Illustration.

Oil Rises 3%

Oil prices climbed by over 3% on Monday amid growing supply concerns following Libya’s announcement of production cuts as geopolitical tensions in the Middle East escalated.

Brent crude futures settled up $2.41, or 3.05%, at $81.43 a barrel, while U.S. West Texas Intermediate (WTI) crude rose $2.59, or 3.5%, to $77.42.

Libya’s National Oil Corporation announced on August 26 that it was forced to shut down all its oil fields and temporarily suspend production and exports due to escalating domestic geopolitical tensions.

According to the Organization of the Petroleum Exporting Countries, Libya’s oil production stood at approximately 1.18 million barrels per day in July.

Meanwhile, crude inventories at Cushing, the delivery point for U.S. crude futures, fell to their lowest levels in six months.

Gold Nears Record High

Gold prices rose to near record highs as markets anticipated an interest rate cut by the U.S. Federal Reserve in September following dovish signals from the Fed Chair, and as safe-haven demand increased due to geopolitical risks in the Middle East.

Spot gold finished the trading session up 0.3% at $2,518.47 per ounce, just shy of the record high of $2,531.60 reached last week. Gold futures for December delivery settled up 0.3% at $2,555.20.

On Friday, the Fed Chair affirmed the likelihood of an upcoming rate cut, stating that the job market would deteriorate if the economy continued to cool.

Gold bullion, traditionally seen as a hedge against geopolitical risks, tends to thrive in low-interest-rate environments.

Copper Hits 3-Week High

Shanghai copper prices rose to their highest level in over three weeks on Monday, supported by recovering demand in China and expectations of a U.S. interest rate cut in September.

The most-traded October copper contract on the Shanghai Futures Exchange (SHFE) closed the session up 2.2% at 75,170 yuan ($10,559.22) per ton, after earlier touching 75,180 yuan, its highest since August 1.

London markets were closed for a public holiday.

Iron Ore Climbs to Near 2-Week High

Iron ore futures rebounded on Monday to their highest level in nearly two weeks as a weaker U.S. dollar and expectations of stronger steel demand during China’s upcoming peak construction season boosted prices.

The January iron ore contract on the Dalian Commodity Exchange (DCE) in China ended the day up 3.45% at 750.5 yuan ($105.40) per ton, the strongest since August 13.

September iron ore on the Singapore Exchange rose 4.4% to $100.30 per ton, also the highest since August 13.

The U.S. dollar hovered near eight-month lows after Fed Chair Jerome Powell’s dovish remarks on Friday reinforced expectations of a rate cut in September.

Prices were also supported by expectations that China’s central bank would maintain its accommodative monetary policy.

Rubber Futures Climb

Rubber futures in Japan rose to their highest level in over two months amid supply concerns due to persistent wet weather in Thailand.

The most active rubber contract for January delivery on the Osaka Exchange (OSE) ended the session up 4.9 yen, or 1.37%, at 353.9 yen ($2.46) per kg.

Rubber futures for January delivery on the Shanghai Futures Exchange (SHFE) climbed by 130 yuan, or 0.8%, to 16,440 yuan ($2,308.83) per ton. Rubber prices were partly supported by weather-related factors affecting trade flows this month, with reports of wet weather, particularly in northern Thailand, impacting the supply of natural rubber.

Thailand’s meteorological department warned of heavy rains that could trigger flash floods from August 27 to 30.

Coffee Futures Rise

Coffee arabica futures for December delivery climbed 2.35 cents, or 1%, to $2.4965 per lb.

The coffee market drew support from fundamental factors, with global supplies tightening, particularly for the robusta variety.

A Reuters poll indicated that coffee prices could rise further towards the end of the year.

Sugar Surges 3.5%

Raw sugar futures jumped more than 3% on Monday after a fire ravaged thousands of sugarcane fields in Brazil, the world’s top sugar producer.

October raw sugar on the New York Board of Trade settled up 0.65 cent, or 3.5%, at 19.04 cents per lb, the highest in a month.

There was no update on white sugar prices as the London market was closed for a holiday.

Corn Hits Near 4-Year Low, Wheat Also Falls, Soybeans Edge Higher

Chicago Board of Trade (CBOT) corn futures dropped to their lowest level since 2020 as the U.S. is expected to harvest a bumper corn crop, and farmers continue to actively sell their inventories. Meanwhile, soybean prices edged higher as traders monitored a heatwave in the U.S. Midwest and tensions in the Middle East. Wheat prices declined amid ample global supplies and selling by commodity funds.

At the close of trading, the most active CBOT corn futures were down 4-1/2 cents at $3.86-1/2 per bushel, after touching their lowest since October 2020.

Soybeans rose 7-3/4 cents to $9.80-3/4 a bushel, while wheat fell 3 cents to $5.25 a bushel.

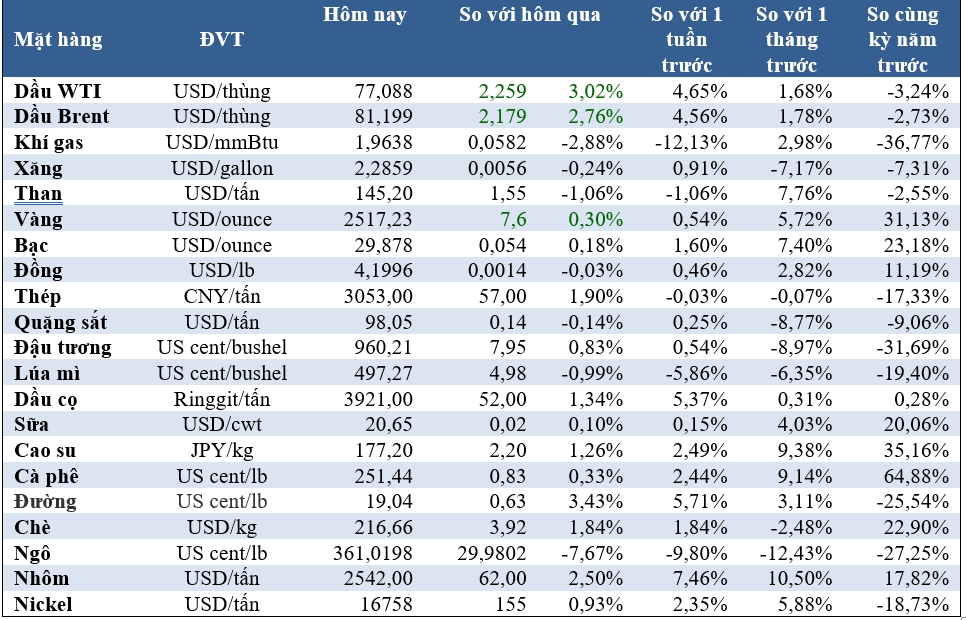

Prices of Key Commodities on August 27:

The Golden Fever of Mini Lucky Wealth to Experience Gold Accumulation

Understanding the increasing demand of the younger generation for investment and wealth accumulation, PNJ introduces the Mini Gold Line – Thanh Loc Dai Phat, a meaningful gold gift that inspires young people to experience wealth accumulation.