Successful purchase of over 6.2 million shares by a company related to the CEO, making it the parent company of DTH

From July 15 to August 5, 2024, Metz USA Vietnam JSC successfully acquired nearly 6.22 million shares of Thanh Hoa Medical Supplies and Pharmaceutical Joint Stock Company (Thanh Hoa Pharma, UPCoM: DTH), out of the registered 6.32 million shares. As a result, Metz USA Vietnam JSC became the parent company of Thanh Hoa Pharma with an ownership ratio of 83.31%.

Metz USA Vietnam JSC is a company related to Mr. Tran Thanh Minh, a member of the Board of Directors and CEO of DTH. The reason Metz USA Vietnam JSC did not complete the entire registered transaction was due to a lack of agreement on the quantity or price between the related parties.

During this period, the transactions related to DTH shares were mostly matching orders. The transactions from July 15 to August 2 matched the volume purchased by Metz USA Vietnam JSC. The total value of these transactions amounted to nearly VND 84.6 billion, equivalent to an average of VND 13,600 per share.

Prior to this, Mr. Minh and his wife, Ms. Tran Thi Huyen Trang, who is also a member of the Board of Directors of DTH, simultaneously registered to divest their entire holdings of 51.39% of the charter capital from July 16 to August 12, 2024. Mr. Minh registered to sell 1.7 million shares (equivalent to 22.91% of charter capital), while Ms. Trang intended to sell 2.1 million shares (equivalent to 28.48%).

Both transactions were successfully executed. Mr. Minh sold all his shares on July 26, while Ms. Trang completed her divestment on August 2, 2024. It is estimated that Mr. Minh and Ms. Trang respectively earned over VND 23 billion and nearly VND 29 billion from these transactions.

A company related to the Chairman increases its ownership in HAH to nearly 17%

Hai Ha Investment and Transport Joint Stock Company, a major shareholder of Hai An Transport and Stevedoring Joint Stock Company (HOSE: HAH), purchased 1.53 million shares during the period from July 23 to August 21, 2024. As a result, their ownership in HAH increased from 15.57% to 16.84%, equivalent to more than 20 million shares.

Previously, Hai Ha had registered to buy 2 million HAH shares but only managed to acquire 76.5% of the intended volume. They attributed the reason for not purchasing the full 2 million shares to market developments that did not meet their expectations.

During the trading period, HAH shares only recorded a matching order volume of 25,000 shares. Therefore, it is likely that Hai Ha’s transactions were entirely matching orders. Based on the average closing price during the trading period (approximately VND 41,061 per share), it is estimated that Hai Ha spent nearly VND 63 billion on this deal.

A company related to Ms. Dang Thi Hoang Yen aims to increase its ownership in ITA to over 12%

Tan Dong Phuong Investment Construction and Development Joint Stock Company, a major shareholder of Tan Tao Investment and Industry Corporation (HOSE: ITA), has registered to purchase by agreement more than 5.8 million ITA shares from August 26 to September 24, 2024.

If the transaction is successful, Tan Dong Phuong’s ownership in ITA will increase from 11.84% to 12.46%, equivalent to 116.9 million shares.

Based on the closing price of VND 3,750 per share on August 21, it is estimated that Tan Dong Phuong will spend nearly VND 22 billion to complete this transaction.

The Chairman of the Board of ITA, Dang Thi Hoang Yen (also known as Maya Dangelas), and the CEO of ITA, Mr. Nguyen Thanh Phong, are currently serving as the CEO and Deputy CEO of Tan Dong Phuong, respectively.

Previously, Tan Dong Phuong successfully purchased by agreement nearly 38 million ITA shares from May 27 to June 18, 2024, thereby increasing their ownership in ITA from 7.79% to 11.84%. The estimated value of this transaction was around VND 213 billion.

Novagroup intends to sell an additional 3 million NVL shares

Novagroup Joint Stock Company continues to register for the sale of 3 million shares of Nova Group Real Estate Investment Corporation (HOSE: NVL) to balance its investment portfolio and support debt restructuring from August 27 to September 6, 2024.

If the transaction is successful, Novagroup’s ownership in NVL will decrease from 17.79% to 17.63%, equivalent to nearly 344 million shares.

Based on the closing price of VND 13,200 per share on August 23, the estimated value of this transaction could reach nearly VND 40 billion.

Previously, Novagroup had sold all 2 million NVL shares in a matching order during the session on July 18, reducing their ownership from 17.89% to the current level of 17.79%. The estimated value of this transaction was around VND 25 billion.

|

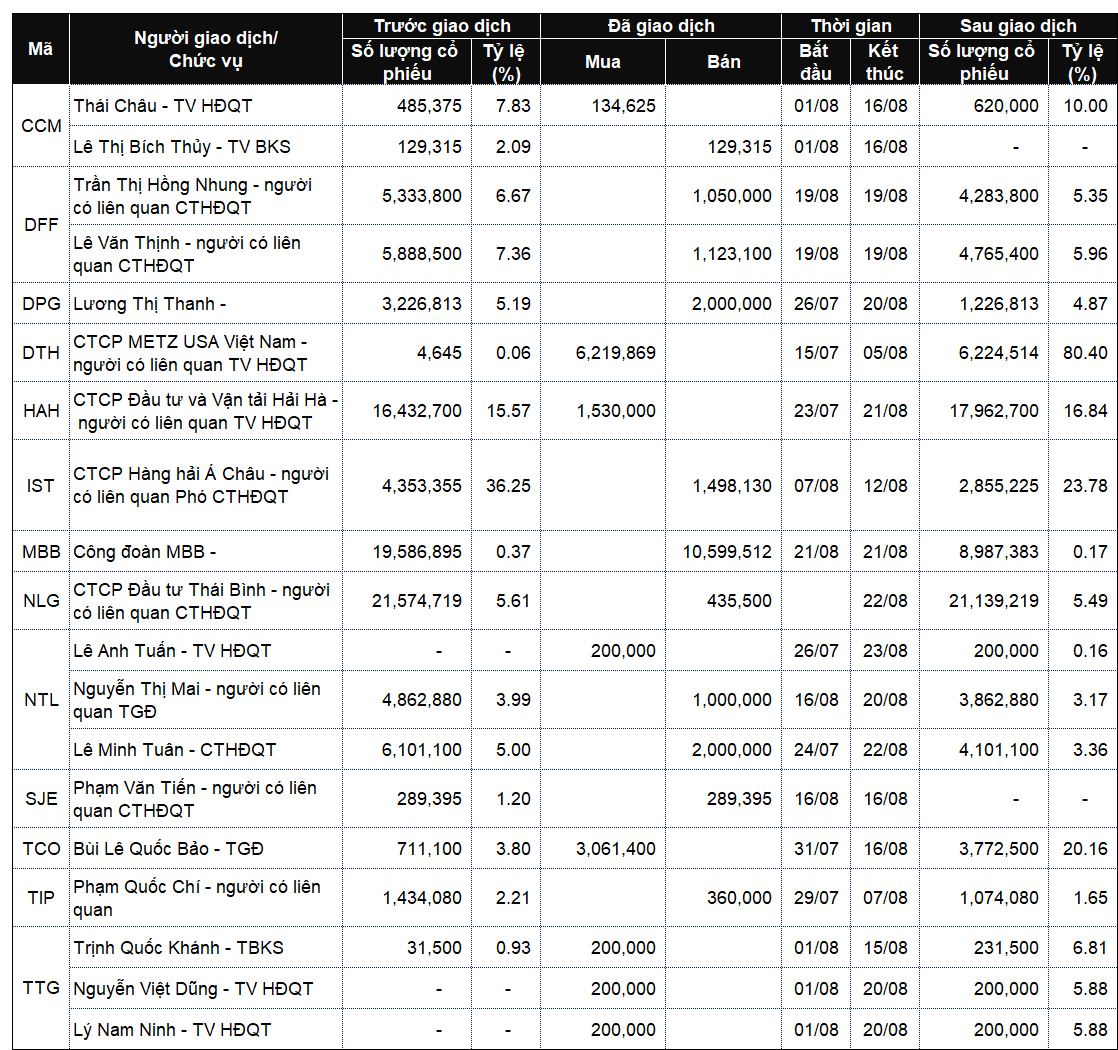

List of company leaders and relatives’ transactions from August 19 to 23, 2024

Source: VietstockFinance

|

|

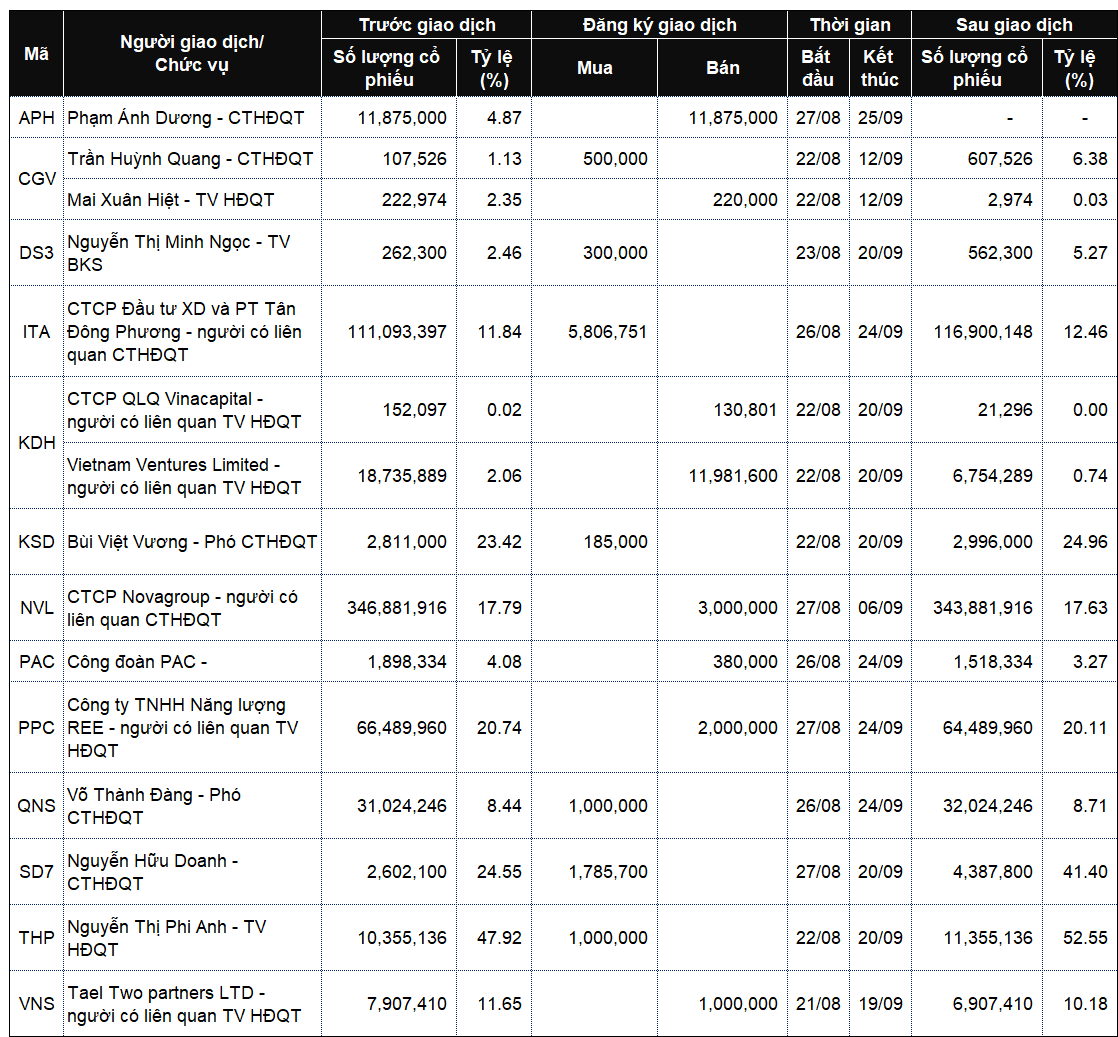

List of company leaders and relatives’ registered transactions from August 19 to 23, 2024

Source: VietstockFinance

|

Choose stocks for “Tet” festival celebrations

Investors should consider choosing stocks in the banking industry with good profitability, healthy real estate, and abundant clean land reserves. In addition, the group of stocks in infrastructure investment, iron and steel, and construction materials should also be considered.

Vietnam’s Largest Deep-water Port Town is Set to Become a Thriving City with Investments from Korean Chaebols: Latest Project Involves Nearly 10 Trillion VND for Fuel

Previously, this chaebol has invested $3.5 billion in projects in various major cities such as Hanoi, Ho Chi Minh City, Dong Nai, and Ba Ria – Vung Tau.