Mr. Nguyen Anh Dinh, Deputy General Director and Assistant to the Chairman of the Board of Directors of TNH Joint Stock Company (code: TNH), has purchased 100,000 shares from July 10 to August 8. Previously, Mr. Dinh registered to buy 1 million shares but only purchased 1/10 of this number due to unfavorable market conditions.

Mr. Dinh is the son of Mr. Nguyen Van Thuy, a member of the Board of Directors and Director of the Yen Binh Thai Nguyen Branch of TNH, who currently holds over 2.6 million TNH shares (equivalent to 2.37% of charter capital).

In the same period, Mr. Ngo Minh Truong, Deputy General Director and Member of the Board of Directors of TNH, also registered to purchase 500,000 shares but only successfully purchased 26,500 shares for similar reasons.

Previously, Blooming Earth Pte. Ltd., an organization from Singapore, bought 412,000 TNH shares on July 12 to become a major shareholder. They then continued to purchase 4.3 million TNH shares on July 15, bringing their total holdings to 10 million shares (9.1% of capital). The transaction on July 15 was likely carried out through a matching method, with an estimated value of nearly VND 129 billion.

Recently, many leaders and related parties of TNH have simultaneously wanted to divest. From July 19 to August 16, two deputy general directors of the company, Mr. Le Xuan Tan and Mr. Nguyen Van Thuy, registered to sell 1.5 million and 3.5 million TNH shares, respectively. Notably, the three children of Chairman Hoang Tuyen also registered to divest all their held shares from July 15 to August 13.

In the market, TNH shares have reversed and declined sharply after reaching a 2-year high. The share price is currently at VND 23,000/share, down nearly 20% after more than a month but still 23% higher than the beginning of the year.

In another development, TNH recently approved the signing of an appendix to the contract to extend the loan term with members of the Board of Directors for an amount of VND 92 billion. This is the amount the company borrowed from its leaders to repay bonds issued in 2020.

The extended period is until March 31, 2025. The reason given is that the company needs to complete the procedure for issuing shares according to the Resolution of the 2023 Annual General Meeting of Shareholders and have new capital to arrange for debt repayment under the signed contract.

This is the third time that TNH has requested a postponement of the debt repayment to its leaders, and the reason provided on all three occasions has been the same. This loan is unsecured, with an interest rate equivalent to the 12-month term deposit interest rate of the Joint Stock Commercial Bank for Investment and Development of Vietnam applied on September 1, 2022.

The list of Board members who lent money to TNH includes: Mr. Hoang Tuyen, Chairman of the Board of Directors (VND 35.6 billion); Mr. Le Xuan Tan (VND 11.4 billion); Mr. Nguyen Van Thuy (VND 35 billion); and Mr. Nguyen Xuan Don (VND 10 billion).

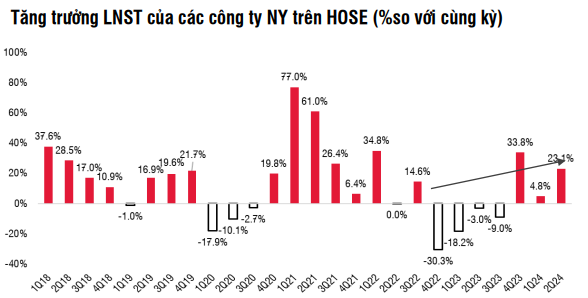

Regarding the business results for the first half of 2024, TNH recorded a revenue of VND 222.5 billion, a decrease of 3.1% compared to the same period last year. After-tax profit reached VND 53.6 billion, down 13.5% year-on-year. With these results, the company has achieved nearly 35% of its full-year profit plan.