Strong Revenue Growth, With Dien May Xanh Remaining the Key Driver

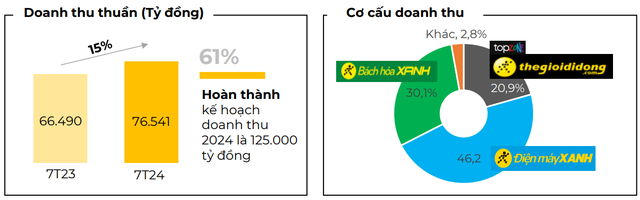

The Mobile World Investment Corporation (MWG) has announced its business results for the first seven months of 2024. Accordingly, MWG’s net revenue reached VND 76,541 billion, a 15% increase compared to the same period in 2023, and completed 61% of the company’s revenue plan (VND 125,000 billion).

In terms of revenue structure, Bach Hoa Xanh contributed 30.1% of the total revenue, Dien May Xanh 46.2%, The Gioi Di Dong (including Topzone) 20.9%, and the remaining came from other segments.

For The Gioi Di Dong (including Topzone) and Dien May Xanh chains, the cumulative seven-month total revenue reached VND 51,300 billion, a 6% increase compared to the same period last year. In July alone, the revenue was VND 7,200 billion. The monthly revenue increased by 5% year-on-year and slightly decreased compared to the previous month due to the off-peak season for air conditioners and the end of the football event.

With the advantage of a diverse product portfolio and proactive sales solutions that bring practical benefits to customers, the company recorded positive growth in some product categories entering the peak season, such as laptops and washing machines, in addition to the group of phones that have been maintaining a positive growth trend continuously for several months. Online revenue for the first seven months reached nearly VND 6,300 billion, accounting for 12% of the total revenue of both chains.

Regarding Bach Hoa Xanh, in the first seven months, the chain achieved VND 23,000 billion in revenue, a 40% increase compared to the same period last year. In July alone, revenue exceeded VND 3,600 billion, a nearly 28% increase compared to the same period last year and a slight increase compared to the previous month. Both fresh and FMCG product categories maintained double-digit growth compared to July 2023. The average revenue in July reached VND 2.1 billion per store.

The Closure Nightmare Sweeps Through An Khang Pharmacy Chain

One notable point in this report is that the store restructuring process for The Gioi Di Dong chain is almost complete, as the number of stores in the chain only decreased slightly compared to previous months. As of the end of July, MWG had 1,028 TGDĐ stores (including Topzone), a reduction of 18 stores compared to the end of June. The Dien May Xanh chain also narrowed down 59 sales points to 2,034 stores.

However, for the An Khang Pharmacy chain, the restructuring process seems to have just begun. As of the end of 2023, the An Khang Pharmacy chain had 527 sales points. However, by the end of the second quarter of 2024, this number had decreased to 481, indicating that 46 pharmacies had been closed in the first six months of the year. And by the end of July, the number of pharmacies in the chain was only 387, implying that 94 stores had been “wiped out” within a month.

Previously, at a meeting with MWG investors and shareholders a few days ago, Mr. Doan Van Hieu Em, CEO of Thegioididong.com, shared that the An Khang Pharmacy chain is undergoing restructuring, similar to the Bach Hoa Xanh and Dien May Xanh chains.

“We are evaluating each pharmacy and will close those that are not meeting revenue and profit targets,” he said. According to the plan, by the end of 2024, the number of An Khang pharmacies will be reduced to approximately 300 stores.

“With the remaining pharmacies, we will focus on perfecting the business model and only consider expansion when the stores have reached the breakeven point,” Mr. Hieu Em added.

He also mentioned that each pharmacy needs to achieve a revenue of VND 550 million per month to reach the breakeven point. Currently, the average revenue of each pharmacy is VND 500 million per month.

The An Khang Pharmacy chain, formerly known as Phuc An Khang Pharmacy, was acquired by The Gioi Di Dong in 2017. The leadership of The Gioi Di Dong was confident in An Khang’s expansion, setting a target of 800 stores by the end of 2022 and 2,000 stores by the end of 2023. However, this plan proved unfeasible as, by 2023, the An Khang Pharmacy chain had only added 27 stores compared to the beginning of the year.

In fact, this pharmacy chain has been consistently loss-making over the years. In 2019, An Khang reported a loss of nearly VND 6 billion, followed by a loss of VND 6.4 billion in 2020. The chain continued to incur a significant loss of VND 306 billion in 2022. In 2023, the chain reported a loss of VND 343 billion. However, a bright spot was that the store’s revenue increased from VND 280 million at the beginning of 2023 to VND 450 million by the year-end.

In the second quarter of 2024, the An Khang Pharmacy chain still reported a post-tax loss of more than VND 102 billion. Overall, in the first six months of the year, the chain recorded a loss of VND 172 billion. Cumulatively, from 2016 to the present, the chain has incurred a tax loss of nearly VND 834 billion.

This year, the company’s management expects the pharmacy chain to achieve double-digit revenue growth, gain market share, and reach the breakeven point by the end of the year.

Assessing An Khang’s business performance, SSI Securities Company estimated that the An Khang Pharmacy chain would achieve VND 2,500 billion in revenue and a loss of VND 339 billion in 2024. In 2025, the revenue is expected to reach VND 2,900 billion, with a loss of VND 243 billion. Thus, it is estimated that the An Khang Pharmacy chain could incur an additional loss of VND 582 billion in two years, bringing the total cumulative loss to VND 1,416 billion.

Mobile World achieves revenue of VND118,000 trillion: TVs, tablets, and phones all decrease by 10% – 50%, while one product grows in both quantity and revenue.

Mobile World Investment Corporation (MWG) has recently announced its 2023 business results. According to the report, the company’s consolidated revenue reached over 118 trillion Vietnamese dong, equivalent to 89% of the revenue in 2022.