On August 30, PVI Joint Stock Company (code: PVI) will finalize the list of shareholders to pay 2023 dividends in cash, at a rate of 32% (1 share will receive VND 3,200). The expected payment date is September 20, 2024.

With more than 234 million shares outstanding, PVI is expected to spend VND 750 billion on this dividend payment to shareholders.

In terms of shareholder structure, HDI Global SE is the largest shareholder, holding more than 96 million shares, equivalent to a 41.05% stake, estimated to receive VND 308 billion. The Vietnam Oil and Gas Group (PVN) currently owns 35% of the shares and is expected to receive more than VND 262 billion, while Funderburk Lighthouse Litmited, with a 12.61% stake, will receive VND 94 billion.

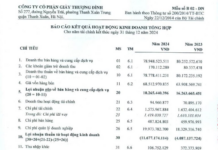

PVI is paying high dividends following a successful 2023. Specifically, total revenue for 2023 exceeded VND 16,000 billion, surpassing the annual plan by 19%. After-tax profit reached a record high of VND 1,007 billion, up 15% from the previous year and exceeding the annual plan by 26%.

In the first half of 2024, PVI recorded total revenue – including insurance, reinsurance, and financial revenue – of VND 11,981 billion, up 51% from the same period last year. Profit before tax increased by 13%, from VND 693 billion to VND 787 billion.

In 2024, PVI set a target of VND 17,398 billion in total revenue and VND 1,080 billion in pre-tax profit. With the results of the first six months, PVI has achieved 69% of the revenue target and 73% of the profit target.

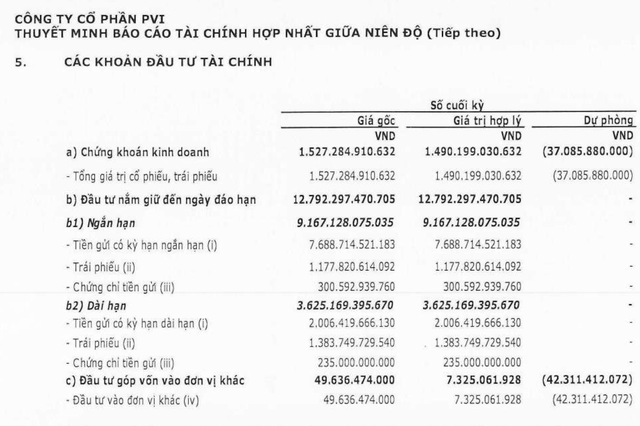

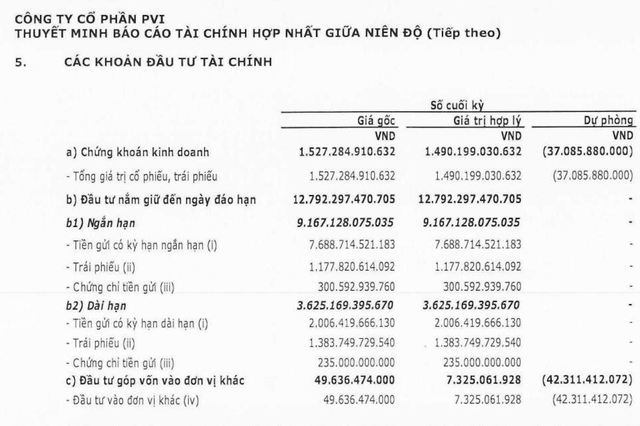

As of the end of the second quarter, PVI’s investment portfolio included nearly VND 1,500 billion in trading securities (stocks, bonds) and nearly VND 12,800 billion in held-to-maturity investments, mainly term deposits.

PVI maintains a safe and liquid investment portfolio (term deposits: 61%; bonds: 28%; real estate investments: 11%). Despite operating in a low-interest-rate environment with a downward trend, the ratio of financial profit to equity has slightly increased compared to the previous year due to long-term deposits with high interest rates from previous years and bonds with good yields.

In another development, PVI’s leadership recently shared that the company is preparing to switch stock exchanges and list its shares on the Ho Chi Minh Stock Exchange (HOSE).

Additionally, according to the plan approved by the Government, the Vietnam Oil and Gas Group will divest from PVI before the end of 2025. Currently, PVN owns 35% of PVI, and the first steps in the divestment process have been prepared. However, the divestment depends on several factors and requires careful preparation and consultation. This also depends on favorable market conditions.

Profit from Sugarcane, Durian, and Leafy Vegetables with the Lunar New Year approaching

Good news for farmers in the Mekong Delta provinces as the prices of sugarcane, durian, and vegetables… have skyrocketed during the days leading up to the Lunar New Year, providing them with attractive sources of income.