Hua Na Hydropower Receives Reminder for Delayed Disclosure of Information

Ho Chi Minh City Stock Exchange (HoSE) recently issued Document No. 1312/SGDHCM-NY to Hua Na Hydropower Joint Stock Company (Stock Code: HNA) regarding their delay in disclosing information.

Specifically, according to this document, during the first six months of 2023, Hua Na Hydropower approved the 2024 production and business plan through Decision No. 10/QD-HHC-HQT dated February 15, 2021, issued by the Board of Directors. However, HoSE has not received the disclosure of this information.

According to Point e, Clause 1, Article 11 of Circular No. 96/2020/TT-BTC dated January 16, 2020, on information disclosure in the securities market: “A public company must disclose abnormal information within 24 hours from the occurrence of one of the events, such as a decision on reorganizing the business, strategy, mid-term plan, and annual business plan of the company.”

HoSE reminded Hua Na Hydropower to “comply with the legal regulations on the stock market to protect the interests of shareholders and conduct a review and supplementary information disclosure,” as stated in the HoSE document.

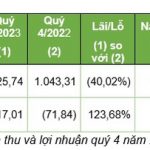

In terms of business performance, according to the consolidated financial statements for the second quarter of 2024, Hua Na Hydropower recorded net revenue of VND 103.2 billion, a 16% increase compared to the previous year.

However, due to operating at a gross loss, the company incurred a gross loss of VND 2.6 billion. Financial income halved to VND 2.3 billion. Financial expenses also decreased significantly from VND 79 billion to VND 2.1 billion. Selling and administrative expenses amounted to VND 7.9 billion.

After deducting various taxes and fees, Hua Na Hydropower posted a post-tax loss of over VND 10 billion.

For the first six months of 2024, Hua Na Hydropower’s revenue reached VND 205.5 billion, a 28% decrease compared to the same period last year, with a post-tax loss of VND 13.9 billion.

As of the end of the second quarter of 2024, the company’s total assets stood at VND 3,396 billion, slightly lower than the beginning of the year. Cash and cash equivalents tripled to VND 302.4 billion. Payables increased by 72% from the beginning of the year to VND 437 billion.

PV

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”

Foreign investors sell nearly 300 billion VND in the final trading session of the week, while strongly accumulating a real estate stock in the opposite direction.

In a fierce market session, foreign trading is a negative factor with net selling across all three exchanges.