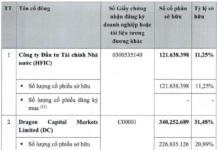

Specifically, Vinatex will offer for sale more than 2.81 million Donagamex shares, equivalent to 25.7% of capital, to less than 100 investors at a starting price of VND 35,000 per share. The expected timeline for this offering is the third quarter of 2024. Vinatex anticipates a minimum proceeds of VND 98 billion from this capital divestment.

Donagamex, a transformed entity from Dong Nai Garment Company, is a state-owned enterprise under the Vietnam National Textile and Garment Group. Its primary operations include the manufacturing and trading of various garment products, as well as dealing in equipment, spare parts, and other products related to the textile and garment industry. Currently, Donagamex has three subsidiaries and one associated company.

Donagamex Photo

|

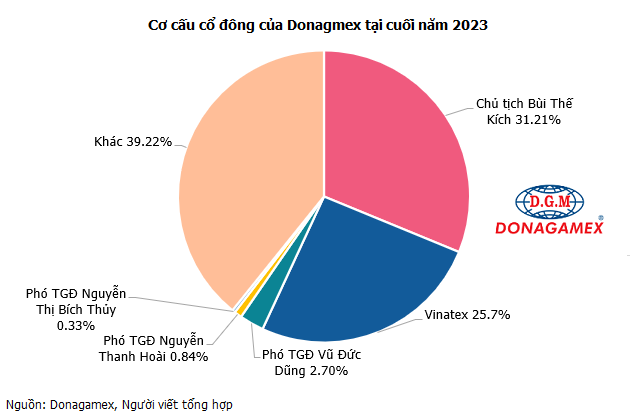

The company’s chartered capital is nearly VND 109.4 billion. The largest shareholder is Mr. Bui The Kich, Chairman of the Board of Directors and General Director of the Company, who holds 31.21% of the capital. Mr. Kich also represents Vinatex, holding 25.7% of Donagamex’s shares.

Additionally, several other executives hold stakes in the company, including Vice General Director Vu Duc Dung with 2.7%, Vice General Director Nguyen Thanh Hoai with 0.84%, and Vice General Director Nguyen Thi Bich Thuy with 0.33%.

A glimpse into Dong Nai Garment Company’s performance before Vinatex’s divestment:

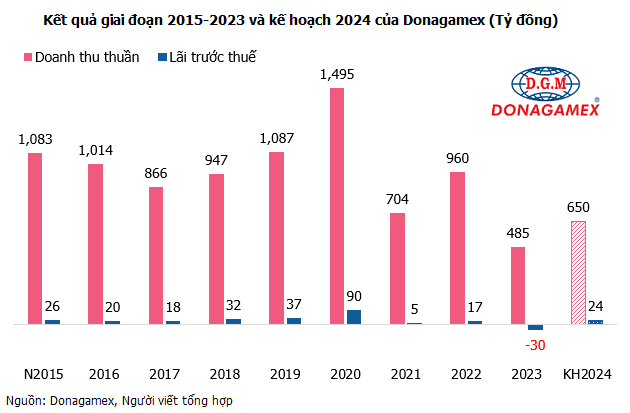

From 2017 to 2020, Donagamex witnessed an average growth of 20% in revenue and 80% in pre-tax profits. Notably, in 2020, the company achieved its highest revenue of VND 1,495 billion and a pre-tax profit of VND 90 billion.

However, during the period of 2021-2023, Donagamex’s business performance fluctuated, even resulting in a pre-tax loss of over VND 30 billion in 2023, the lowest in almost a decade, while still managing a profit of VND 17 billion in 2022.

The company attributed these fluctuations to the impact of COVID-19, conflicts in Europe, and high inflation, which led to a decrease in garment orders. To maintain operations, Donagamex had to accept lower-margin contracts, while production costs remained relatively high compared to revenue. The average number of employees in 2023 was 705.

For 2024, Donagamex sets its sights on a revenue target of VND 650 billion, marking a 34% increase compared to the previous year, and a pre-tax profit of VND 24 billion. Similar to 2023, the company does not plan to pay dividends.

As of the end of 2023, Donagamex’s total assets amounted to nearly VND 333 billion, including VND 70 billion in bank deposits and nearly VND 55 billion in inventory. On the liabilities side, the company had nearly VND 163 billion in payables, of which bank loans accounted for over VND 89 billion. The company recorded an accumulated loss of nearly VND 29 billion as of December 31, 2023.

Regarding its medium and long-term development strategy, Donagamex intends to maintain its focus on the garment industry, maximizing the export-oriented FOB business model, and gradually transitioning to the ODM value chain in the garment industry.

Simultaneously, the company aims to diversify into a multi-industry corporation, shifting towards industrial services and commercial urban area development. Specifically, Donagamex plans to venture into commercial and urban area projects in Zone A – Bien Hoa 1 Industrial Park and Zone B in Trang Dai Ward, Bien Hoa City, Dong Nai Province.

Furthermore, Donagamex will continue to develop the Hung Loc Industrial Cluster, spanning 40 hectares in Thong Nhat District, Dong Nai Province, with aspirations to expand it into an industrial park when conditions permit. As of December 31, 2023, the company has invested over VND 70 billion in construction costs for this cluster.

Internet Photo

|

|

Vinatex’s divestment from Donagamex aligns with the “Restructuring Plan of Vietnam National Textile and Garment Group for the Period of 2021-2025, with a Vision to 2030”. In early May 2024, Vinatex’s Board of Directors approved the divestment from eight units, including Donagamex. Most recently, on July 16, Vinatex decided to divest its entire capital contribution in Binh Minh Garment Joint Stock Company (UPCoM: BMG). Accordingly, Vinatex will offer for sale more than 1.32 million BMG shares (25% stake) at a starting price of VND 43,700 per share, potentially raising VND 60 billion from this transaction. Vinatex auctions 25% stake in May Binh Minh, starting price more than doubles market price |

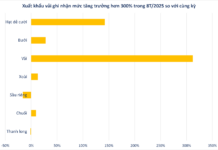

Vietnam’s Textile and Apparel Industry Shows Impressive Growth in 2024

Against the backdrop of multiple challenges, Vietnam’s textile and garment industry sets a target of $44 billion in exports by 2024, driven by efforts to improve management and operations, as well as the adoption of technology in production and business.