On August 19, the Board of Directors of Mobile World Investment Corporation (stock code: MWG) approved the decision to dissolve Tran Anh Digital World JSC – the owner of the Tran Anh electronics chain. The reason for the dissolution was MWG’s desire to restructure its subsidiaries to optimize operations.

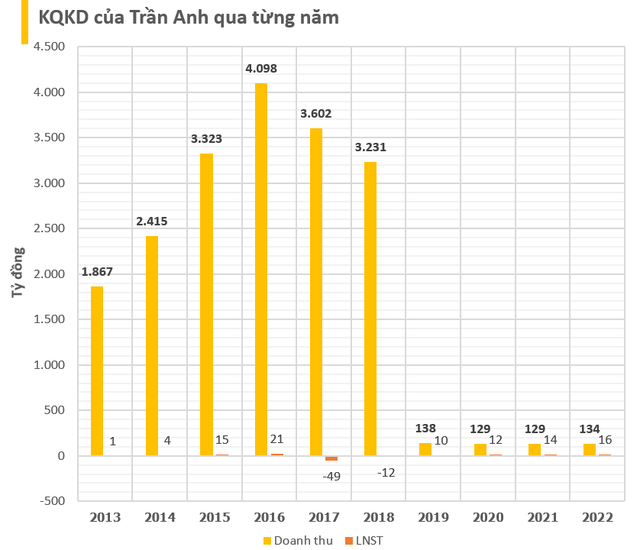

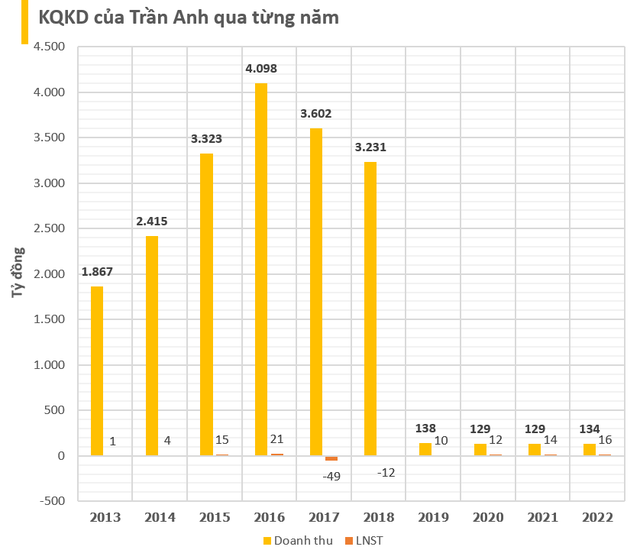

Tran Anh Digital World is a company operating in the electronics retail field. It used to be a leading distributor of computer and electronic equipment in the Northern market. During the period of 2007-2017, the company’s revenue grew steadily and reached a record high of over VND 4,000 billion in 2016.

In January 2018, MWG acquired 99.3% of Tran Anh’s capital, along with a system of more than 30 supermarkets. Subsequently, Tran Anh transitioned its business model to a partnership with The Gioi Di Dong, by recognizing revenue from leasing space, offices, assets, and brands. Inventory was no longer recognized, and the company’s main asset was bank deposits, earning interest annually.

From 2019 to 2022 – the last year it published its financial report, the company only generated about VND 100 billion from sales, with sales and management expenses reduced to zero. The company’s main profit came from financial activities, earning tens of billions of VND each year.

Tran Anh Digital World was once listed on the Hanoi Stock Exchange (HNX) in 2010 with the code TAG, but it was delisted in 2018. Subsequently, TAG was moved to UPCoM, and then lost its public company status in October 2022 due to its shareholder structure not meeting legal requirements.

Thus, it can be seen that MWG’s acquisition of the Tran Anh electronics chain was mostly for their locations and market share, rather than for maintaining the brand.

At the Q2/2024 investor meeting, Mr. Vu Dang Linh, Chief Financial Officer, stated that MWG had basically completed the closure of The Gioi Di Dong and Dien May Xanh stores by the end of June.

MWG representatives also shared more details about the restructuring process of The Gioi Di Dong and Dien May Xanh chains, which included three activities:

First, regarding the closure of inefficient stores, these are stores with revenue below expectations or excessively high expenses. Especially when a store is closed, it is highly likely that the customer flow will not be lost but transferred to nearby stores. The review process has been carried out from the fourth quarter of last year to the first months of this year.

Second, it is related to streamlining the personnel team. And finally, restructuring salary and contract policies to make employees more proactive and dynamic, along with a “manage-to-own” policy for each store.

“The number of stores will be adjusted depending on the situation. If the market develops strongly and many opportunities arise, we will focus on expanding our scale to increase revenue and market share. However, in the context of the current difficult market, MWG focuses more on the ‘quality’ of each store”, said Mr. Linh.

On the other hand, regarding personnel arrangement when stores are closed, MWG leaders said that there is no plan to recruit new personnel and priority will be given to reusing the personnel of the closed stores.