The Board of Directors of Vinhomes JSC (HoSE: VHM) has proposed to the Annual General Meeting of Shareholders to consider and approve a plan to repurchase 370 million VHM shares, representing 8.5% of the total outstanding shares, to protect the interests of the company and its shareholders as the current share price is lower than its intrinsic value. The repurchase will be funded by undistributed profits as of June 30, totaling VND 146,584 billion.

Vinhomes will proceed with the share repurchase immediately after obtaining approval from the State Securities Commission of Vietnam (SSC). The company will repurchase shares through open market purchases and/or negotiated deals via securities companies, in compliance with relevant laws and regulations.

Following the completion of this transaction, Vinhomes’ charter capital will decrease by VND 3,700 billion, from VND 43,543 billion to VND 39,843 billion. The reduction in the number of outstanding shares is expected to increase earnings per share (EPS).

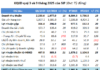

As of the market close on August 15, VHM shares traded at VND 37,850 per share, approximately 14% lower than the book value per share as of Q2 2024 (around VND 44,200 per share). Based on the share price on August 15, Vinhomes is expected to spend more than VND 14,000 billion to repurchase the aforementioned number of shares. This transaction also marks the largest deal in the history of Vietnam’s stock market.

Since the announcement of the share repurchase plan, VHM shares have witnessed a positive reaction from investors. As of August 16, the share price has increased by nearly 1% to VND 38,250 per share, marking the third consecutive session of gains. Since the disclosure of the share buyback plan, Vinhomes’ market capitalization has increased by 10%, reaching VND 166,336 billion.

In 2019, Vinhomes conducted a similar share repurchase program, acquiring 60 million shares at an average price of VND 92,425 per share, as the company believed that the market price was undervalued. This move was intended to safeguard the interests of both the company and its shareholders.

In 2021, when VHM shares surged past VND 110,000 per share, Vinhomes sold its entire treasury stock to boost working capital.

Along with the proposal to amend the company’s charter capital, Vinhomes also seeks to expand its primary business activities to include trading, installation, and consulting services related to fire protection equipment and materials.