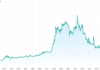

Gold prices kicked off the new trading week in a downward trend, following a sharp surge that saw it surpass the $2,500 per ounce mark for the first time in history last Friday. Despite this temporary dip, experts remain optimistic about the precious metal’s prospects, predicting new records to be set in the coming months and years.

As of 8 a.m. Vietnam time, spot gold prices in Asian markets dipped by $6 per ounce compared to Friday’s close in New York, equivalent to a 0.24% decrease, trading at $2,502.70 per ounce. Converted using Vietcombank’s selling exchange rate, this price point translates to approximately 76.1 million VND per tael.

The recent surge in gold prices can be attributed to expectations of an upcoming interest rate cut by the Federal Reserve. This week, the market will continue to closely monitor Fed’s actions, with interest rate prospects expected to dominate gold price movements.

The highlight of the week is the Fed’s annual symposium in Jackson Hole, Wyoming. On Friday, Fed Chairman Jerome Powell is anticipated to deliver a highly anticipated speech, with investors eagerly awaiting insights into the pace and magnitude of future interest rate adjustments.

A swift and substantial reduction in interest rates by the Fed would bode well for gold prices, as this zero-yield asset becomes more attractive in a low-interest-rate environment.

According to the FedWatch Tool from CME Group, the interest rate futures market predicts a full percentage point cut in the federal funds rate from its current level. This suggests that the Fed is likely to announce rate cuts in each of its three remaining meetings this year, with at least one cut expected to be in the magnitude of half a percentage point.

Beyond the Fed’s actions, gold prices are also finding support in global geopolitical and political risks. Tensions in the Middle East continue to simmer, and the upcoming US presidential election in November adds further uncertainty to the mix.

When compared to equity investments in the US, gold has delivered superior returns year-to-date. While the S&P 500 index has climbed 16% since the start of the year, gold prices have surged an impressive 21%.

In a report released last Friday, Commerzbank forecasted three interest rate cuts by the Fed for the remainder of 2024 and an additional three reductions in the first half of 2025. This revised outlook doubles the number of expected rate cuts compared to previous predictions.

“As a result, we predict gold prices to continue climbing, reaching $2,600 per ounce by mid-2025. Towards the end of 2025, gold prices may retreat slightly to the $2,550 level as inflation could pick up again, prompting the Fed to consider rate hikes in 2026,” said Carsten Fritsch, senior analyst at Commerzbank.

Some experts are even more bullish in their outlook. Bart Melek, TD Securities’ head of global commodity strategy, shared with Bloomberg that gold prices could reach the $2,700 mark in the upcoming quarters, fueled by anticipated interest rate cuts from the Fed.

Appearing on CBS Money Watch last month, Patrick Yip, director of business development at American Precious Metals Exchange, predicted that gold prices could hit the $3,000 mark in 2025 if geopolitical tensions persist and central banks continue to lower interest rates and/or increase their gold purchases.

Additionally, experts cite the US government’s tendency to borrow and spend as a significant driver of gold’s upward trajectory. Phil Carr, head of precious metals trading at FXEmpire, emphasized to Kitco News the historical correlation between US national debt and gold prices.

“There is a compelling argument that the eightfold increase in gold prices since the turn of the century, when US national debt soared from $5 trillion to over $35 trillion today, is more than just a coincidence,” Carr noted. “If history is any indication, we could see gold prices reach $5,000 per ounce as US national debt approaches the $70 trillion mark,” he added.