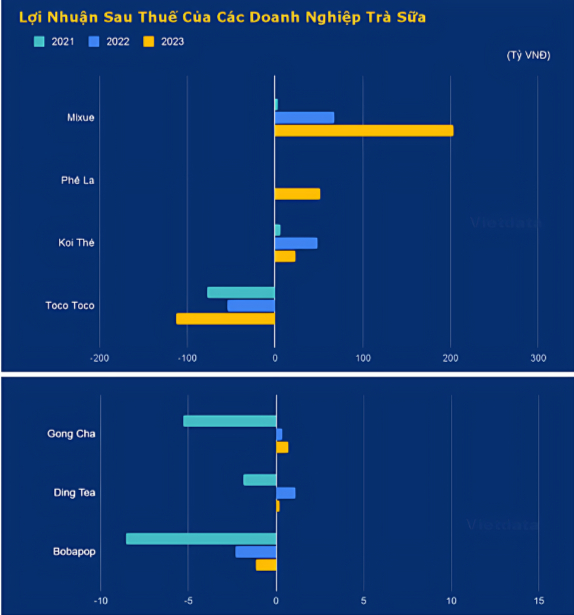

A report by Momentum Works in early 2023 revealed that the bubble tea craze has created a nearly $3.7 billion market in Southeast Asia. Vietnam ranked third in this market with a scale of over $360 million, equivalent to over 8.5 trillion VND according to Momentum Works.

To get a piece of this $360 million pie, according to Vietdata – a private organization specializing in data and analysis of businesses and the economy – potential always comes with competition as the market constantly sees the entry of new brands. This competition affects the revenue growth and profits of many brands in the industry.

Mixue – Expanding Scale, Revenue Increases by Almost Half

As of April 2023, Mixue had reached the 1,000-store milestone in Vietnam in less than 5 years. The company’s main products are bubble tea and ice cream, featuring a competitive advantage in pricing, ranging from 25,000 to 35,000 VND.

According to Vietdata’s assessment, Mixue has shown flexibility in Vietnam. As the bubble tea market reached saturation, the company swiftly shifted its focus to fresh ice cream. In parallel, Mixue also streamlined its bubble tea menu, targeting students with competitive pricing.

As a result, the Chinese tea and ice cream brand recorded revenue of nearly 1,260 billion VND, a surge of over 160% compared to 2022. The company’s after-tax profit also increased significantly, surging over 200% year-on-year. The growth rate of after-tax profit exceeded that of gross revenue, indicating that revenue from franchise licensing significantly contributed to the company’s financial performance.

TocoToco – Second Highest Revenue but Net Loss for 3 Years

TocoToco, which opened its first store in 2013, took a different approach by not glorifying foreign products and instead, prioritizing the use of Vietnamese agricultural produce from the outset. Positioning itself as “bubble tea made in Vietnam”, TocoToco quickly expanded its presence to over 700 stores nationwide and internationally in the US, Australia, and Japan.

TocoToco offers a diverse range of promotions, providing customers with numerous opportunities to enjoy their drinks at discounted prices. The company frequently applies various discount strategies such as buy-one-get-one, free toppings, discounts on total bills, and vouchers.

In addition to its pricing strategy, TocoToco constantly reinvents itself with eye-catching designs and festive patterns, enhancing the excitement of its loyal customers when enjoying their products in-store.

Despite strong revenue growth in the 2021-2023 period, TocoToco’s gross revenue in 2023 reached only about 380 billion VND, a 17% decrease compared to 2022. The company incurred after-tax losses for the past three years, with 2023 being the peak.

“These are all indicators that the company is facing operational issues. TocoToco’s business strategy needs adjustment,” Vietdata stated in its report.

Currently, TocoToco aims to reach 1,500 stores by 2024, covering the entire nation and expanding into the US, Japan, South Korea, Canada, and other countries.

Phê La – Pioneer of the Intense Flavor Tea Trend

Just when the bubble tea market seemed to be saturating, intense flavor tea emerged as a “new breeze”, creating a booming trend. Phê La was the pioneer of this trend. Established in 2021, the brand quickly expanded to 23 stores nationwide. Each store spans a few hundred square meters, strategically located in prime areas of Hanoi and Ho Chi Minh City.

The brand stands out for its use of Vietnamese agricultural produce, especially the signature Oolong tea from Da Lat. Phê La offers a diverse menu with uniquely crafted beverages, resulting in a higher price range of 40,000 to 60,000 VND per cup. Recently, in June 2024, Phê La announced extended operating hours from 4 am to 11 pm to cater to young customers who enjoy having tea early in the morning to watch the sunrise, attracting significant attention from tea enthusiasts.

In 2023, Phê La achieved revenue of nearly 300 billion VND, and its after-tax profit reached several billion VND. Vietdata assessed that these are positive initial signals, indicating Phê La’s significant potential for continued growth and sustainable development in the future.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

“Prosecution of government officials, land registration officers, and tax department employees in the largest bribery case ever”

The Thanh Hoa Police Investigative Agency has initiated legal proceedings against 23 individuals involved in the crimes of “Bribery” and “Receiving bribes”. This is the largest bribery case in terms of the number of suspects ever discovered and apprehended by the Thanh Hoa Police.