Ho Chi Minh City Stock Exchange (HoSE) announced that August 22 is the effective date of the listing change of more than 304 million VND shares of VNDirect Securities. These are VNDirect’s publicly offered and dividend payout shares.

Of these, nearly 295 million shares will be credited to investors’ accounts and can be traded starting September 4, 2024.

The remaining over 9.5 million unexercised shares, which will be allocated to other investors, will be restricted from transfer for one year. The trading date will be from July 14, 2025.

Following the offering, the total proceeds amounted to nearly VND 2,436 billion. With a total circulating volume of over 1.52 billion shares, VNDirect officially surpassed SSI to become the securities company with the largest charter capital in the market (nearly VND 15,223 billion).

On the exchange, VND shares closed at VND 15,600 per share on August 23. Compared to the closing price at the end of May, the share price decreased by nearly 13%.

At the 2024 Annual General Meeting of VND shareholders, the shareholders also approved the private placement of shares, the Employee Stock Ownership Plan (ESOP), and the issuance of bonus shares to employees. These are plans that were approved at the 2023 Annual General Meeting but have not yet been implemented. The expected timeline for implementation spans from 2024 to 2026. If all the aforementioned offering and issuance plans are completed, VNDIRECT’s charter capital will increase to over VND 18,300 billion.

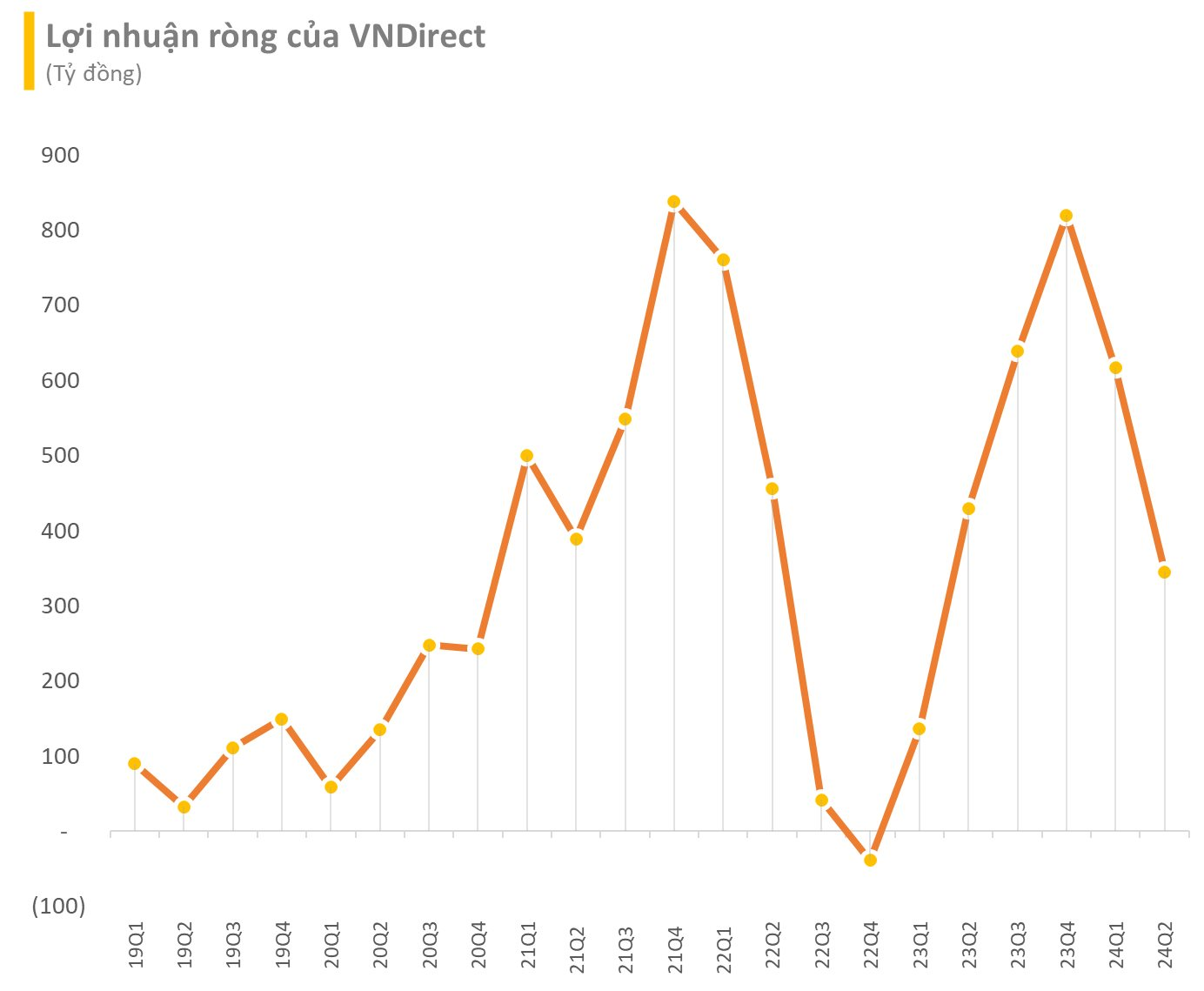

In terms of business performance, for the first six months of 2024, VNDirect’s operating revenue slightly decreased by 1% to VND 2,843 billion. As a result, the company’s pre-tax profit was VND 1,193 billion, up 70% over the same period last year, thus completing 47% of the yearly plan.

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”

Stocks rally as bank shares change hands at record levels

The VN-Index experienced its biggest drop of the year today (31/1), closing down over 15 points. Trading volume surged due to profit-taking pressure, mainly focused on the banking sector. SHB saw a record high turnover with over 127 million shares changing hands.