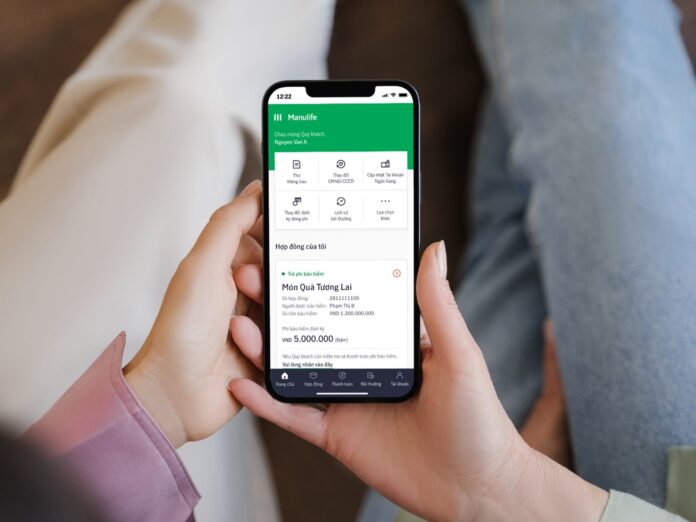

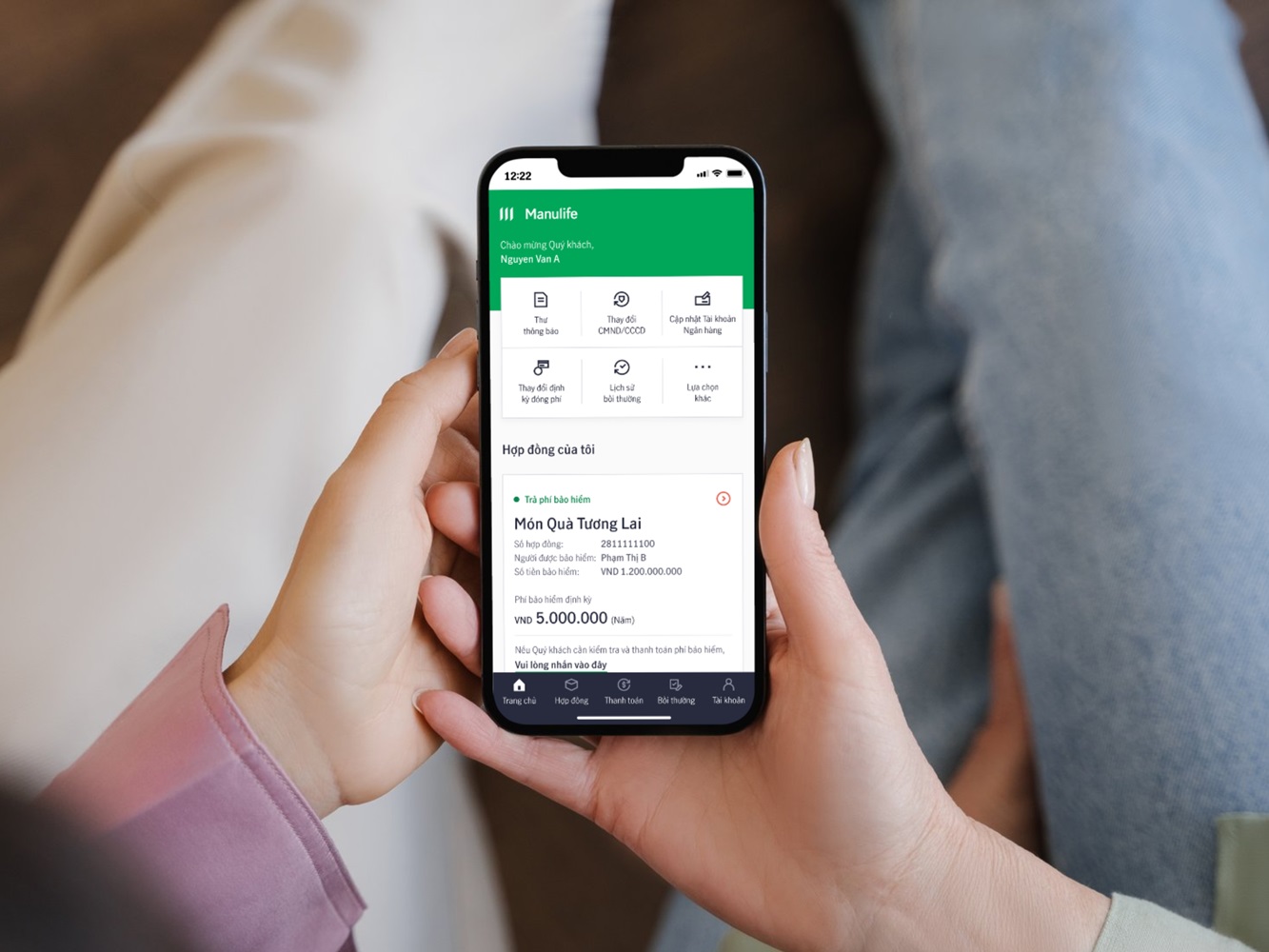

With just a few simple steps, Manulife customers can easily access their insurance contract information, make online premium payments, track claim status, update personal information, and download electronic contracts and documents. Additionally, customers can enjoy other features such as requesting cash withdrawals, policy loans, and more.

The Manulife Vietnam app also offers quick login options with Touch ID and Face ID, along with OTP authentication for added security. With its intuitive interface and advanced security measures, this new app is expected to meet customers’ needs throughout their insurance journey with Manulife Vietnam.

“The Manulife Vietnam app is our latest effort to provide maximum convenience and safety for our customers’ transactions throughout their insurance journey,” said Tina Nguyen, CEO of Manulife Vietnam.

The Manulife Vietnam app offers a range of features for customers’ convenience.

Designed to be a multi-functional insurance app, Manulife Vietnam showcases the company’s commitment to providing smart and efficient solutions. The app will continue to evolve with new features such as integrated hospital guarantee cards and hospital-finding functionality. Currently available on both iOS and Android platforms, customers can download the app here and start experiencing its benefits.

The launch of the Manulife Vietnam app is a significant step in Manulife’s digitalization journey. The company has previously introduced innovative digital initiatives, including the M-Pro insurance contract authentication and monitoring process, which won the “Digital Transformation Solution of the Year” award at the Insurance Asia Awards 2024. Manulife has also upgraded its online claims process to eClaims 3.0, reducing the claims processing time to just 1.1 days.

As the largest foreign-owned life insurance company in Vietnam, Manulife Vietnam serves nearly 1.5 million customers through its extensive network of modern offices across the country. In the first six months of 2024, the company paid out nearly VND 4,000 billion in insurance benefits to its customers. On average, Manulife Vietnam processes over 41,000 requests for insurance benefit payments each month.

Deposit Interest Rate Reaches 40.1% by 2023, MB Holds Top Spot in CASA for 2nd Consecutive Year

Thanks to our pioneering efforts in digital banking, 2023 marks the third consecutive year that MB has attracted over 6 million new customers annually, bringing the total number of customers served to 27 million.