Prime Minister Pham Minh Chinh speaks at a meeting of the Government’s Standing Committee on three draft laws led by the Ministry of Finance, relating to corporate income tax, special consumption tax, and state capital management and investment – Photo: VGP/Nhat Bac

|

Also attending the meeting were Deputy Prime Minister Tran Hong Ha, Deputy Prime Minister Le Thanh Long, ministers, and leaders of ministries, sectors, and governmental agencies.

The meeting discussed and provided opinions on the draft Law on Amendments to the Law on State Capital Management and Investment in Enterprises; the draft Law on Corporate Income Tax (amended); and the draft Law on Special Consumption Tax (amended), including several social issues and public concerns such as tax subjects and methods for calculating special consumption tax.

Since the beginning of this term, the Government has been very determined and vigorous in developing and perfecting the institutional system, one of the three strategic breakthroughs. It has continuously held meetings, provided guidance, and established a Steering Committee to review and handle obstacles in the system of legal documents, thereby helping resolve difficulties and reduce administrative procedures and compliance costs for people and businesses.

After listening to the reports and opinions of the delegates, Prime Minister Pham Minh Chinh concluded and highly appreciated the Ministry of Finance for its practical summary and evaluation, as well as its coordination with ministries, sectors, and localities, and its collection of opinions from relevant agencies, individuals, and organizations, including affected entities, to synthesize opinions and develop the draft laws.

Along with providing opinions on specific contents, the Prime Minister emphasized several additional guiding viewpoints and orientations in the process of building the draft laws.

Regarding the draft Law on State Capital Management and Investment in Enterprises, the Prime Minister requested that the proposed amendments focus on removing difficulties and obstacles to mobilize and use resources effectively; inherit the suitable and positively impactful provisions in the current law; and implement what has matured and been proven effective and agreed upon by the majority. Management must be clear and transparent, with well-defined people, tasks, responsibilities, and products.

Promote decentralization and delegation of authority, along with resource allocation, improvement of enforcement capacity, and clear definition of the responsibilities of each agency and level. Design tools to enhance supervision, inspection, and control of power; reduce administrative procedures; eliminate the “asking-giving” mechanism; and minimize intermediaries.

Additionally, create mechanisms and policies to release resources at enterprises; enhance the autonomy and accountability of state-owned enterprises; focus state-owned enterprises on key, essential, and strategic sectors and important localities; and have special provisions for state-owned enterprises in the fields of national defense and security. Delegate more authority and responsibility to state capital representatives.

State agencies should focus on performing state management tasks, including strategy, planning, regime, mechanism, and policy formulation, as well as standards, criteria, and tools for supervision, inspection, rewards, and discipline.

Prime Minister Pham Minh Chinh emphasizes additional guiding viewpoints and orientations in the process of building the draft laws – Photo: VGP/Nhat Bac

|

Regarding the draft Law on Special Consumption Tax (amended), the Prime Minister stressed that this tax law impacts many industries, businesses, and people. Special consumption tax is a tool to guide consumption and restrict consumption for certain goods, but it needs to be suitable for Vietnamese conditions and circumstances.

The Prime Minister clarified the need for policies to limit the consumption of goods that can affect human health, the environment, and natural resources, as well as luxurious goods serving high-end demands. However, a balance must be struck between the interests of businesses and people, ensuring that the state does not lose tax revenue. There should be harmony between the goals of promoting production and business and socio-economic development and the objective of limiting the negative aspects of consuming these items, protecting people’s health, and encouraging the consumption of goods in the digital economy, green economy, circular economy, sharing economy, and knowledge economy.

The Prime Minister advised avoiding abrupt changes and having a suitable roadmap for the affected entities to prepare. Reduce procedures, promote digitization in tax management, minimize inconvenience for taxpayers, and limit direct contact between taxpayers and tax officials. Tax adjustments must be accompanied by strengthened anti-smuggling and anti-tax evasion efforts, and the drafting agency must provide convincing explanations for the proposed policies.

Regarding the draft Law on Corporate Income Tax (amended), the Prime Minister instructed the following principles: broaden the tax base, collect the right amount of tax, collect it promptly, and combat tax evasion, especially in areas such as e-commerce, catering services, and retail. Promote electronic invoices and the application of information technology and digitalization in tax management and collection.

At the same time, consider decentralizing certain contents to allow the Government to make flexible adjustments according to the situation; address bottlenecks in tax refunds and collections; and reduce administrative procedures and inconvenience for people and businesses to facilitate tax payments and reduce travel and time costs.

While ensuring fairness and equality among enterprises and economic sectors, provide tax incentives for appropriate entities, such as those building social housing, and encourage investment in science and technology, innovation, the digital economy, green economy, circular economy, sharing economy, and knowledge economy. For stable contents, such as investment incentive policies, continue to improve them without causing unnecessary disruptions.

The Prime Minister requested a thorough review of the scope of the aforementioned draft laws to ensure no legal gaps during implementation compared to the current law. Additionally, review the provisions of other related laws to ensure clarity and avoid overlaps, contradictions, or differing interpretations during the application of the law.

Moreover, the Prime Minister requested that when formulating the law, there should be tools to flexibly and promptly handle emerging issues and adapt to the rapidly changing reality.

Assigning the Deputy Prime Ministers to directly guide the development of these laws, the Prime Minister asked the Ministry of Finance to comprehensively synthesize the opinions of relevant agencies and organizations, absorb reasonable contributions, and promptly complete the draft law dossiers according to the Law on Promulgation of Legal Documents to submit to the Government at the law-themed session in August 2024 and then to the National Assembly for consideration and decision, ensuring progress and quality.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Accelerating disbursement of the 120 trillion VND credit package for social housing

Deputy Prime Minister Trần Hồng Hà has recently issued directives regarding the implementation of the 120,000 billion VND credit package for investors and buyers of social housing, workers’ housing, and projects for the renovation and construction of apartment buildings.

Vietnam’s Irresistible ‘Specialty’ That China Desperately Wants to Revive: Highly Popular from the US to Asia, Bringing in Millions of Dollars

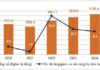

Vietnam is one of the largest exporting countries in the world, along with China and the Philippines.