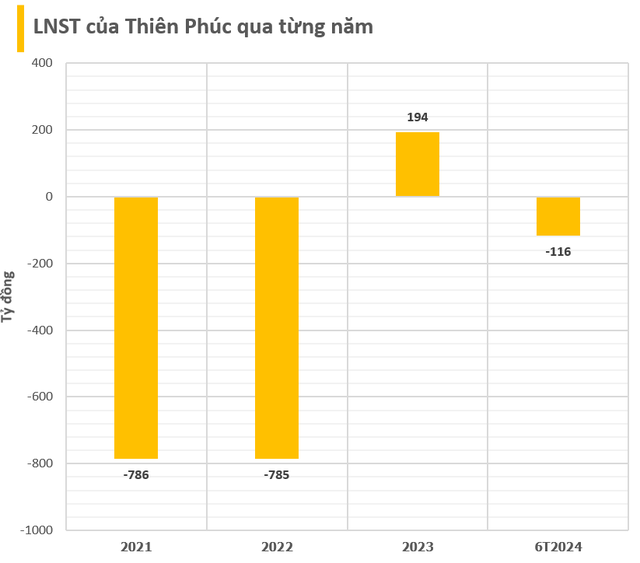

International Thien Phuc Joint Stock Company has released its financial report for the first half of 2024, revealing a post-tax loss of VND 116 billion, an improvement from the VND 370 billion loss in the same period last year.

The company had previously reported losses of VND 786 billion and VND 785 billion in 2021 and 2022, respectively. Surprisingly, in 2023, the company reported a profit of VND 194 billion, mainly due to strong performance in the last few months of the year.

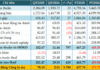

As of June 30, the company’s equity was negative VND 455 billion. The debt-to-equity ratio stood at 10.67 times, corresponding to a debt of over VND 4,800 billion. Of this, bond debt amounted to approximately VND 3,000 billion.

According to HNX data, Thien Phuc has 30 lots of bonds still in circulation. These bonds were issued in the latter part of August 2020, with interest rates as high as 11% per annum. Due to capital constraints, the company has been unable to pay interest on these bonds, totaling VND 150 billion, as of the end of June.

Established in 2013, Thien Phuc operates in the hotel and real estate business. The company’s legal representative is Ms. Hong Kim Yen (born in 1988). As of December 27, 2021, the company’s charter capital was approximately VND 2,242 billion.

Thien Phuc is known for its ownership of the 4-star Novotel Saigon Centre hotel. The hotel features 247 rooms and is located at 167 Hai Ba Trung, District 3, Ho Chi Minh City. The hotel was previously owned by Quê Hương – Liberty Joint Stock Company. In 2006, Thien Phuc took over 100% of the hotel’s capital.

Novotel Saigon Centre Hotel

In addition to Novotel Saigon Centre, Thien Phuc is also linked to the The Sun Tower project, which is located on a 6,042 sq. m plot of land with a total floor area of over 107,000 sq. m. The project includes 5 basement levels and 55 floors above ground, comprising 87,000 sq. m of Class A office space and 20,000 sq. m of premium commercial space.

In a disclosure regarding the delay in bond interest payments in October 2023, Thien Phuc explained that the bonds were issued to raise capital for the payment of a deposit and the transfer of a portion of the Saigon – Ba Son Complex project at 2 Ton Duc Thang, Ben Nghe, District 1, Ho Chi Minh City. The company intended to use the revenue from this project to fulfill its bond obligations.

However, due to market conditions over the past two years, Thien Phuc acknowledged the challenges in the real estate business and anticipated that the market would not recover within the next 1-2 years. As a result, the company, in agreement with Capitaland, decided to terminate the transaction. Capitaland will refund Thien Phuc, enabling the company to repay the issued bonds.

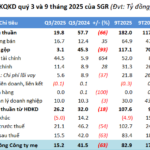

LandX Services reports a loss of 160 billion VND in 2023, cuts over 1,000 staff

In 2023, Dat Xanh Services incurred a net loss of 160 billion VND primarily due to a shortfall in real estate service revenue. Additionally, the company downsized its workforce by over 1,000 employees in the past year.

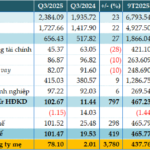

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.