Understanding the factors affecting loan limits is the first step.

In the journey to realize the dream of owning an apartment in Ho Chi Minh City, carefully calculating the loan limit is the first and decisive step. Especially for families or individuals with a total monthly income of about 20 million VND, understanding the factors affecting loan limits will help you easily define your financial capabilities and avoid being in a “broken” situation.

Monthly income: For example, with an income of 20 million VND, the monthly repayment amount should be around 13 million VND, equivalent to 65% of the income. This is a safe threshold recommended by experts, helping you balance debt repayment and daily expenses, ensuring that life is not “overwhelming.”

Age and loan term: Your age will directly determine the loan term. Usually, young people will be given a longer loan term, reducing the monthly financial burden. For example, if you are under 35 years old, you can borrow for 20-25 years, which means your loan amount will be larger, and the monthly repayment amount will be more “breathable.”

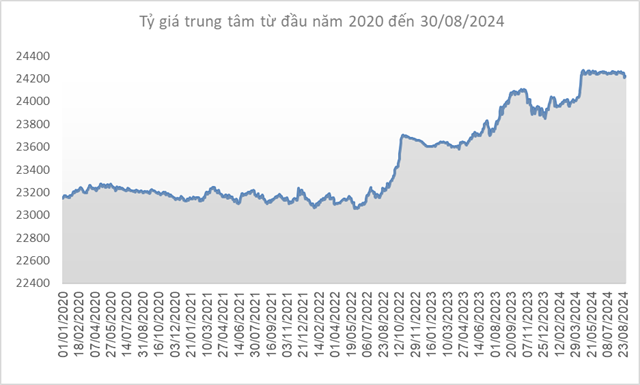

Interest rate: In the context of fluctuating interest rates, choosing a loan package with preferential and stable interest rates is crucial. With low and stable interest rates, you can avoid unwanted financial “storms” in the future.

For objectivity, let’s look at the table below to get an initial assessment of how much you can borrow with a monthly income of X million VND, and what the monthly repayment amount should be to stay within 65% of your total income:

The data on loan limits for home purchase in this article are for reference only. Actual limits may depend on other objective factors, and each bank has its own decision.

Refer to some apartment projects in Ho Chi Minh City suitable for a monthly income of 20 million VND or more

With a monthly income of 20 million VND or more, you can consider borrowing an amount ranging from 2.5 billion to 3 billion VND to own an apartment in the outskirts of Ho Chi Minh City. These areas are becoming the focal point of urban development, with improving transportation infrastructure and utilities, promising high potential for future price increases:

Vinhomes Grand Park, District 9: One of the most modern and intelligent urban area projects in Ho Chi Minh City, covering an area of 271 hectares. The project is expected to provide a quality living space with the standard of “ALL IN ONE – A city within a city.”

Apartments here are priced from 2.5 billion to 3 billion VND, integrating various utilities such as a 36-hectare light park, schools, hospitals, commercial centers, and entertainment areas, providing an ideal living environment for residents. With the rapid development of District 9 and the completion of Metro Line 1, Vinhomes Grand Park is not only an ideal place to live but also a profitable investment opportunity in the future.

Safira Khang Dien: Located in the heart of District 9, Safira Khang Dien is one of the hottest real estate development spots today. With prices ranging from 1.7 billion to 3 billion VND, a 24/7 security system, and substantial infrastructure investment, it offers an ideal environment for young families.

The apartments at Safira Khang Dien are designed in a modern style, optimizing space and natural light. The project is also equipped with high-end amenities such as a swimming pool, gym, internal park, and children’s playground, providing a comfortable and convenient life.

Akari City: The “City of Light” urban area project located on Vo Van Kiet Boulevard, Binh Tan District, covering an area of 8.5 hectares. Akari City apartments are priced from 2.3 billion to 3 billion VND, suitable for young families with stable incomes of 20 million VND per month. The project is designed in a Japanese style, featuring a modern and spacious living space and a diverse range of internal utilities such as parks, swimming pools, BBQ areas, and entertainment venues.

Its prime location on Vo Van Kiet Boulevard, a major artery connecting directly to the central districts, along with the synchronous development of the area’s infrastructure, makes Akari City an ideal choice for those seeking a stable and modern place to live.

Kasikornbank Ho Chi Minh City Branch offers a preferential interest rate of only 6.25%, fixed for the first 3 years, optimizing benefits for home buyers

With a fixed interest rate of 6.25%/year for the first 3 years – the lowest rate in the market today, you can get closer to your dream home without worrying too much about financial burden. After the promotional period, the floating interest rate is calculated based on the 12-month term deposit interest rate of BIG 4 + 5% margin. Even with the floating rate, you can rest assured that the term deposit interest rate of BIG 4 usually hovers around 4.6-4.7%, ensuring that the loan interest rate remains “favourable” compared to the market. This is a great opportunity for you to lay the foundation for a solid financial future without the heavy pressure of debt repayment.

In addition, KBank offers flexible loan terms ranging from 5 to 30 years, allowing you to easily choose an option that suits your income and personal financial plan. With a longer loan term, the monthly repayment burden is reduced, helping you maintain a balanced life.

The combination of KBank’s preferential loan package and the above-mentioned apartment projects is undoubtedly an ideal solution to help you open the door to your dream home. For more information about KBank’s home loan promotion, click here or register for KBank’s home loan information here to get the fastest support.

Booming real estate market for affordable apartments in Ho Chi Minh City

With its vast land and well-established infrastructure, the Binh Duong housing projects are continuously being announced in the market throughout 2023. Not stopping there, the real estate market in this suburb of Ho Chi Minh City is projected to supply tens of thousands of apartments on the market by early 2024.

Chairman of Sunshine Group Do Anh Tuan: “Winter Wind” to burst in 2024

2023 is being hailed as the most challenging year for the real estate industry in over a decade. Businesses are navigating through stormy waters, like a ship tossed amidst a raging sea. Despite being battered and thrown off course, they remain resilient, forging ahead and eagerly awaiting the dawn after the stormy night.