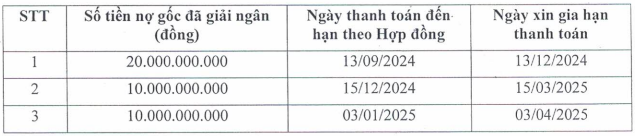

There are three loans in total: a loan of 20 billion VND due on September 13, 2024, which DRG wishes to extend to December 13, 2024; a loan of 10 billion VND due on December 15, 2024, requesting an extension until March 15, 2025; and a loan of 10 billion VND due on January 3, 2025, seeking a new due date of April 3, 2025.

|

Principal amount and time period for which DRG seeks an extension

Source: DRI

|

Looking back to August 2022, the Board of Directors of DRI approved a loan of up to 40 billion VND to DRG, with the funds sourced from sales and debt collection from Daklaoruco, a subsidiary of DRI operating in Laos.

The loan was set at a floating interest rate with a minimum of Vietinbank – Dak Lak Branch’s rate, and the repayment period was 24 months. DRG’s shares in DRI were pledged as collateral for this loan.

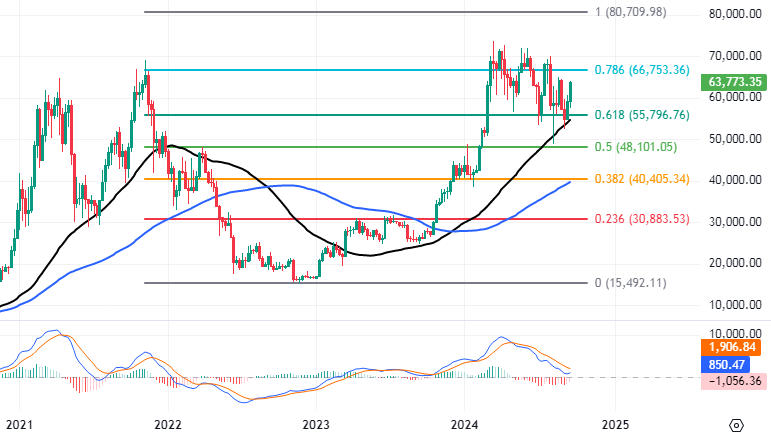

The move to divest has heated up the price of DRI shares.

DRI is a subsidiary directly owned by DRG, with a 60.84% stake. Recently, DRG has been seeking to divest from DRI.

On May 22, 2024, DRG’s Board of Directors passed a resolution to divest from DRI. As per the resolution, DRG planned to sell nearly 22.4 million DRI shares (30.6% of capital) at a starting price of 14,100 VND per share, equivalent to approximately 316 billion VND in value.

Subsequently, DRG registered to sell nearly 22.4 million DRI shares between June 3 and July 2, 2024, and actually sold over 4.2 million shares, reducing its ownership from 66.6% to 60.84%, or more than 44.5 million shares.

DRG then registered to sell the remaining nearly 18.2 million DRI shares between July 10 and August 8, 2024. However, after this period, no shares were sold due to unfavorable market conditions.

Following the unsuccessful sale, DRG registered to sell the same number of shares again to complete its divestment plan, with the sale scheduled from August 20 to September 18, 2024. If successful, DRG’s ownership in DRI will decrease to 36%.

Currently, the price of DRI shares is in a correction phase, hovering around 13,000 VND per share. Prior to the divestment moves, the share price of DRI had surged from above 7,000 VND per share in January 2024 to over 14,000 VND per share in May 2024.

| DRI share price surged ahead of the active divestment moves |

In contrast to the share price movement, DRI’s business results for the first half of 2024 were not positive, with revenue of over 180 billion VND and a net profit of nearly 31 billion VND, an 11% and 3% decrease, respectively, compared to the same period last year. The core business of trading rubber products experienced a decline, especially in the second quarter.

Huy Khai

Businesses Struggle as Companies Rush to Divest Investments in 2023

Taseco Land has withdrawn from the West Lake urban area project, while VNDirect Securities has sold its entire stake in IPAAM to IPA… These are among the notable divestment deals in 2023.

Capital withdrawal at VIMC, MobiFone, VRG: Potential to earn 50,000 billion VND

The Ministry of Planning and Investment (MPI) has submitted a proposal to the Government regarding the approval of a plan to restructure three state-owned enterprises (SOEs) under the State Capital Management Committee at Enterprises (SCMC) by the end of 2025. The three SOEs to undergo divestment are Vietnam Maritime Corporation (VIMC), Vietnam Mobile Telecom Services Corporation (MobiFone), and Vietnam Rubber Group (VRG).