The Vietnamese stock market just experienced a less-than-favorable trading session. High selling pressure right from the market open pushed the main index into negative territory for the entire trading session. At the close of the August 15 session, the VN-Index fell 6.8 points (-0.55%) to 1,223.56. Liquidity on HoSE was also subdued, with a total value of just 11.541 trillion VND.

Foreign trading continued to be a bright spot, with a net buy of over 134 billion VND across the market.

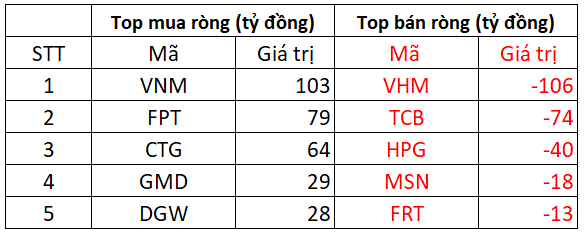

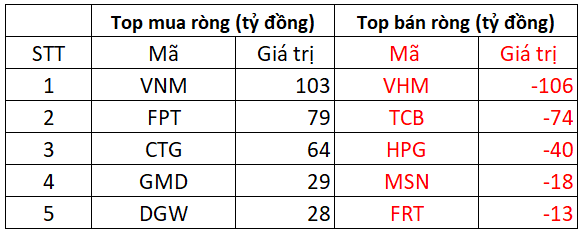

On the HoSE, foreign investors net bought 120 billion VND

In the buying column, the VNM stock was net bought by foreign investors for 103 billion VND. FPT and CTG were the next two codes that were accumulated with 79 billion VND and 64 billion VND, respectively. In addition, GMD and DGW were also bought for 28-29 billion VND.

On the other hand, VMM faced the strongest selling pressure from foreign investors, with nearly 106 billion VND. TCB and HPG were also offloaded, with 74 billion VND and 40 billion VND, respectively. MSN and FRT stocks were also sold off for tens of billions of VND each.

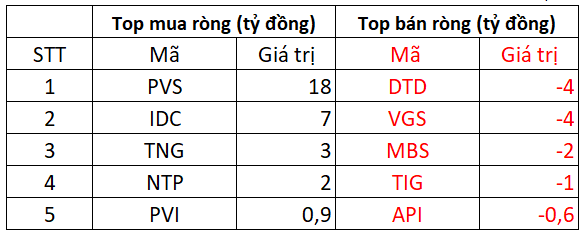

On the HNX, foreign investors net bought 18 billion VND

PVS was the most net bought stock on the HNX, with a value of 14 billion VND. Additionally, NTP was the next stock that foreign investors net bought strongly on the HNX with 7 billion VND. Foreigners also spent a few billion VND to net buy BCC, VGS, and HUT.

On the selling side, TNG faced net selling pressure from foreign investors, with a value of nearly 8 billion VND, followed by MBS, IDC, and BVS, which were sold off for a few billion VND.

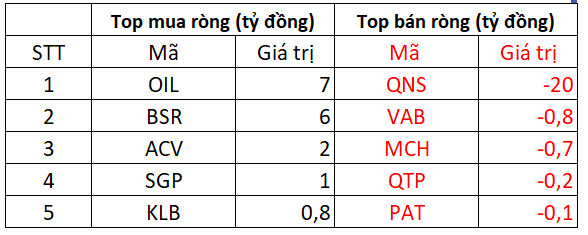

On the UPCOM, foreign investors net sold 4 billion VND

In contrast, QNS was net sold by foreign investors for nearly 20 billion VND. Additionally, stocks such as VAB, MCH, QTP, and PAT also witnessed net selling from foreign investors.

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”