Illustration.

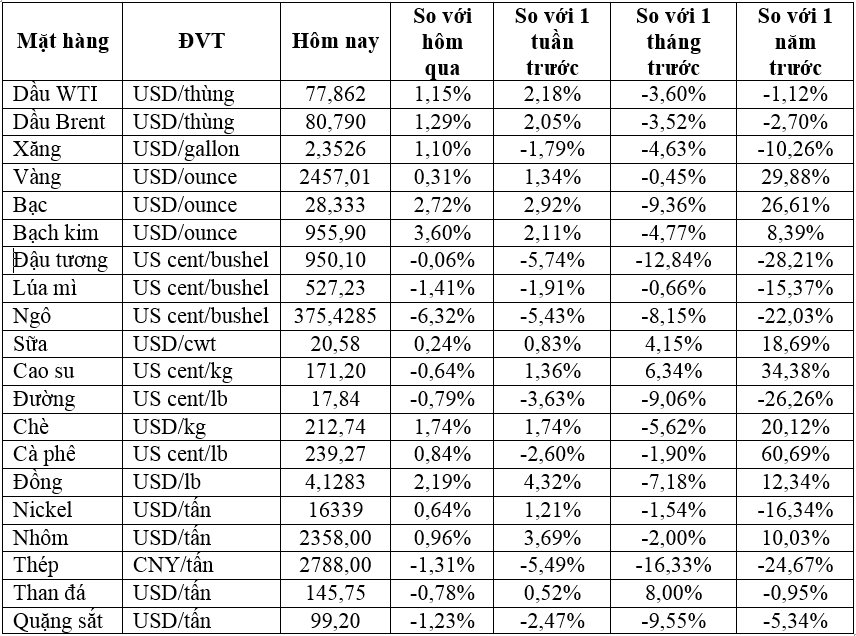

Oil Rises Nearly 2% on Upbeat US Economic Data

Oil prices climbed over $1 per barrel after positive US economic data eased concerns about a recession in the world’s largest economy. However, worries about a global slowdown kept gains in check.

On August 15, Brent crude oil rose by $1.28 or 1.6% to settle at $81.04 a barrel. WTI oil increased by $1.18 or 1.53% to $78.16 per barrel.

US retail sales for July rose more than expected, and the number of new unemployment benefit claims was lower than anticipated. This could lead the Fed to cut interest rates next month, potentially boosting economic activity and oil consumption.

Oil prices also found support in the uncertainty surrounding Iran’s response to the assassination of a Hamas leader in Palestine last month. The Russia-Ukraine conflict further added to the upward pressure on prices. Russia announced it would strengthen its border defenses and send additional forces.

However, China’s factory output slowed in July, and refinery production fell for the fourth consecutive month, highlighting the country’s uneven economic recovery and limiting the upside for the oil market.

Gold Prices Edge Higher

Gold prices trimmed their gains as the US dollar and Treasury yields rose following stronger-than-expected US economic data, which could influence the scale of the Fed’s interest rate cut.

Spot gold rose by 0.3% to $2,454.4 an ounce after climbing nearly 0.9% earlier. Gold futures for December delivery on the COMEX settled 0.5% higher at $2,492.4 an ounce.

US retail sales increased by 1% in July, rebounding from a 0.2% decline in June, according to the Commerce Department.

A separate report from the Labor Department showed that the number of Americans filing new claims for unemployment benefits fell to a one-month low last week.

Following the data, the US dollar strengthened by 0.5% against rival currencies, making gold more expensive for buyers using other currencies.

Copper Hits Two-Week High

Copper prices surged to a two-week high, supported by a technical breakthrough and potential supply risks related to a strike at the Escondida mine. However, trading volume remained low as fund investors stayed on the sidelines.

Three-month copper on the LME touched $9,175 a ton, surpassing both its 200-day and 21-day averages. It closed the session 2% higher at $9,155 a ton.

Copper had hit historic highs in late May due to speculation, but many funds have since withdrawn, shifting their focus from metals to gold and oil.

Unionized workers at Escondida, the world’s largest copper mine, rejected BHP’s request to pause their strike. BHP has not disclosed any estimates of the strike’s impact on production.

Iron Ore Falls to 14-Month Low

Iron ore prices continued their decline for the fourth straight session, hitting their lowest level in over 14 months, as weak Chinese real estate data fueled pessimism about demand prospects.

The January 2025 iron ore contract on the Dalian Commodity Exchange settled 2.09% lower at CNY 703.5 ($98.32) per ton. It fell to its lowest since May 26, 2023, at CNY 691 per ton earlier in the session.

In Singapore, September iron ore futures dropped 2.81% to $93.50 a ton, the lowest since November 2022.

Real estate investment in China fell 10.2% in the first seven months of the year compared to the same period last year. This follows a 10.1% decline in the first half of the year. Official data showed that the number of new construction starts fell 23.2% in floor area terms compared to the same period last year, after a 23.7% drop in the first half.

The real estate sector remains the largest consumer of steel in China, despite its shrinking share amid the prolonged crisis since 2021.

In Shanghai, rebar fell 0.16%, hot-rolled coil dropped 1.71%, wire rod shed 0.83%, and stainless steel was unchanged.

China’s crude steel output in July fell 9.5% from the previous month, marking the second consecutive monthly decline as many steelmakers underwent maintenance amid prolonged losses.

Japanese Rubber Falls, Snapping Six-Day Winning Streak

Japanese rubber prices snapped a six-day winning streak, falling on weak economic data from top consumer China. However, synthetic rubber prices and supply disruptions limited the downside.

The January 2025 rubber contract on the Osaka Exchange closed 0.4 JPY or 0.12% lower at 323.2 JPY ($2.20) per kg.

Shanghai’s January 2025 rubber contract rose 150 CNY, or 0.94%, to CNY 16,025 ($2,239.25) per ton.

Data from the National Bureau of Statistics showed that China’s factory output fell for the third straight month in July, indicating that the recovery in the world’s second-largest economy is losing steam. However, the consumer sector, which has been hit hard, showed a mild rebound as stimulus measures targeting households took effect.

Sugar Falls

Raw sugar for October delivery closed down 0.09 cents or 0.5% at 17.88 cents per lb.

Dealers said the outlook for the cane crop in India was boosted by relatively high rainfall, while the outlook in Thailand was also improving.

However, in the key Center-South region of Brazil, output in the current harvest is down and looks set to fall further in the coming weeks.

October white sugar fell $2.10 or 0.4% to $513.30 a ton.

Ukraine’s 2024 beet crop could fall to 10 million tons from around 12 million tons in 2023, according to agricultural consultancy APK-Inform.

Coffee Prices Rise

Robusta coffee for November delivery closed up $86 or 2% at $4,378 per ton.

Exports from Vietnam fell, but this was partly offset by increased shipments from Brazil.

December arabica coffee rose 3.40 cents or 1.4% to $2,380.50 per lb.

Robusta coffee prices in Vietnam continued to fall this week amid slow trading at the end of the season, while prices changed little in Indonesia as some traders started stockpiling.

Farmers in the Central Highlands are selling coffee beans at VND 116,900-118,000 ($4.67-$4.71) per kg, down from VND 122,000-123,000 last week.

Ngoc Quynh, deputy director of the Vietnam Commodity Exchange, said the domestic coffee market was sluggish, contrasting with the global market’s optimism due to recovering demand from major importers. This situation is expected to persist for a few more months.

Vietnam’s new crop will typically start in October.

Traders offered robusta coffee with 5% black and broken beans at a premium of $450-$600 per ton to the November contract in London.

Vietnam’s coffee exports in the first seven months of the year reached 979,353 tons, down 12.4% from the same period last year. The country exported 76,982 tons of coffee in July, up 9.7% from the previous month.

In Indonesia, Sumatran coffee was offered at a premium of $320 per ton to the September contract, unchanged from last week.

Indian Rice Prices Ease on Muted Demand, Higher Output Outlook

Indian rice export prices eased this week amid weak demand and expectations of higher output in the upcoming crop due to expanded planting.

In India, the 5% broken parboiled variety was offered at $536-$540 per ton, down from $539-$545 last week.

The Indian rupee hit record lows this week, boosting exporters’ profits.

In Vietnam, the 5% broken rice variety was quoted at $570 per ton, up from $565 the previous week.

A trader in Ho Chi Minh City said domestic supplies were low, while exporters were increasing shipments to Indonesia and Africa.

Vietnam’s rice exports in July jumped 46.3% from the previous month to 751,093 tons. This brought the total exports for the first seven months of the year to 5.3 million tons, up 8.3% from the same period last year.

In Thailand, the 5% broken rice variety was quoted at $567 per ton, up slightly from $565 per ton a week earlier.

Top Investment Channels for 2024: Safe and Profitable

2023 is a year full of volatility in the global financial market. Against this backdrop, many investors are interested in gold as a store of assets.

Market Update 02/07: Oil, Gold, Copper Rise while Iron Ore, Rubber Decline

Oil prices increased at the end of the trading session on June 2nd, with gold strengthening as the USD weakened. The currency experienced its first upward trend in 5 sessions, while iron ore and rubber declined.