In May 2024, the Ministry of Finance proposed several support packages for the domestic automobile industry, including an extension of the deadline for special consumption tax payments for the months of June, July, August, and September 2024 to November 2024; and a 50% reduction in registration fees for domestically produced and assembled automobiles.

While the decision to extend the special consumption tax deadline was approved earlier, on August 15, the Government Office issued Notification 384/TB-VPCP, announcing the conclusion of the Government’s Standing Committee on the Draft Decree on registration fee rates for domestically produced automobiles. In this notification, the Government Office stated that the Deputy Prime Ministers and the Standing Committee agreed to implement a 50% reduction in registration fees for domestically produced and assembled automobiles for a period of three months.

However, in a recent report, SSI Research argued that after waiting for information about the reduction in registration fees, consumers are likely to purchase vehicles immediately after the seventh lunar month. This is because some automobile dealerships are also offering a 100% discount on registration fees for domestically produced vehicles, eliminating the need for buyers to wait for the reduced registration fee policy to take effect.

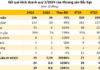

According to statistics from the Vietnam Automobile Manufacturers’ Association (VAMA), automobile sales in July 2024 increased by 17% compared to the same period last year and 9% compared to the previous quarter, thanks to significant discounts offered by automobile dealerships.

Nevertheless, SSI Research assessed that the revenue of automobile companies in the third quarter of 2024 is expected to be impacted by consumers postponing their vehicle purchases to await promotional policies and the psychological reluctance to purchase high-value products during the “ghost month” (seventh lunar month). However, in the fourth quarter of 2024, pent-up demand will be a driving force for revenue growth.

As a result, automobile sales of companies such as Toyota, Honda, and Ford Vietnam in the second half of 2024 are expected to be higher than initially projected. These companies are currently affiliated with the Vietnam Engine and Agricultural Machinery Corporation – Joint Stock Company (VEAM, code VEA), so VEAM is likely to benefit significantly from its holdings in these entities. Currently, VEAM holds 20% of Toyota Vietnam, 30% of Honda Vietnam, and 25% of Ford Vietnam.

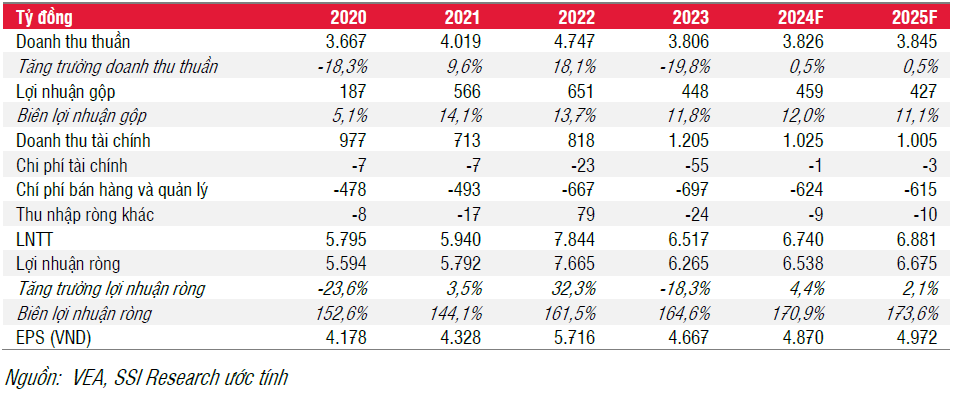

In the second quarter of 2024, VEAM announced consolidated net revenue and post-tax profit of nearly VND 1,024 billion (up 5% over the same period) and VND 1,822 billion (up 1% over the same period), respectively. The majority of the company’s profits came from savings interest and profits from joint ventures such as Honda Vietnam, Toyota Vietnam, and Ford Vietnam.

SSI Research stated that while the revenue figure was in line with the securities company’s forecast, post-tax profit exceeded expectations by 10% due to strong exports from Honda Vietnam. Specifically, profit from associated companies reached approximately VND 1,630 billion (up 3.6% over the same period and 31% over the previous quarter), consistent with recovery signals from vehicle sales data. Financial revenue decreased by 32% over the same period due to lower deposit interest rates than the previous year.

With the recovery in vehicle sales and higher-than-expected profits from associated companies in the second quarter of 2024, the analysis team assumed that VEAM’s domestic automobile and motorcycle sales in 2024 would increase by 9% and 2%, respectively, compared to the previous year.

In addition to other supportive factors, such as recovering consumption and attractive dividend rates (VEAM’s estimated dividend rates for 2024 and 2025 are 11% and 10%, respectively), SSI Research maintains its forecast for VEAM’s consolidated net revenue and post-tax profit for 2024 at VND 3,800 billion (up 0.5% compared to 2023) and VND 6,540 billion (up 4.4% compared to 2023), respectively.

For 2025, the analysis team projects VEAM’s consolidated net revenue to remain at over VND 3,800 billion, with a consolidated post-tax profit of VND 6,700 billion, up 1% and 2%, respectively, compared to 2024, assuming higher deposit interest rates and a continued recovery in automobile sales.

In the long term, SSI Research expects the income from the motorcycle and automobile joint venture segments to achieve a CAGR of 1.6% and 4.8%, respectively, during the 2024-2028 period. Therefore, VEA’s dividends are expected to be at their lowest in 2025 and gradually increase through 2028.

Vietjet Air achieves revenue of 62.5 trillion VND in 2023, cash surplus doubles

Last year, Vietjet safely operated 133,000 flights, transporting 25.3 million passengers (excluding Vietjet Thailand), including over 7.6 million international travelers, marking a remarkable 183% increase compared to 2022.