The market maintained its upward trajectory last week, with the VN-Index consecutively surpassing the 1,260 and 1,270 marks and approaching the strong resistance zone of 1,290 – 1,300. However, the momentum showed signs of slowing down in the last two sessions before the aforementioned strong resistance level, as well as awaiting updates from the Chairman of the Federal Reserve (Fed) on monetary policy for the next phase.

At the end of the week, the VN-Index rose 2.6% to 1,285.3. The group of bank stocks, including VCB (+4.9%), BID (+6.3%), and CTG (+7.5%), were the main drivers of the market. Liquidity increased by 19% to VND 17,756 billion per session. Foreign investors net sold VND 963 billion on all three exchanges.

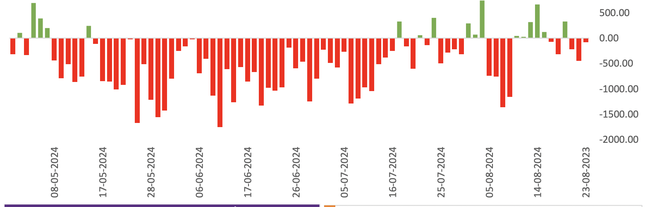

Foreigners resumed net selling last week. Data source: TPS

According to observations by VPBank Securities analysts, the market rebounded but was in a “green peel, red flesh” situation. Money flowed into steel and bank stocks, which are considered market pillars. In the last session, even as the VN-Index was pulled up by these pillars, the number of declining stocks on the market still outnumbered the gainers. Technically, the VN-Index faces resistance at the 1,290 – 1,300 level, and the increased profit-taking pressure could signal a technical correction.

Accordingly, investors can take profits on stocks that have risen sharply and restructure their portfolios towards stocks that have not yet increased significantly to catch the rotation of cash flow in the coming weeks.

VNDirect’s research team opined that the market’s primary concern now is the extent and intensity of the Fed’s interest rate cuts in the latter part of this year. Currently, the market expects the Fed to cut its policy rate by around 0.75-1% by the end of the year. However, if the Fed adopts a more cautious approach, it could impact investor expectations and the market.

In this context, domestic investors should exercise caution as the positive news has been reflected in the impressive recent gains. The VN-Index is facing strong resistance at the 1,290 – 1,300 zone. Investors should refrain from new investments in stocks that have already recovered strongly in this region, maintain a moderate stockholding level, and avoid high leverage to manage risks.

“If the market undergoes a correction towards the support area of 1,255- 1,260, it will create an opportunity to accumulate more stocks, prioritizing sectors with improved prospects in the second half of 2024, such as banking, exports (garments, seafood, wood), and some specific real estate businesses that have been deeply discounted recently,” VNDirect recommended.

With the VN-Index approaching the old peak of 1,300, many analysts believe that the short-term downtrend has ended, and the market has returned to a positive accumulation range of 1,250 – 1,300. It is predicted that the VN-Index will continue towards the old peak zone of 1,280 – 1,300.

BIDV Securities (BSC) forecasts three scenarios for the VN-Index in 2024. In the negative scenario, the VN-Index approaches 1,200. In the base case scenario, it reaches 1,298. In the positive scenario, the index targets 1,425.

BSC assesses that with the expected easing of exchange rate pressure as the Fed cuts interest rates, businesses’ profit growth in the second half will continue to be supported mainly by lower borrowing costs, reduced foreign exchange losses, reduced selling and management expenses, along with the low base from the third quarter of the previous year.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.