News of the draft resolution to remove the prefunding knot blew a gust of wind into the securities group’s stock prices, helping them to reverse and rise during the afternoon trading session. This positive momentum spread to other sectors, with the index closing the week up 2.54 points, approaching the 1,285-point level.

Securities stocks led the gainers, with many notable risers such as SSI up 1.51%, HCM up 2.68%, FTS up 1.49%, and AGR up 2.71%. In the financial sector, insurance stocks also rose 1.65%, while banks ticked up 0.18% with a deep divergence among individual stocks. The real estate sector climbed 0.15%, raw materials gained 0.57%, and food and beverage stocks rose 0.39%.

The top stocks driving the market included GVR, HPG, CTG, VNM, and BID, collectively contributing 2.83 points to the market. On the flip side, the sectors facing adjustment pressure today were telecommunications services, down 1.17%; oil and gas, down 0.83%; and transportation, down 0.84%. The two stocks with the most negative impact on the market were FPT and LPB.

Aggressive buying activity picked up towards the end of the session, but morning trading saw hesitant capital inflows, resulting in low liquidity across the three exchanges, with matched orders reaching nearly VND 19,000 billion.

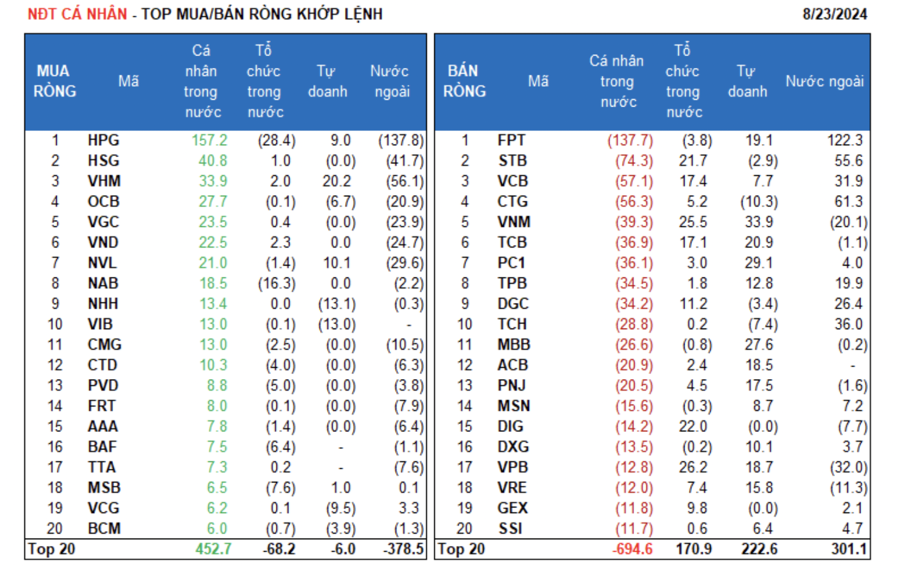

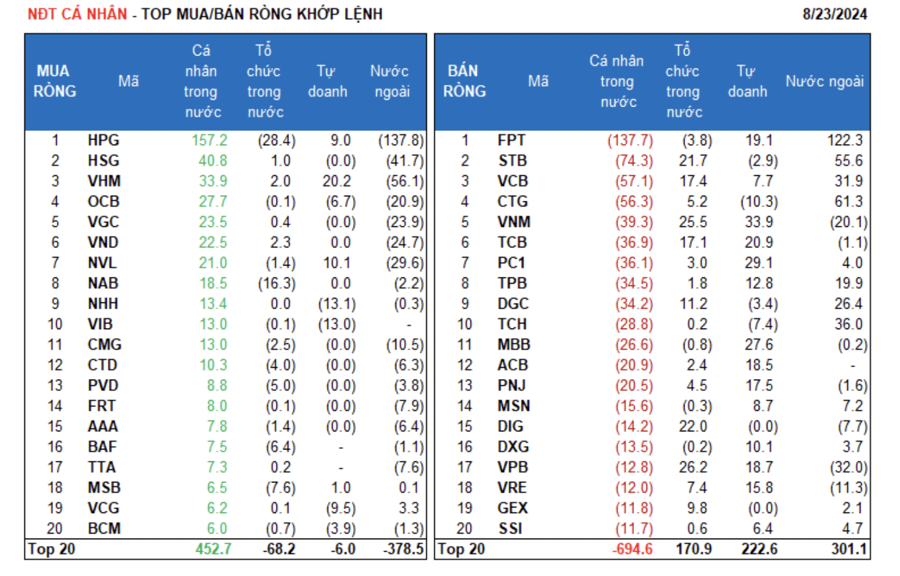

Foreign investors net sold over VND 102.9 billion, with a net sell value of VND 71.9 billion in matched orders. Their main net buy on the matched orders side was in the Information Technology and Banking sectors. The top net bought stocks by foreign investors on a matched orders basis included FPT, CTG, STB, TCH, VCB, DGC, FUEVFVND, TPB, VHC, and NTL.

On the other hand, their main net sell on a matched orders basis was in the Basic Materials sector. The top net sold stocks by foreign investors on a matched orders basis were HPG, VHM, HSG, VPB, NVL, VGC, OCB, HDB, and VNM.

Individual investors net sold VND 783 billion, with a net sell value of VND 295.8 billion in matched orders. In terms of matched orders, they net bought 7 out of 18 sectors, mainly in the Basic Materials sector. Their top net bought stocks included HPG, HSG, VHM, OCB, VGC, VND, NVL, NAB, NHH, and VIB.

On the net sell side for matched orders, they net sold 11 out of 18 sectors, mainly in the Banking and Information Technology sectors. The top net sold stocks included FPT, STB, VCB, CTG, VNM, TCB, TPB, DGC, and TCH.

Proprietary traders net bought VND 272.4 billion, with a net buy value of VND 260.7 billion in matched orders. In terms of matched orders, proprietary traders net bought 13 out of 18 sectors. The sectors with the largest net buys were Banking and Real Estate. The top net bought stocks by proprietary traders in today’s session included VNM, PC1, MBB, TCB, VHM, FPT, VPB, ACB, PNJ, and VRE.

The top net sold sector was Chemicals. The top net sold stocks included NHH, VIB, CTG, DPM, VCG, VCI, KDH, FUESSV30, TCH, and OCB.

Domestic institutional investors net bought VND 588.1 billion, with a net buy value of VND 107.0 billion in matched orders. In terms of matched orders, domestic institutions net sold 7 out of 18 sectors, with the highest value in the Basic Materials sector. The top net sold stocks included HPG, FUEVFVND, NAB, MSB, BVH, BAF, VJC, PVD, BID, and GMD.

The sector with the highest net buy value was Banking. The top net bought stocks included VPB, VNM, DIG, STB, VCB, TCB, HDB, DGC, GEX, and MWG. Today’s matched orders trading volume reached VND 2,731.4 billion, up 60.8% from the previous session and contributing 14.5% to the total trading value.

Capital allocation shifted towards Real Estate, Securities, Steel, Food, Building Materials, and Personal Goods sectors while decreasing in Banking, Retail, Construction, and Chemicals. Specifically, in terms of matched orders, capital allocation increased in the mid-cap VNMID and small-cap VNSML sectors while decreasing in the large-cap VN30 sector.

Stocks rally as bank shares change hands at record levels

The VN-Index experienced its biggest drop of the year today (31/1), closing down over 15 points. Trading volume surged due to profit-taking pressure, mainly focused on the banking sector. SHB saw a record high turnover with over 127 million shares changing hands.