Today’s market could have shown significant weakness if it weren’t for the unexpected performance of bank stocks. The late rally was led entirely by blue-chip stocks, causing the indices to rise despite the worst breadth in the last four sessions.

The change in the ratio of rising to falling stocks within an index is often an indicator of differentiation, suggesting a potential decrease in the index’s strength. However, with the calculation method of the VNI, capitalization weights play a crucial role, allowing the index to reflect a completely different picture. Today was one such case, as the index rose similarly to the previous two sessions, but with a less favorable ratio.

This subtle change is not necessarily negative, but it warrants attention. Observing the index does not always equate to overall market strength. Many stocks will still be subject to profit-taking and price reversals, despite a positive index. When the overall trend, as reflected by the representative index, remains positive, but stocks weaken, the situation can become worse if the index turns downward. This is the opposite of the recent bottom-forming phase, where the index continued to decline while stocks either consolidated or rose.

Of course, there is a possibility that the weakness in stocks today is due to short-term profit-taking pressure. Once this pressure is absorbed, creating a stable price range for a few sessions, the stocks may continue their upward trajectory. Therefore, this is a signal to be cautious, but not an exit signal. It is essential to closely monitor the supply and demand dynamics of individual stocks, as there is no universal trading strategy. Some stocks may be subject to gradual profit-taking, while others may have room for further gains.

This differentiation among stocks can lead to a rotation of rising stocks interspersed with short-term pauses, as long as the inflow of funds remains stable. Currently, intraday corrections still have low liquidity, while rising liquidity is more prominent. The matched order volume of the two exchanges today was similar to the previous session, at around 19.1k billion, maintaining a higher level than the average. However, it’s worth noting that this liquidity is partly due to the contribution of bank stocks, and many other stocks are starting to see a decrease in liquidity. With the VNI approaching the 1300 peak, any fluctuations in this region could have a more significant psychological impact, as many investors still rely on the index for decision-making. Another possibility is the emergence of a distribution phase after the VNI surpasses its peak, as this is when investor sentiment will be at its most optimistic, and funds will be most stimulated.

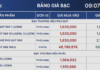

The derivatives market today reflected caution in the first half, as F1 accepted a wide discount, but had to pay the price for this basis in the latter half. In the morning, the VNI fluctuated up to 1307.xx, and from this level down to 1300.xx, F1 did not change much due to the basis adjustment. However, in the second upward movement, F1 signaled early through a narrower basis and increased liquidity in derivatives, indicating the accumulation of Long positions. When the bank stock group was strongly pulled, VN30 rose rapidly, and F1 also closely followed this time. The strength of bank stocks has a significant impact on VN30, and the index surpassed both 1307.xx and 1315.xx. Unfortunately, time ran out in the final stretch, and VN30 couldn’t quite reach 1319.xx, peaking at 1318.19.

The bank stock group is bringing the indices back to the peak region, and their performance will determine whether the indices can break through. Therefore, in the coming sessions, derivatives will need to closely monitor this group. The strategy is to employ a flexible Long/Short approach, carefully exiting stock positions.

VN30 closed today at 1317.69. Tomorrow’s nearest resistance levels are 1319; 1327; 1337; 1341; 1349. Support levels are 1315; 1307; 1301; 1290; 1281.

“Stock Market Blog” reflects the personal views of the author and does not represent the opinions of VnEconomy. The perspectives and assessments are solely those of the individual investor, and VnEconomy respects the author’s viewpoints and writing style. VnEconomy and the author are not responsible for any issues arising from the published investment views and opinions.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.