The stock market has seen a robust recovery with vibrant trading activities after hitting a short-term bottom earlier in August. This favorable context has created numerous attractive opportunities for investors to increase their stock holdings and achieve considerable profitability. It is forecasted that this will drive up the demand for margin leverage in the coming time.

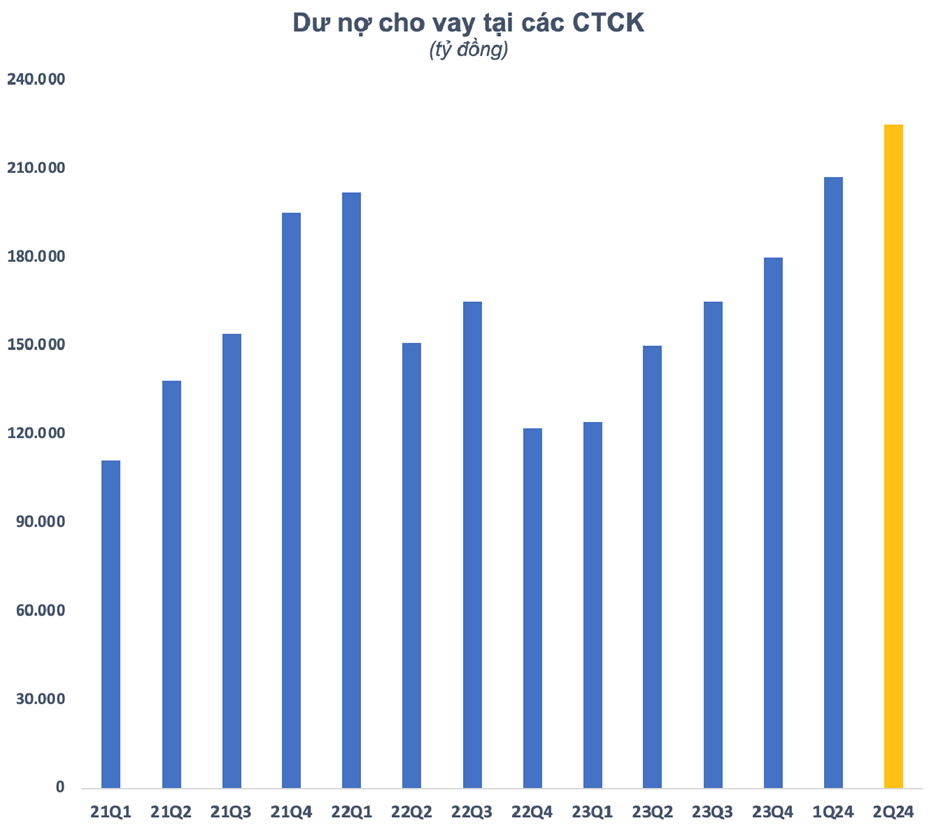

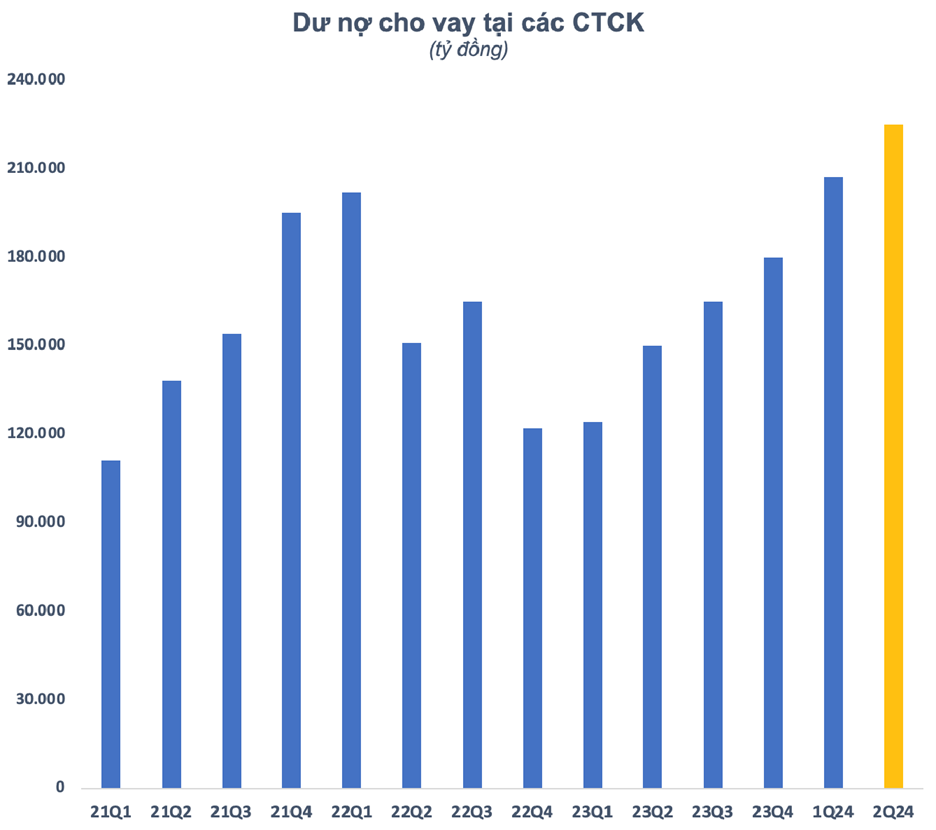

Previously, margin debt recorded at the end of the second quarter also reached its highest level ever. According to statistics, the estimated total borrowing debt in the market at the end of the quarter was VND 225,000 billion ($9 billion). Of this, margin debt amounted to VND 218,000 billion, an increase of VND 23,000 billion compared to the end of the first quarter and a record high. Since the beginning of 2023, margin debt has consistently increased each quarter.

The increased demand for leverage is partly due to the series of interest rate incentive packages offered by securities companies during the past two quarters, which saw no significant breakthroughs in the market.

For example, Yuanta Vietnam offered packages with interest rates of 8-9%; Mirae Asset introduced a low-interest rate package of 7.99%, and more recently, ACBS launched a 7% margin lending package, among others.

DNSE, with its dynamic and abundant financial resources, has naturally joined the fray. This securities firm offers its clients a range of attractive margin lending packages with interest rates as low as 5.99% or 9.99%. What sets DNSE apart is the diversity of its products, catering to the risk appetite of the majority of investors in the stock market.

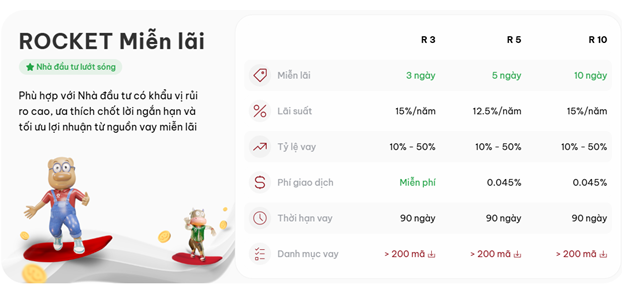

With the Rocket Free Interest package, a short-term lending product with one of the lowest costs in the market, DNSE provides investors with a high-risk appetite and a preference for short-term profit-taking, the opportunity to optimize their profits from interest-free loans. Moreover, with the 3-day Rocket Free Interest package, investors are also exempt from transaction fees.

DNSE’s Rocket Free Interest package offers optimal investment opportunities, especially for short-term traders.

|

The stock market in the third quarter has witnessed significant fluctuations, creating short-term “trading” opportunities for investors. This is an opportune moment for the Rocket Free Interest package to maximize its utility by enabling traders to ride the waves without worrying about interest expenses and fees. Notably, this product is applicable to over 200 stock codes, catering to almost all investors’ needs.

On the other hand, long-term investors can utilize the Rocket X package, with interest rates starting at just 5.99%, to seize the opportunity to accumulate multiple stocks currently trading at low valuations.

However, investors should remain cautious and allocate their margin leverage proportionally, given the market’s unpredictable fluctuations. Risk management is not a straightforward task for both professional and amateur investors. Therefore, DNSE has implemented a borrowing and debt management system called Margin Deal, which governs each buy and sell transaction.

With Margin Deal, margin lending and management are governed by each buy and sell order, allowing investors to avoid “selling across” their portfolios and replacing the traditional method of managing and borrowing margin based on total accounts. Currently, all DNSE lending packages are managed through the Margin Deal system. After 1.5 years in the market, this product has gained traction among investors, evident from DNSE’s continuously growing margin debt, reflecting the effectiveness of this approach in helping investors manage their risks.

Margin Deal helps investors better manage risks when using margin leverage by governing each transaction.

|

At this stage, the stock market is showing positive signs of consolidating its medium-term recovery trend, following the explosive trading session on August 16. With a stable macro environment, the growth potential of listed companies is highly regarded, and valuations are relatively attractive compared to other regional markets. Vietnam’s stock market has ample opportunities for long-term development. Notably, if upgraded to an emerging market, the stock market could attract billions of dollars from foreign investors, serving as a driving force for its long-term growth.

For detailed information about DNSE’s margin lending packages, please refer here

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.