The upcoming dividend payout will be distributed at a rate of 6% in cash, equivalent to VND 600 per share. With over 28 million shares in circulation, SRC is estimated to pay out more than VND 16.8 billion for this dividend. The ex-dividend date is set for September 17, 2024, and payments are expected to be made on October 3, 2024.

The major beneficiary is Hoanh Son Group Joint Stock Company (SRC’s parent company) owing to its ownership of 50.22% of the shares, entitling them to receive nearly VND 8.5 billion. Another significant shareholder is Vietnam Chemical Group (Vinachem), which holds 36% of the shares and is expected to receive almost VND 5.6 billion. The ownership ratios are based on data as of June 30, 2024.

This dividend payout aligns with the plan approved by the 2024 Annual General Meeting of Shareholders in April, but it differs from the initial proposal disclosed in the first meeting documents.

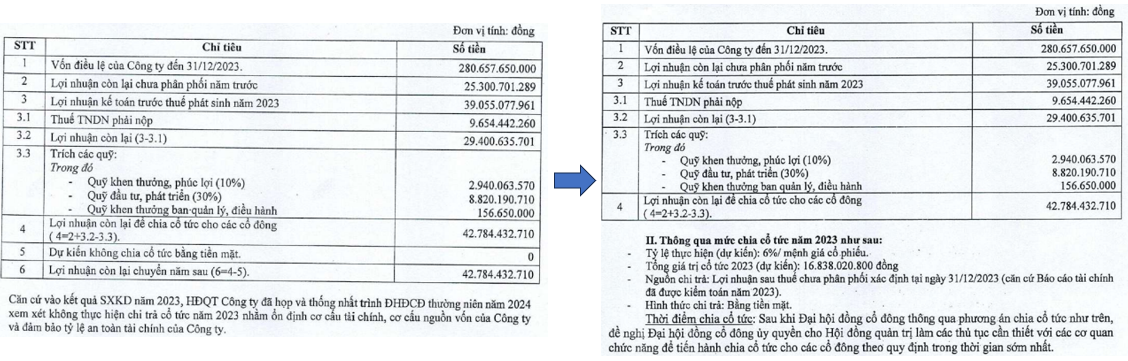

Specifically, in the documents first disclosed in March, the SRC Board of Directors, based on the 2023 business performance, intended to propose to the AGM that no dividend be paid for 2023 to maintain financial structure stability and ensure the company’s financial safety ratios.

However, in April, SRC announced amendments to the meeting documents, particularly regarding the proposed profit distribution and dividend payout for 2023, which included a plan to distribute a 6% dividend.

|

SRC Adjusts 2023 Dividend Plan

Source: Author’s Compilation

|

In reality, SRC experienced growth in 2023, recording nearly VND 1,198 billion in net revenue and over VND 29 billion in net profit, a 31% and 6% increase, respectively, compared to 2022. Nonetheless, SRC has only achieved 39% of the profit plan approved by the 2023 Annual General Meeting of Shareholders.

For Q2 2024, SRC reported a record-high net profit of nearly VND 114 billion, an 18.5-fold increase compared to the same period last year. This impressive performance was largely attributed to the transfer of land lease rights with infrastructure and attached assets, which generated VND 306 billion in other income. After deducting expenses, the company recognized VND 162 billion in profit from business activities. As a result, the tire manufacturing company recorded a net profit of VND 117 billion in the first six months of the year, an eleven-fold increase compared to the same period in 2023.

Although not explicitly mentioned, this real estate asset is likely the 212,000 sq. m property located in Chau Son Industrial Park, Phu Ly City, Ha Nam Province. In 2016, SRC leased this land from VPID Hanoi Joint Stock Company for 40 years to carry out the project of relocating and producing radial tires in this industrial park. However, in 2020, the company’s management decided to halt the project and sublease the land.

The two lessees are Casla Joint Stock Company and Casablanca Vietnam Joint Stock Company, leasing 102,538 sq. m and 110,000 sq. m, respectively. The transfer price for these two contracts is over VND 1.4 million/sq. m, equivalent to approximately VND 303 billion, which matches the amount recognized by SRC.

| SRC Records Exceptional Profit in Q2 2024 |

In the stock market, SRC shares continue to trade in the VND 30,000/share range, reflecting a nearly 70% increase over the past year and extending the upward trend since 2012.

| SRC Shares Maintain Uptrend Since 2012 |

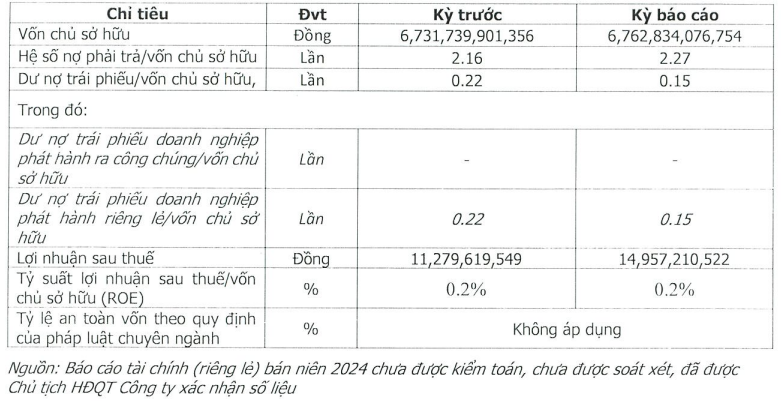

HPX Expects 22% Decrease in Profit in 2024

In the market, HPX stock is still classified as a suspended stock due to the continued violation of disclosure regulations by the listed organization after being placed under trading restrictions…