The Board of Directors of UIC has decided to halt the implementation of a cooperation agreement involving capital contribution in the form of land-use rights for a planned apartment building project located in Hoa An Ward, Bien Hoa City, Dong Nai Province.

Almost a year ago, on October 11, 2023, UIC approved a plan to collaborate with IDICO-URBIZ (a subsidiary of IDICO) by establishing a joint venture with a proposed charter capital of VND 40 billion. As per the agreement, UIC was to contribute 49% in cash and land-use rights for a plot of land measuring 2,208 square meters, while IDICO-URBIZ would contribute the remaining 51% in cash, amounting to VND 20.4 billion.

However, with this decision to discontinue the partnership, the UIC Board of Directors has instructed the Company’s Director to carry out the necessary procedures to terminate the investment in IDICO Urban and Housing Development Company. Additionally, they are tasked with coordinating with IDICO-URBIZ to dissolve this joint venture.

The Company is now directed to seek capable partners for collaboration on the apartment project, subject to approval by authorized agencies, to ensure the project’s investment efficiency.

It is worth noting that IDICO (HNX: IDC) is the parent company of both UIC (with a 66.93% stake) and IDICO-URBIZ (wholly owned).

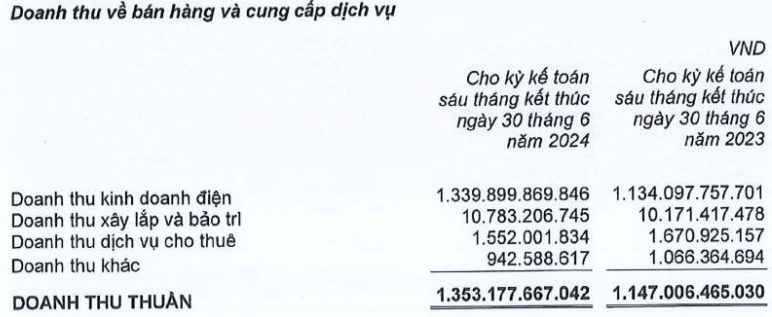

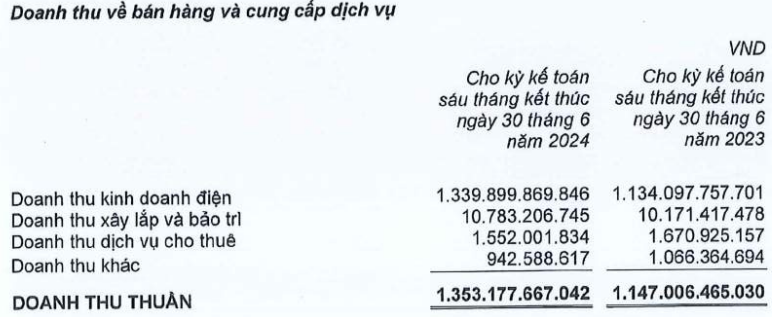

In the first half of 2024, UIC reported a 13% increase in post-tax profit to over VND 22 billion, on the back of an 18% rise in net revenue to more than VND 1,353 billion. The majority of the revenue was generated from the electricity business, contributing nearly VND 1,340 billion, an increase of 18% compared to the previous year.

Source: UIC

|

As of the first half of 2024, UIC has achieved 51% and 26% of its full-year revenue and pre-tax profit targets, respectively.

On the stock market, UIC shares closed at VND 38,050 per share on August 23, 2024, up 17% since the beginning of the year. However, the average trading liquidity remained low, with an average of only about 3,700 shares traded per session.

| Share Price Movement of UIC since the beginning of 2024 |

GVR loses lawsuit against hydroelectric company, will have to refund over 141 billion VND

This is the deposit amount of Dak R’Tih Hydropower Joint Stock Company to purchase the entire 5-share stock batch of hydropower companies owned by Vietnam Rubber Industry Group (HOSE: GVR) and its subsidiaries under the 2016 transfer agreement.

Is Pomina selling assets in its new restructuring plan?

According to the recently announced plan, Pomina (HOSE: POM) will collaborate with strategic investors to establish a new company to facilitate the corporate restructuring process. It is noteworthy that Pomina will only contribute 35% of the capital to the new company, with the new investors taking control of the newly established company.