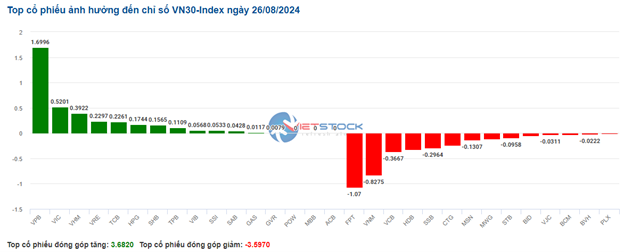

The breadth of stocks in the VN30 basket was relatively balanced between buyers and sellers. Specifically, VPB, VIC, VHM, and VRE contributed 1.7 points, 0.52 points, 0.39 points, and 0.23 points to the overall index, respectively. In contrast, FPT, VNM, VCB, and HDB faced selling pressure, deducting over 2.5 points from the index.

Source: VietstockFinance

|

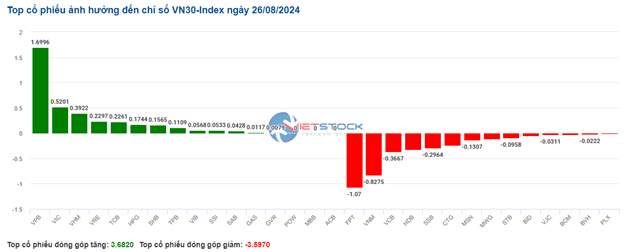

Among the groups supporting the current index, the energy sector posted a modest gain of 0.39%. Buying interest was primarily focused on oil and gas giants such as PVS, which rose by 0.99%, PVC with a 1.48% increase, and notably, BSR climbed by 0.84% following the news of this “giant” refinery and petrochemical company submitting a listing registration for 3.1 billion BSR shares on HOSE on August 21, 2024.

With a market capitalization of up to VND 74,700 billion (ranking 21st compared to companies on HOSE as of August 16, 2024), if approved for a transfer to the HOSE listing, BSR will become a blue-chip stock and is expected to enter the VN30 basket in the near future. The appearance of this extremely high-quality “blockbuster” is expected to attract additional capital inflows into the stock market from individual and institutional investors, both domestic and foreign.

Source: VietstockFinance

|

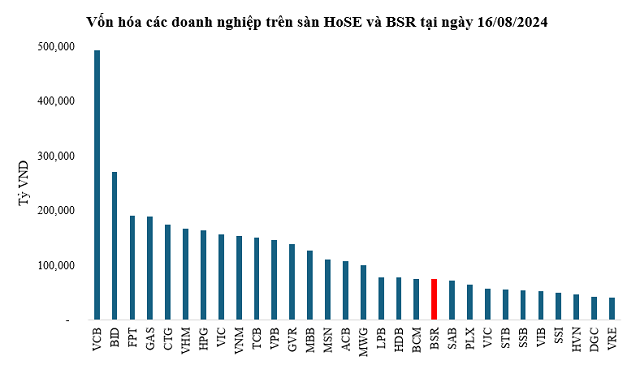

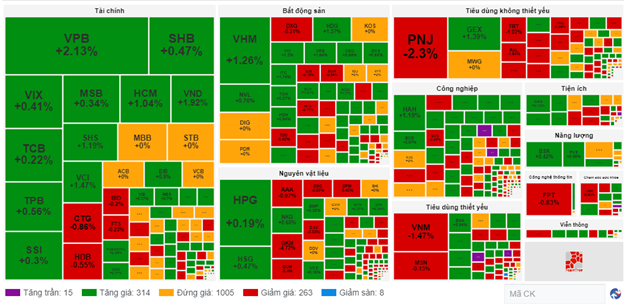

The financial group narrowed its morning gains and turned somewhat negative on the overall index, but the performance was mixed, with a majority of stocks still in positive territory. Notably, VPB rose by 1.87%, TCB climbed by 0.45%, VIB gained 0.27%, and SHB increased by 0.47%… Meanwhile, SSB, CTG, HDB, and VCB continued to face selling pressure, but their declines were not significant.

As of the opening, the market remained somewhat mixed, with over 1,000 reference codes, but buyers had a slight edge. There were 314 gainers and 263 decliners.

Source: VietstockFinance

|

Opening: Green Dominates Most Sectors

As of 9:40 am on August 26, the VN-Index had gained over 2 points to reach 1,287.73 points, while the HNX-Index also edged slightly higher to 241 points.

Green prevailed among the VN30 basket constituents, with 19 gainers, 9 decliners, and 2 unchanged stocks. SAB, VIC, and VRE were the top performers. On the flip side, SSB, BVH, and VNM experienced minor losses of 1%, 0.76%, and 0.93%, respectively.

As of 9:40 am, the energy sector was off to a strong start, with several stocks posting gains from the opening bell: PVD (+0.72%), PVS (+1.24%), BSR (+0.84%), PVC (+1.48%), and PVB (+1.03%).

Additionally, the telecommunications services group also contributed positively to the market, with most stocks trading in positive territory: VGI (+0.44%), CTR (+0.23%), FOX (+1.08%), FOC (+2.18%), and so on.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.