Ms. Trinh Quynh Giao, CEO of PVI Fund Management JSC, assessed that the scale of the corporate bond market in Vietnam is still very small compared to GDP and compared to the corporate bond market of many countries in the world.

According to Ms. Giao, in developed markets, the main capital mobilization channel for the economy is the bond market. This market always has a larger scale than the stock market and bank credit. However, in Vietnam, the opposite is true, as the bond market is still in its infancy, and businesses depend on bank credit. With borrowing capital through the banking system becoming increasingly difficult due to strict regulations in line with international practices that Vietnam has to integrate, Ms. Giao believes that management agencies and market members need to urgently improve the infrastructure for the corporate bond market so that institutional and individual investors, both domestic and foreign, can confidently invest in corporate bonds.

“To evaluate a bond, an investment fund like ours must have at least a team of 5-7 experts, including analysts, risk managers, and legal experts, before presenting it to the investment council. Therefore, individual investors who want to participate in the corporate bond market and rely solely on the white paper published by the enterprise will find it very difficult to make investment decisions,” said Ms. Giao.

BOND RATING IS MAINLY BASED ON EXPERIENCE

Speaking at a recent seminar on corporate bonds in Hanoi, Ms. Duong Kim Anh, Investment Director of Vietcombank Securities Investment Fund Management Company Limited, said that during the process of managing bond portfolios for institutional investors, especially global insurance companies, they always ask about the delay ratio or probability of default of corporate bond codes.

Because when investing in corporate bonds in Vietnam, foreign institutions must also comply with their internal regulations on risk management. One of the tools for effective risk management is the probability of default.

“This data not only helps investors decide on the initial bond purchase but will also be monitored throughout the bond holding period. However, in Vietnam, only commercial banks can calculate this default probability, and they only use it internally,” shared Ms. Kim Anh.

Representatives of some investment funds said that up to now, most organizations in Vietnam still price bonds based on market experience, experience accumulated from deals they have done, or consult colleagues, rather than having standard data.

For example, the risk margin for corporate bonds in the real estate industry is about 4%; if the enterprise is riskier, this number can be 5% or 6%. But these numbers are mostly based on experience.

“The risk when pricing bonds based on experience is that there are many situations where investors lack information; information asymmetry between investors and issuers is common in Vietnam. In addition, there is another problem in the Vietnamese corporate bond market, which is that Repo transactions (buyback contracts for debt restructuring) or transactions between related parties with the issuer are very common, leading to the bond price published on HNX not being the standard price,” said Ms. Duong Kim Anh; at the same time, she emphasized that if investors only look at the price on HNX for reference, they will naturally make the wrong decision.

DATA BASIS IS NOT CLEAN AND DEEP ENOUGH

According to Mr. Tran Phu Viet, Head of Research and Product Development, Financial Data Department (FiinGroup), the standard method to estimate profits and risks is the foundation for building an efficient and sustainable bond investment portfolio. In addition to the nominal/absolute interest rate, investors should also refer to data on the yield to maturity (YTM), credit spread with other asset classes or within specific bonds, and the probability of delay to make investment decisions that match their investment objectives and risk appetite.

Mr. Viet pointed out four benefits of the yield curve for the corporate bond market in particular and the debt capital market in general.

First, individual investors can make better investment decisions by better understanding the risks and expected returns, instead of relying entirely on advisors.

Second, institutional investors can start implementing and applying international standard models in investment and risk management activities and take advantage of secondary market liquidity to adjust their portfolios promptly and operate according to proper portfolio management instead of dealing with individual deals as at present.

Third, consulting organizations can use the reference as a basis for consulting, especially the issuance interest rate for their clients, as well as support the basis for improving the efficiency of book-building and investor search activities for a specific bond lot.

Fourth, issuing enterprises can refer to it as a basis for optimizing their capital strategy and supporting the determination of an appropriate issuance interest rate, matching the investment appetite of the target group of investors.

However, bond pricing currently faces significant challenges due to the lack of depth in transaction data in the corporate bond market, especially the secondary market; the low coverage of credit ratings, not to mention the lack of a series of non-financial information as a basis for investors’ evaluation.

Therefore, representatives of some investment funds said that the market needs third parties to collect and process data and provide a standard yield curve for the market to reference, based on supply and demand data from the real market.

“Credit ratings and yield curves help investors know what price to buy at, negotiate interest rates with issuers, and manage post-investment risks. For insurance companies, it also helps enterprises develop asset allocation strategies for the whole year. The yield curve can help insurance companies or investment funds build scenarios for their business plans for the next year.”

According to fund management companies, to make investors, especially individual investors, feel secure about participating in the bond market, the first thing to do is to expand the coverage of credit ratings. Along with the credit rating results of A or B, equivalent to a certain probability of default, the rating agencies will calculate the risk premium to help investors understand that a bond rated A corresponds to an interest rate of 7%, while a B-rated bond must be 10-11%/year, for example; thereby gradually forming a yield curve for the market to reference for corporate bond pricing.

Ms. Trinh Quynh Giao said that the initial decision only accounts for 30%, while post-investment management accounts for 70% of the success of the investment. During the 3-year or 5-year period when investors hold the bond and decide to sell to realize profits or even have to cut losses, there must be a quantitative basis. Therefore, regularly updated credit rating results and yield curves will help investors decide on their next steps.

THREE BOTTLENECKS THAT NEED TO BE ADDRESSED IN THE CORPORATE BOND MARKET

According to experts, to sustainably grow the corporate bond market, it is necessary to simultaneously address three issues: increasing supply and demand and developing intermediary institutions.

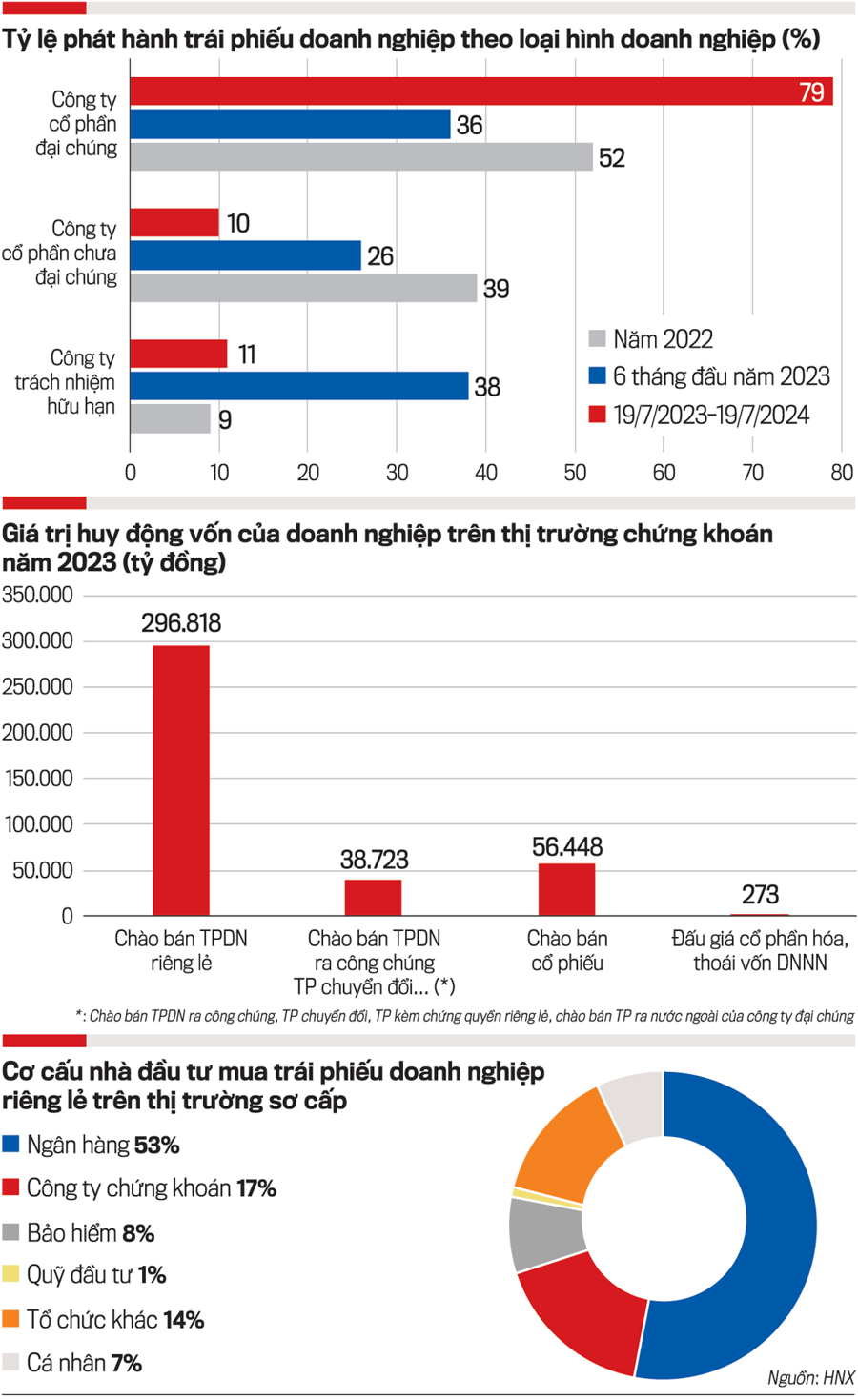

First, regarding the supply, the ratio of corporate bonds issued to the public is currently very low. Analysts and market members point out that the main reason is the lengthy permission procedure at the State Securities Commission…

https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-kinh-te-viet-nam