Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 609 million shares, equivalent to a value of more than 14.4 trillion VND; HNX-Index reached over 53 million shares, equivalent to a value of more than 1,104 billion VND.

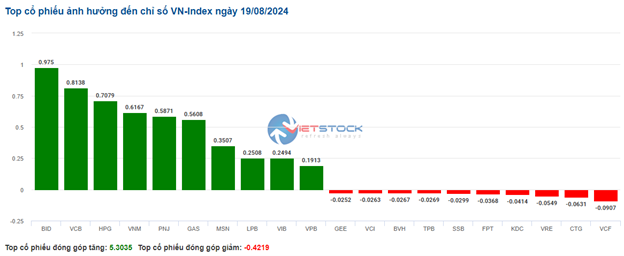

| Top 10 stocks with the strongest impact on the VN-Index on August 19, 2024 (in points) |

The afternoon session started with a prolonged tug-of-war due to short-term profit-taking pressure, but the buying force remained slightly stronger, helping the VN-Index maintain its green color until the end of the session. In terms of impact, VNM, GAS, VCB, and TCB were the most positive influences on the VN-Index, contributing over 3.9 points. On the other hand, HVN, SSI, GEE, and PLX had negative impacts, but their effects were negligible.

The HNX-Index also performed quite positively, with positive contributions from PVS (+1.77%), KSV (+3.16%), IDC (+1.31%), CEO (+2.65%), and others.

|

Source: VietstockFinance

|

The telecommunications services sector was the group with the strongest growth, up 2%, mainly driven by VGI (+2.4%), ELC (+1.92%), and FOX (+1.93%). This was followed by the industry and energy sectors, which rose by 1.74% and 1.29%, respectively. On the contrary, the information technology sector witnessed the most significant decline in the market, falling by -0.01%, mainly due to FPT (-0.08%), VTB (-0.97%), and PIA (-2.59%).

In terms of foreign trading, they continued to net sell over 308 billion VND on the HOSE exchange, focusing on VHM (77.97 billion), HPG (68.08 billion), TCB (49.88 billion), and HSG (42.69 billion). On the HNX exchange, foreigners net sold more than 28 million VND, mainly in IDC (26.77 billion), NTP (10.85 billion), TNG (4.59 billion), and DTD (4.41 billion).

| Foreign Trading Buy – Sell Net |

Morning Session: Maintaining the Uptrend

The market continues to attract positive buying force in the morning session of the new week. At the midday break, the VN-Index stood at 1,261.64 points, up 9.41 points, or 0.75%; while the HNX-Index rose by 0.47% to 236.26 points. The buying side temporarily dominated with 455 gainers and 224 losers.

Liquidity in the morning session decreased compared to the strong surge at the end of the previous week. The trading volume of the VN-Index reached nearly 328 million units, equivalent to a value of almost 8 trillion VND. The HNX-Index recorded a trading volume of nearly 27 million units, with a value of nearly 575 billion VND.

Source: VietstockFinance

|

In terms of impact, GAS, VCB, and VNM were the main pillars contributing positively to the VN-Index, helping the index gain about 3 points. Conversely, FPT, SSB, and KDC performed less favorably in the morning session, negatively affecting the index, but the impact was not significant.

Green dominated most industry groups, with telecommunications services temporarily taking the lead with a 2.28% gain, driven mainly by VGI (+2.7%), FOX (+2.15%), and CTR (+0.63%). The energy sector also traded quite actively in the morning session, rising nearly 2%. Most stocks were in a positive uptrend, notably BSR (+2.1%), PVS (+1.77%), PVD (+1.1%), and PVC (+1.5%).

On the other hand, information technology was the only sector in the red during the morning session, although the decline was not significant, mainly due to the “big brother” FPT falling slightly by 0.23%.

Foreign investors were a downside factor, net selling over 202 billion VND on the three exchanges. The largest net sell volume was spread across TCB, VHM, HSG, CSV, and FPT (ranging from about 20 to over 30 billion VND). Conversely, VNM continued to be favored by foreign investors, net buying over 60 billion VND.

10:45 a.m.: Buyers Remain in Control

The main indices maintained their positive momentum as market liquidity continued to recover in the morning session. As of 10:40 a.m., the VN-Index rose more than 7 points, trading around 1,260 points. The HNX-Index gained over 1 point, trading around 236 points.

Stocks in the VN30 group had a relatively balanced performance, but the gainers slightly outweighed the losers. Specifically, BID, VCB, HPG, and VNM contributed 0.97 points, 0.81 points, 0.71 points, and 0.62 points to the VN30-Index, respectively. Meanwhile, VCF, CTG, VRE, and KDC faced selling pressure but did not significantly impact the index.

Source: VietstockFinance

|

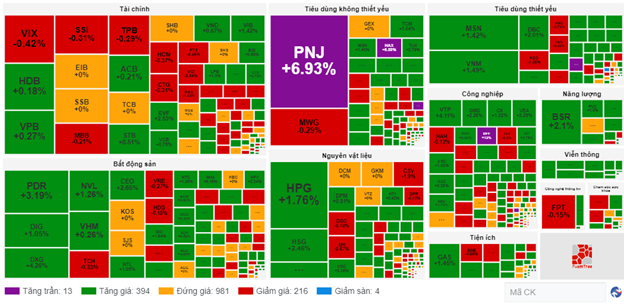

Financial and real estate stocks remained the two main groups supporting the market’s recovery. However, the financial sector showed strong internal divergence, with gainers slightly outpacing losers, but the increases were modest, such as VIX (+0.42%), VPB (+0.27%), EIB (+0.27%), and STB (+0.51%). On the other hand, SSI fell by 0.31%, TPB by 0.29%, MBB by 0.42%, and SSB by 0.23%, with red dominating, but the declines were not significant.

Similarly, the real estate sector exhibited somewhat similar dynamics, with slight internal divergence. Gainers included PDR (+2.93%), DIG (+1.05%), DXG (+4.26%), and NVL (+1.26%), while VRE fell by 0.27%, HDG by 0.18%, KDH by 0.4%, and SIP by 0.14%. Overall, the buying momentum slightly outpaced the selling pressure in this sector.

Additionally, the non-essential consumer goods sector posted a solid gain of 0.82%. The focus of this group was on PNJ and HAX stocks, which turned purple early in the session. From a technical perspective, on August 19, 2024, PNJ stock witnessed a strong surge and formed a Rising Window candlestick pattern, accompanied by a breakthrough in trading volume, surpassing the 20-session average. This indicated a significant influx of capital into the stock. Moreover, PNJ‘s price reached a new 52-week high, with the MACD continuing its upward trajectory and staying above zero after generating a buy signal, suggesting a positive outlook for the medium term.

Source: VietstockFinance

|

Compared to the opening, the tug-of-war dynamics resulted in a high proportion of reference stocks, with 980 stocks, but the gainers slightly outnumbered the losers, with 394 gainers and 216 losers.

Source: VietstockFinance

|

Opening: Real Estate Group Continues Its Growth

At the start of the August 19 session, as of 9:40 a.m., the VN-Index rose more than 5 points to 1,259.78 points. The HNX-Index also witnessed a slight increase, reaching 236.19 points.

At 9:27 a.m. (local time) on August 18, General Secretary of the Central Committee of the Communist Party of Vietnam, President of the Socialist Republic of Vietnam To Lam, and his spouse, along with a high-ranking Vietnamese delegation, arrived in Guangzhou, Guangdong Province (China), beginning their state visit to the People’s Republic of China at the invitation of General Secretary of the Central Committee of the Communist Party of China, President of the People’s Republic of China Xi Jinping and his spouse.

As of 9:40 a.m., the telecommunications services sector led the market with a 2.17% gain in the morning session. Notable performers included VGI (+2.55%), CTR (+0.86%), FOX (+1.07%), and ELC (+0.64%), among others.

Additionally, energy stocks also spread green early in the session, with a series of stocks such as BSR (+2.1%), PVD (+0.55%), PVC (+0.75%), AAH (+5%), and PSB (+8%) trending upward.

Following closely was the real estate sector, which continued its growth trajectory, rising by 1.33%. Standout performers included NHA (+5.75%), PDR (+3.46%), DXG (+4.61%), NVL (+2.51%), NLG (+1.52%), and VRE (+0.27%).

Bank stocks sold off heavily

Today (2/2), the VN-Index continues to rise, but in a cautious trading atmosphere. It is noteworthy that most banking stocks in the VN30 basket are facing strong selling pressure.