The market has established an upward trend

In a recent report, BSC Securities estimated a 20% growth in NPAT-MI for the whole market, led by the non-financial sector, which saw a 34% increase compared to the same period last year. This marks the third consecutive quarter of positive growth, confirming the economy’s recovery trend.

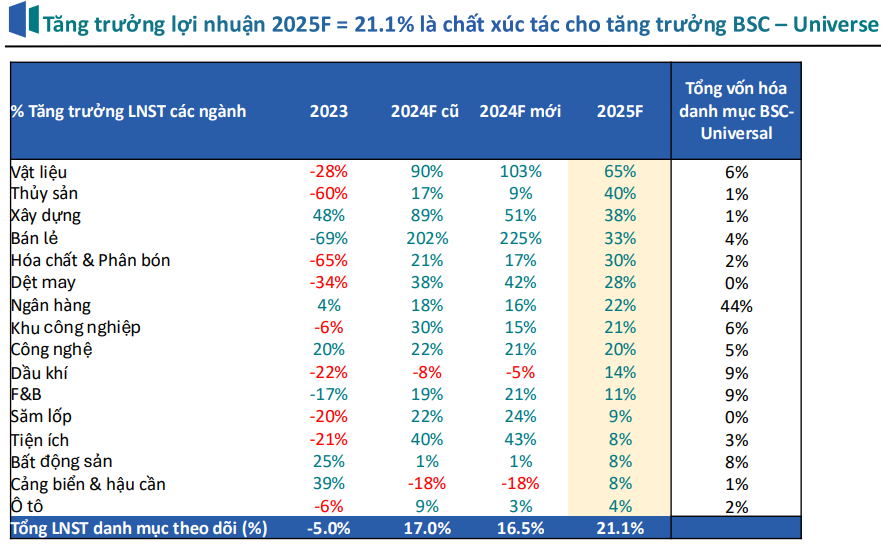

Looking ahead to the second half of the year, BSC slightly lowered its growth forecast for the BSC-Universe in 2024 from 17% to 16.5%, mainly due to adjustments in the projections for banks, industrial parks, construction, chemicals-fertilizers, and seafood. Meanwhile, they increased their projections for the retail, building materials, textiles, and F&B sectors.

BSC expects that with the pressure on exchange rates expected to ease as the Fed cuts interest rates, profit growth in the second half will continue to be supported by lower borrowing costs, reduced foreign exchange losses, and lower sales and management expenses, along with the low base from Q3 2023. As a result, the risk of lower-than-expected profit growth, as seen in Q3 2023, is expected to diminish.

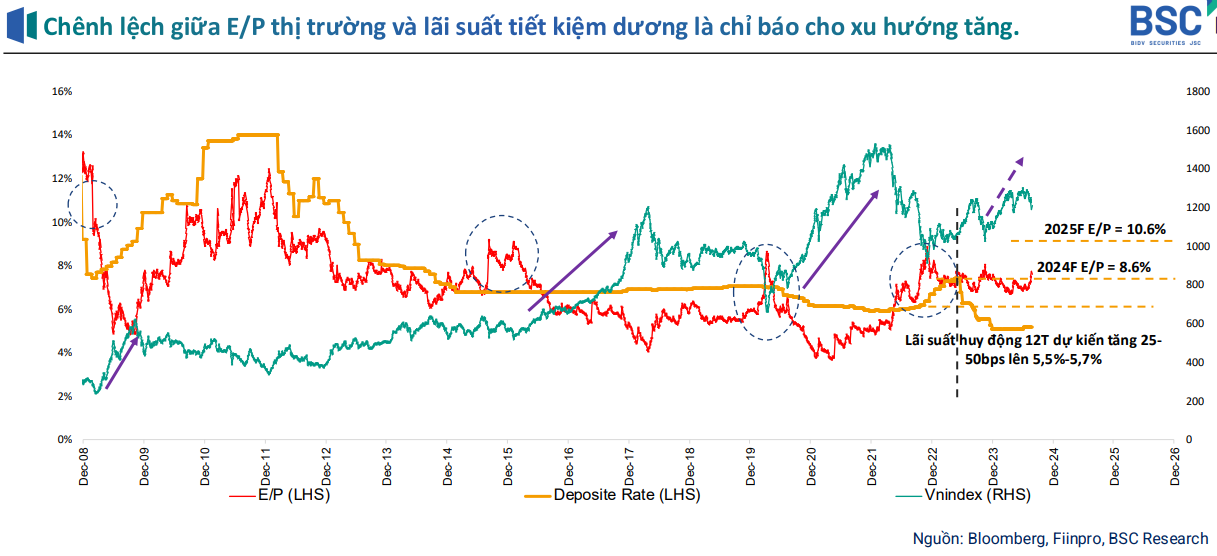

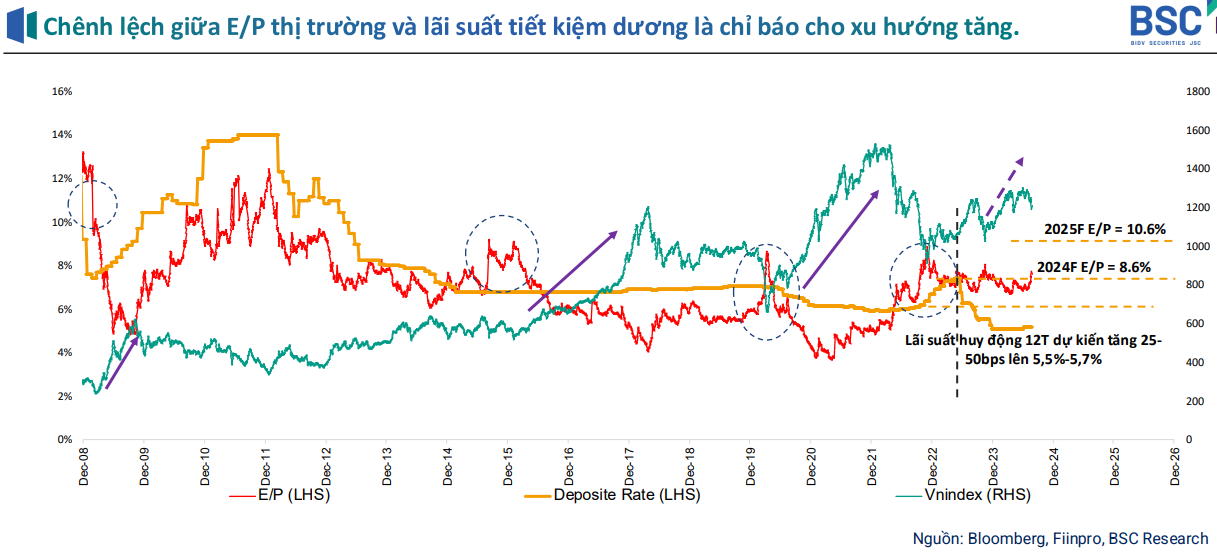

Comparing the market’s return on investment with savings deposit rates, a trusted indicator of market trends, BSC found that the necessary condition for the formation of a medium- and long-term upward trend in the market is (1) the stock market’s return on investment being more attractive than other investment channels, and the sufficient condition is (2) EPS maintaining its growth rate to ensure that the expected return on investment remains attractive, similar to what happened in the 2015-2016 and 2020-2021 periods.

“Therefore, in the context of a projected profit growth of 21.1% YoY in 2025, we expect the market to maintain its upward trend in the remaining period of 2024 and into 2025,” the BSC report stated.

BSC believes that in the context of low-interest rates on deposits, the growth rate of corporate earnings will be the main driver of stock prices, with the VN-Index’s forward E/P for 2024 at 8.6% and 10.6% at the end of 2025, higher than the current deposit interest rate of ~5.5-6%.

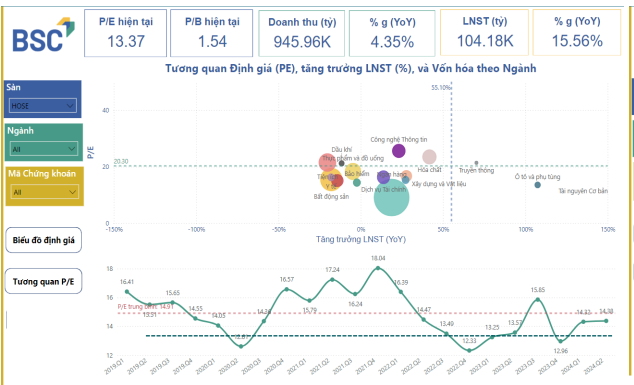

Attractive market valuation

At a trailing PE of 13.4 times and a trailing PB of 1.5 times, after updating Q2/2024 financial statements and the market’s strong adjustment in the first half of Q3/2024, the VN-Index is trading at an attractive valuation compared to history, only about 5-6% higher than the historical lows of Q2/2020 (Covid pandemic), Q4/2022 (Van Thinh Phat incident), and Q3/2023 (strong market adjustment due to Q3 financial performance falling short of market expectations).

Assuming that the market’s profits will continue to improve in the second half of the year and that the market has already discounted relatively, -6.5% from the 2024 peak, BSC believes that adjustments are good opportunities to accumulate stocks for the medium and long term. Investors can consider a “buy on dips” strategy at attractive price levels.

In terms of valuation, BSC believes that the gap between the non-financial sector (excluding banks, real estate, and securities) and the financial sector has narrowed after the sharp adjustment in July 2024, and the strong profit growth of this sector. The PE FWD 2024 of the non-financial sector in the BSC-Universal is at 15.3 times, approaching the standard deviation of -1 time and lower than the 5-year average of 18 times.

Therefore, BSC believes that the risk of a downward correction will be limited, and adjustments will present more opportunities than risks. However, it is important to note the above-mentioned risks related to a potential recession, which could impact profit growth and valuation projections.

The analysis team found that sector valuations showed a clear differentiation when comparing PE FWD 2024 with the 4-year average PE. Some sectors still offer attractive valuation discounts, such as Banks, Industrials, Real Estate, and Port Services. Some sectors, such as Retail, Technology, and Oil & Gas, have seen strong price increases and are trading at higher-than-average valuations due to their strong financial performance.

Most other sectors no longer offer significant valuation attractions for 2024, so investors should look at profit growth expectations for 2025 to find opportunities. In addition, in the recovery cycle, profit growth is given top priority, so a valuation approach based on P/E will be more effective than P/B. However, P/B will be the lower limit for valuations in the event of a sharp market correction.

BSC maintains a positive outlook for 2025 for the Information Technology, Industrial Parks, Seafood, Retail F&B, Building Materials, Textiles, Utilities, Banks, Chemicals – Fertilizers, Oil & Gas, and Maritime Transport sectors, based on an assessment of profit growth in 2025 with the criterion of >15% growth in net profit.

The stock portfolio of interest focuses on key factors: (1) leading enterprises with strong competitive advantages that benefit from the recovery cycle, (2) companies with their own growth stories, such as increased capacity, improved profit margins, and benefits from new policies, (3) enterprises with strong financial foundations, and (4) those that are attractively valued in the medium and long term.

HDBank Investor Conference: Sustaining High and Stable Growth

On the morning of February 1, 2024, HDBank (HoSE: HDB), a leading commercial bank in Ho Chi Minh City, organized an Investor Conference to provide updates on its business performance in 2023 and share insights on future directions and prospects for 2024.