Thus, the list of shareholders owning 1% or more of the bank’s charter capital will be continuously updated based on the reports of the shareholders.

It is known that in addition to the four shareholders mentioned above, MB has many other shareholders owning 1% or more of its charter capital, including four major shareholders holding more than 44.3% of the bank’s capital: Saigon New Port Corporation (376 million MBB shares, equivalent to 7.1% of charter capital); Vietnam Helicopter Corporation (holding 447 million shares, equivalent to 8.43%); Military Industry and Telecoms Group (Viettel holding 1 billion shares, or 19%) and State Capital Investment Corporation (SCIC holding 9.8% of MB’s capital, equivalent to 532 million shares).

Mango and Xemesis Sell 40% Stake in Beef Selling Avocado, Xemesis’s Brother Inherits as New Owner

The reason for the couple’s retreat to Bơ Bán Bò is revealed by Xoài Non, due to the unresolved issues of the shareholders.