At the joint collaboration event for the development of 2,000 affordable housing units at TT Avio in Binh Duong, Mr. Keisuke Muraoka – Director of Housing Management Unit, International Business Branch of Cosmos Initia, shared that this is the first time the company has invested in the Vietnamese real estate market in collaboration with TT Capital and Koterasu Group.

Cosmos Initia is a member of Daiwa House Group, a Japanese real estate group with almost 70 years of experience and a charter capital of over $1 billion. The group operates in Japan and 25 other countries worldwide. Cosmos Initia has invested in nearly 2,000 projects, including mid- and high-rise apartments, townhouses, and detached homes.

In Vietnam, since 2018, Daiwa House Group has developed industrial parks and operated leased factories and logistics warehouses in the outskirts of Ho Chi Minh City. They also manage serviced apartments in Hanoi for foreigners and business travelers, as well as hotels and serviced apartments in Hai Phong. Additionally, the group has developed apartment projects in Ho Chi Minh City.

Mr. Keisuke Muraoka – Director of Housing Management Unit, International Business Branch of Cosmos Initia

Despite being a member of Daiwa House Group, this is the first time Cosmos Initia has entered the Vietnamese market to develop affordable housing in Di An, Binh Duong. Cosmos Initia, a Japanese “giant” founded in 1969, started investing in real estate in 1974. Over the past 50 years, the company has invested in nearly 2,000 projects and developed more than 100,000 apartment units in Japan, while also expanding its international presence in countries like Australia and the United States. Their headquarters are in Tokyo, with seven representative offices across Japan.

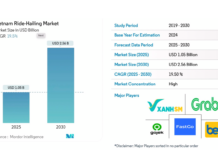

Explaining the reason for entering the Vietnamese market, Mr. Keisuke Muraoka stated that the Vietnamese real estate market still has a lot of potential and opportunities for growth. Ho Chi Minh City, with a population of over 10 million, has a cumulative supply of only about 300,000 housing units of all types, and the number of projects entering the market each year is quite limited, especially in the mid-range segment, which has not yet met the housing demands of the people.

The reason for choosing Binh Duong and focusing on apartment development in their plans for Vietnam is that Binh Duong is located right next to Ho Chi Minh City. Although there are already many apartment projects in this market, there is still a large demand and potential. TT AVIO is the company’s first project in Vietnam, marking the beginning of their journey to establish their brand in the mid-range affordable housing segment in the country.

“Up until now, high-rise residential buildings have been our company’s forte. During the period of strong growth in the Japanese real estate market, we focused on developing apartment projects, starting in Tokyo, where there was a housing shortage. The high demand helped us sell hundreds of thousands of units. Now, as we enter the Vietnamese market, we still prioritize the mid-range segment to seek opportunities,” shared Mr. Keisuke Muraoka.

According to Cosmos Initia’s representative, there is still a large potential in the Vietnamese real estate market, especially in the mid-range apartment segment that meets the actual housing demands. Photo: Illustration

In recent times, major Japanese companies have continuously joined hands with Vietnamese enterprises to invest in and develop diverse housing segments in Hanoi, Ho Chi Minh City, and neighboring provinces, demonstrating the attractiveness of the Vietnamese real estate market to these investors. Most of the collaborations between the two sides focus on products that cater to actual housing demands and well-planned urban areas.

On the other hand, Japanese real estate is losing its appeal to foreign investors. The total investment in Japanese real estate in 2023 dropped to its lowest level in five years. According to CBRE, foreign investment in Japanese real estate decreased by about 30% in 2023 to ¥1 trillion ($6.7 billion), while sales doubled to around ¥1.37 trillion.

Increasing interest rates and rising costs are barriers for Japanese real estate to foreign investors. They are now looking to cash in on profits from long-held assets. This is also the reason why Japanese companies or investment funds are starting to seek new opportunities in potential markets like Vietnam.

The move by some Japanese giants to enter the Vietnamese market to develop affordable housing shows their long-term vision. This segment has been performing the best in the Vietnamese market after recent fluctuations. They recognize the demand potential and aim to minimize risks by investing in this segment.

Astonishingly high price for old and dilapidated apartment buildings reaching nearly 200 million VND/m2, rivaling the most luxurious condominiums in Hanoi

Old collective apartments with prices starting from 100 million VND/m2 are usually the first-floor units that can be used for commercial purposes, while the upper-floor units are priced at 60-80 million VND/m2 for residential purposes.

Binh Duong: Land prices to increase up to 247% from current prices.

If passed, the proposed Resolution will result in an increase in land prices in Binh Duong province, ranging from a minimum of 11% to a maximum of 247% compared to the current prices. This adjustment is aimed at aligning the land prices with the current reality, as some communes are upgraded to wards and towns.

Construction of First Luxury Condominium Project in Binh Duong Begins: Becamex Tokyu

Becamex’s latest project in the southern province signifies their entry into the luxury condominium market in the beginning of 2024.