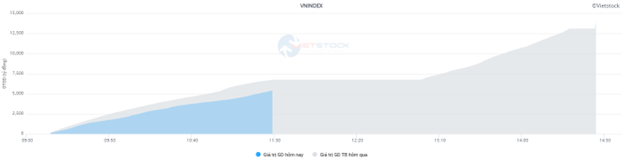

Market liquidity increased from the previous session, with the VN-Index matching volume reaching over 635 million shares, equivalent to a value of more than 14.2 trillion VND. The HNX-Index reached over 64 million shares, equivalent to a value of more than 1,207 billion VND.

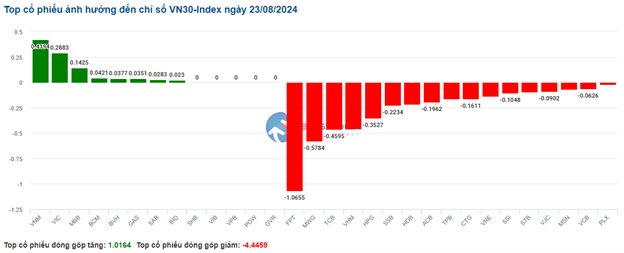

The VN-Index opened the afternoon session with buying pressure returning, helping the index quickly regain the reference level. The sellers also increased selling pressure but were unable to change the situation, and the green status was still preserved. In terms of impact, GVR, HPG, CTG, and VNM were the most positive influences on the VN-Index, with an increase of more than 1.9 points. On the contrary, FPT, LPB, VRE, and HVN were the most negative influences, but the impact was negligible.

| Top 10 stocks with the strongest impact on the VN-Index on August 23, 2024 |

Similarly, the HNX-Index also had a positive performance, with the index positively impacted by the codes DNP (+9.95%), IDC (+1.49%), NVB (+5.49%), and HUT (+1.73%)…

|

Source: VietstockFinance

|

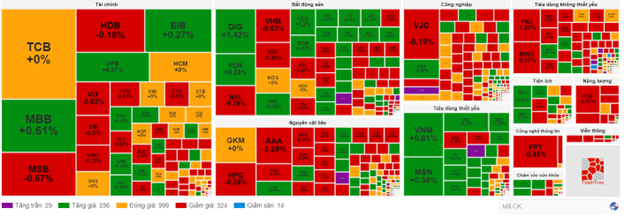

The materials sector was the group with the strongest increase of 0.6%, mainly driven by the codes HPG (+1.17%), HSG (+2.17%), and NKG (+3.02%). This was followed by the consumer staples and financial sectors, with increases of 0.41% and 0.3%, respectively. On the other hand, the telecommunications services sector saw the largest decline in the market, with a decrease of -1.1% mainly due to the code VGI (-1.58%), YEG (-0.82%), FOX (-0.32%), and MFS (-2.43%).

In terms of foreign trading, they continued to net sell more than 106 billion VND on the HOSE exchange, focusing on the codes HPG (137.84 billion), VHM (46.7 billion), HSG (41.69 billion), and NVL (29.23 billion). On the HNX exchange, foreigners net sold more than 45 billion VND, focusing on the code PVI (46.43 billion), NTP (4.47 billion), DTD (1.23 billion), and API (990 million).

| Foreign Buying and Selling Dynamics |

Morning Session: Pressure from Large-cap Stocks, VN-Index Starts to Slide

The market traded rather sluggishly in the morning session, continuing to fluctuate within a narrow range. However, unexpected selling pressure in large-cap stocks towards the end of the morning session caused the index to slide rapidly. At the midday break, the VN-Index decreased by 5 points, equivalent to 0.39%, settling at 1,277.78 points; the HNX-Index decreased by 0.34%, settling at 237.66 points.

Cautious sentiment kept liquidity low in the morning session, with the VN-Index trading volume reaching nearly 247 million units, equivalent to a value of more than 5.4 trillion VND. The HNX-Index recorded a trading volume of over 29 million units, with a value of nearly 470 billion VND.

Source: VietstockFinance

|

The VN30-Index closed the morning session down 6.19 points, or 0.47%, at 1,312.38 points. Stocks such as VHM (-1.1%), HPG (-1.2%), FPT (-0.9%), and CTG (-0.9%) were the main drags on the VN-Index, causing the index to lose nearly 2 points.

Red dominated across all sectors. The telecommunications services sector ranked last with a decrease of 1.67%, mainly due to large-cap stocks such as VGI (-1.87%), FOX (-2.44%), and CTR (-0.16%). Meanwhile, many stocks rose sharply, such as CAB (+13.71%), GLT (+9.84%), VIE (+7.14%), SGT (+3.7%), and DST (+3.33%), but their small market capitalization did not significantly impact the overall index.

The energy and information technology sectors also faced selling pressure, falling by about 1%. Many stocks declined by more than 1%, including BSR (-1.24%), PVS (-1.23%), PVC (-1.47%); CMT (-2.58%), CMG (-1.83%), HPT (-1.41%)…

Consumer staples and utilities were the only two sectors that managed to stay in positive territory, with minor increases of 0.16% and 0.14%, respectively. Large-cap stocks such as VNM (+0.54%), QNS (+0.21%), VHC (+2.37%); GAS (+0.12%), REE (+1%), and HND (+1.48%) supported these sectors.

10:35 am: Cautious Sentiment Prevails, VN-Index Hovers Around Reference Level

Investors remained cautious, resulting in low trading volume, and the main indices fluctuated around the reference level. As of 10:30 am, the VN-Index rose slightly by 0.44 points, trading around 1,283 points. The HNX-Index increased by 0.15 points, trading around 238 points.

Stocks in the VN30 basket showed mixed performance, but the selling pressure was slightly stronger. Specifically, FPT, MWG, TCB, and VHM respectively subtracted 1.07 points, 0.58 points, 0.46 points, and 0.45 points from the overall index. Conversely, VNM, VIC, MBB, and BCM maintained their positive performance and contributed nearly 1 point to the VN30-Index.

Source: VietstockFinance

|

The telecommunications services sector was the worst-performing group, declining by 1.17%. The selling pressure was mainly concentrated in codes such as VGI, which fell by 1.44%, ELC by 1.02%, YEG by 2.06%, and FOX by 1.17%…

On the other hand, the financial sector exhibited mixed performance, with red slightly dominating and exerting the most significant pressure on the main index. Specifically, on the selling side, bank codes included TCB, which fell by 0.22%, MSB by 0.67%, HDB by 0.37%, and TPB by 0.83%… Conversely, some codes maintained their positive performance, including MBB, which rose by 0.61%, EIB by 0.27%, and LPB by 0.16%…

In a more positive development, the consumer staples and utilities sectors were the only two groups that remained in positive territory, with gains of 0.16% and 0.14%, respectively. The consumer staples sector stood out with the presence of two large-cap stocks, VNM, which increased by 0.67%, and MSN by 0.13%. In the utilities sector, GAS rose by 0.47%, POW by 0.37%, and REE by 0.14%…

Compared to the beginning of the session, the selling pressure intensified. There were 324 declining stocks and 236 advancing stocks.

Source: VietstockFinance

|

Opening: Maintaining a Slight Gain

At the start of the session on August 23, as of 9:40 am, the VN-Index rose over 2 points to reach 1,285.6 points. Meanwhile, the HNX-Index also edged higher, reaching 238.88 points.

Green temporarily dominated the VN30 basket, with 12 declining stocks, 13 advancing stocks, and 5 stocks trading unchanged. Notably, some large-cap stocks showed positive performance from the beginning of the session, including BCM, which rose by 1.81%, VNM by 1.21%, MBB by 0.61%, and MSN by 0.51%…

Large-cap stocks such as VNM, GAS, and BCM propelled the market, contributing a total increase of nearly 1.5 points. On the contrary, VCB, FPT, and DGC led the negative influences on the market, but the decline was less than 0.5 points.

The real estate sector maintained stable growth from the beginning of the session, with stocks such as BCM rising by 1.94%, VRE by 0.51%, VIC by 0.6%, and IDC by 0.5%… Conversely, other stocks in the sector, such as VHM, DIG, PDR, DXG, and HDG, showed minor declines of less than 1%.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.