DIC Corporation (HoSE: DIG) witnessed a significant development on August 12 as a brokerage firm sold over 5.3 million shares previously owned by the late Chairman, Nguyen Thien Tuan. This sale reduced their holdings from 46.82 million shares (7.68% of charter capital) to 41.51 million shares (6.8%).

Consequently, DIG shares experienced a sharp sell-off during the trading session, closing 3.67% lower at VND 22,300 per share.

This sale of pledged shares followed the announcement of Mr. Nguyen Thien Tuan’s passing on August 10.

DIC Corp announced the passing of Nguyen Thien Tuan on August 10

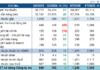

In terms of business performance, DIC Corporation reported impressive growth in the second quarter of 2024. Revenue reached VND 821 billion, a substantial increase of 408% year-on-year. Gross profit also surged by 539% to VND 203.5 billion during the same period.

However, financial income for the quarter decreased by 45% year-on-year to over VND 15 billion. The company also recorded a reversal of financial expenses of over VND 8 billion, while selling and management expenses increased by 34% to VND 58 billion.

As a result, DIC Corporation posted a quarterly after-tax profit of VND 125 billion in the second quarter of 2024, a remarkable thirteen-fold increase compared to the same period last year.

For the first half of 2024, the company’s revenue stood at VND 822 billion, up 129% year-on-year. However, after-tax profit reached only VND 3.96 billion due to a loss of VND 121 billion in the first quarter, resulting in a 95% decline compared to the previous year.

Looking ahead, DIC Corporation has set ambitious targets for 2024, aiming for a revenue of VND 2,300 billion, representing a 72% increase, and a pre-tax profit of VND 1,010 billion, a significant surge of 509% compared to 2023.

Given the first-half performance, with a pre-tax profit of VND 48 billion, the company has achieved nearly 5% of its full-year plan.