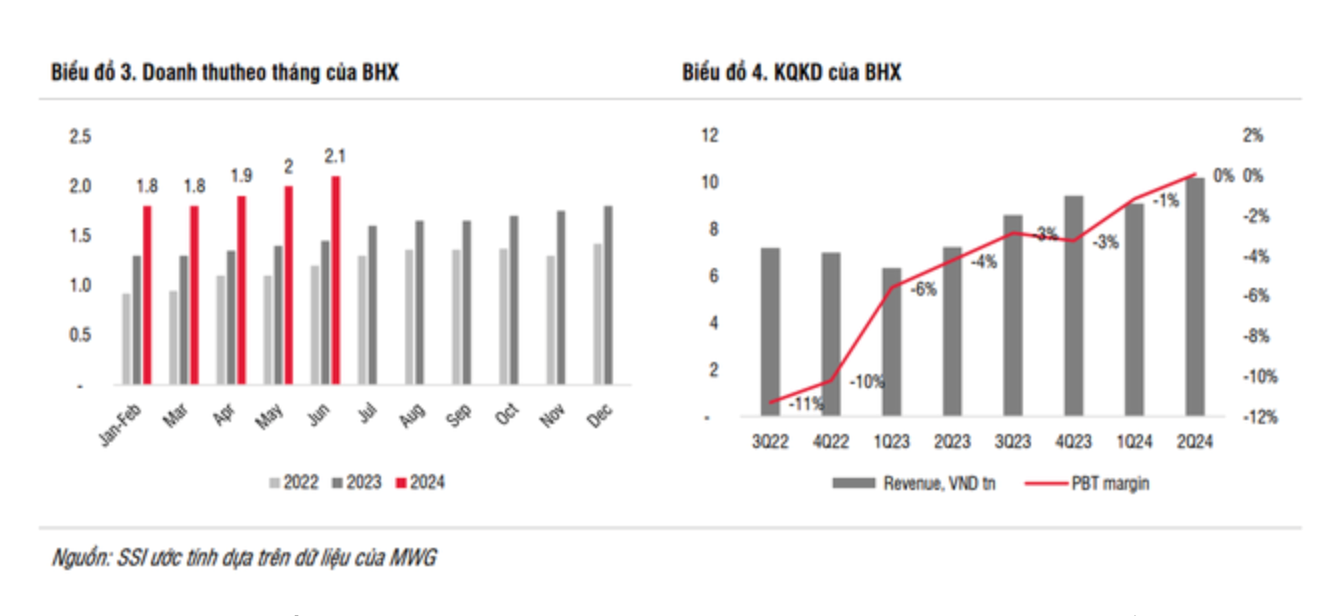

According to the latest report on Mobile World Investment Corporation (MWG), SSI Research states that Bach Hoa Xanh’s revenue for Q2 2024 exceeded VND 10,200 billion, a 41% increase year-over-year.

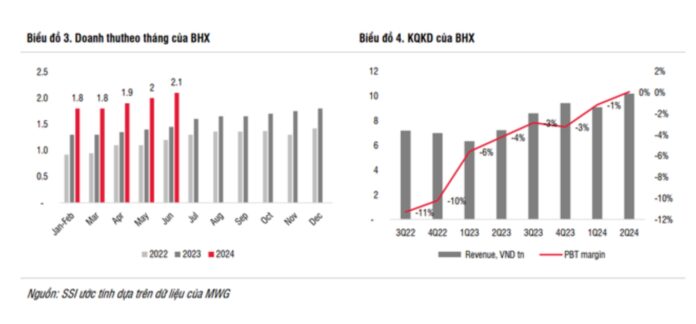

Revenue per month per store continued to grow, reaching VND 2 billion in the last quarter, attributed to an improved product mix. Stores in urban areas offered a wider range of vegetables, while rural stores provided more imported fruits and branded meat/seafood products. Bach Hoa Xanh stores offer a more diverse range of products compared to Winmart, effectively attracting new customers from traditional markets.

Consequently, the Bach Hoa Xanh chain recorded a pre-tax profit of VND 7 billion in Q2. SSI Research believes that with the current store model, it will be challenging for Bach Hoa Xanh to further increase revenue. As store revenue stabilizes (VND 2.1-2.2 billion), SSI Research anticipates that MWG will optimize costs by automating operations to reduce labor and logistics expenses, ultimately improving the pre-tax profit margin.

SSI Research suggests that MWG will expand the Bach Hoa Xanh store network to ensure long-term growth. By the end of Q2 2024, the number of Bach Hoa Xanh stores is expected to surpass the count of phone and appliance stores (approximately 3,200) in the medium term.

SSI Reseach estimates that Bach Hoa Xanh can attain VND 40 trillion in revenue for 2024 and potentially reach VND 45 trillion in 2025, corresponding to a monthly store revenue of VND 1.95-2.1 billion during 2024-2025. Net profit estimates stand at VND 228 billion and VND 668 billion for 2024 and 2025, respectively (compared to a loss of VND 1,200 billion in 2023).

Similarly, a report by FPTS (FPT Securities) indicates that Bach Hoa Xanh offers a more extensive product range in both fresh produce and FMCG compared to other mini-supermarket chains (WinMart+, Satrafoods, Co.op Food). This competitive advantage attracts new customers and increases the purchasing frequency of existing ones. Additionally, fresh produce acts as a conduit for customers to buy FMCG products with higher gross margins.

FPTS mentions that Bach Hoa Xanh aims to open more stores in existing areas to optimize the operational capacity of its distribution centers. The food retail chain under MWG is projected to operate 1,740 stores by the end of 2024 and then open 100 new stores annually from 2025 to 2029. Average store revenue could reach VND 2.65 billion per month by 2029.

While Bach Hoa Xanh has been profitable, the An Khang pharmacy chain is expected to incur losses for the next two years. Since mid-2022, MWG has halted the opening of new pharmacies to adjust its business model before expanding the network. However, the profit situation of the An Khang pharmacy chain remains stagnant. According to SSI Research estimates, the pre-tax profit margin declined by 15% in 2023 and 10% in the first half of 2024 due to an inappropriate product mix.

As a result, MWG decided to close 45 An Khang pharmacies in June. In July, the company accelerated the closure of pharmacies. From the beginning of the year until now, MWG has closed 139 pharmacies (approximately 25% of the total number of pharmacies).

SSI Research predicts that the An Khang pharmacy chain will incur losses of VND 339 billion and VND 243 billion in 2024 and 2025, respectively. Therefore, the closure of the An Khang pharmacies is not expected to significantly impact MWG’s total net profit.

Mobile World achieves revenue of VND118,000 trillion: TVs, tablets, and phones all decrease by 10% – 50%, while one product grows in both quantity and revenue.

Mobile World Investment Corporation (MWG) has recently announced its 2023 business results. According to the report, the company’s consolidated revenue reached over 118 trillion Vietnamese dong, equivalent to 89% of the revenue in 2022.