As of 10 a.m. on August 19, the VN-Index traded at 1,260 points, an increase of over 8 points from the reference. The HNX-Index was up over 1 point to 236.15, while the Upcom Index edged higher to 93.62.

Notably, this increase significantly narrowed from a few minutes earlier when investors were optimistic about the market outlook after last week’s surge.

The strong rise in liquidity indicated positive cash inflows from investors. Just over an hour after the opening bell, the trading value on the HOSE exceeded VND 5,200 billion.

Many stocks in sectors such as real estate, steel, securities, oil and gas, etc., witnessed positive movements.

On various forums and investment groups, investors actively discussed stocks across sectors, a stark contrast to the subdued atmosphere last week when the VN-Index traded gloomily with low liquidity.

The VN30 basket, including stocks like BID, HPG, VCB, VNM, and PNJ, positively influenced the market.

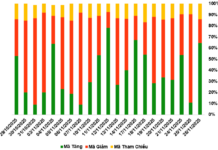

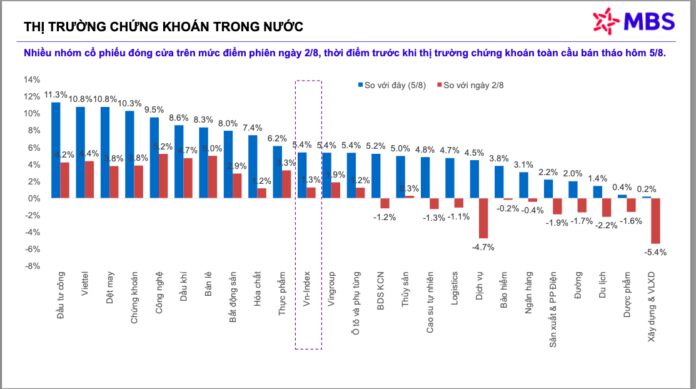

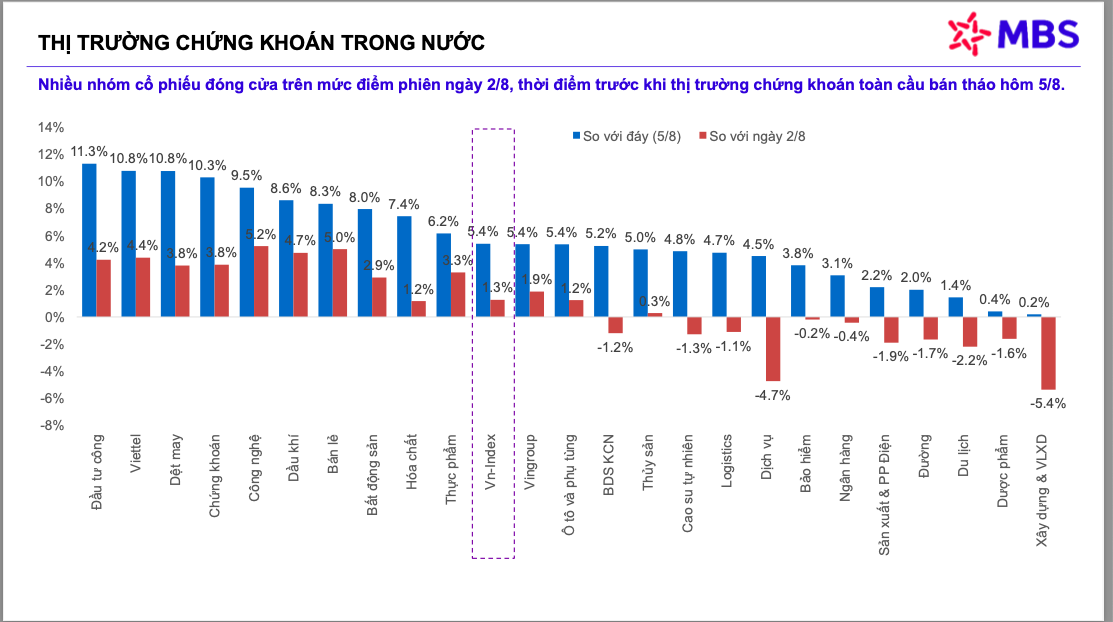

Many sectors outperformed the overall market compared to the VN-Index’s low of 1,190 points. Source: MBS

However, after 10 a.m., the momentum slowed as many investors who had bottom-fished low-priced stocks last week started to take profits. By 10:30 a.m., the VN-Index was up just over 6 points, the HNX-Index gained over 0.7 points, and the UpCoM-Index rose slightly over 0.1 points. Many securities and real estate stocks narrowed their gains or returned to the starting point.

Commenting on today’s trading session, VPS Securities Company stated that the stock market surged in the last session of the previous week and closed above the 1,250-point mark with improved liquidity.

As cash flow spread across most sectors, led by financial, real estate, and retail stocks, the VN-Index is likely to continue its recovery momentum towards the 1,260-1,270 range today.

“The market’s explosive session helped the VN-Index further reinforce its medium-term recovery trend towards the old peak of 1,290-1,300 points from the bottom area of around 1,200 points. Financial, maritime transport, utility, chemical, and oil and gas stocks will be the market’s focus,” said VPS experts.

VN-Index surges at the start of this week’s trading

Predicting the market trend this week, MBS Securities Company also stated that the domestic market’s explosive rise last Friday ended the VN-Index’s five-week losing streak. In the short term, the market may head towards the 1,260 or 1,270 ranges.

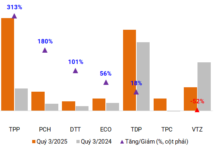

“Compared to the recent low, the VN-Index has gained 68 points (+5.76%), and some stock groups have performed better and attracted cash flow, including food, oil and gas, banking, retail, securities, investment, textiles, logistics, and real estate. Investors can consider new allocations or portfolio restructuring,” MBS experts suggested.