The VN-Index trading volume reached over 350 million units in the morning session, equivalent to a value of nearly 7.8 trillion VND. The HNX-Index recorded a trading volume of more than 28 million units, with a value of over 507 billion VND.

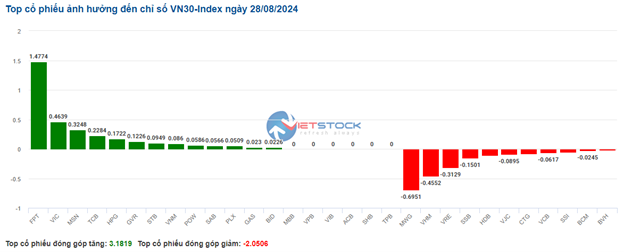

In terms of impact, VHM, CTG, MWG, and VCB were the most negative-impact codes, taking away more than 1.5 points from the VN-Index. On the other hand, GVR, TCB, and FPT are trading positively, helping the index increase by more than 1 point.

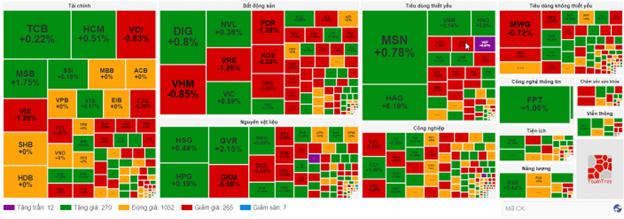

The industry groups are still polarized, with increases and decreases of less than 1%. Among them, the information technology group, thanks to the main support of FPT, is currently leading the market, up 0.77%. This is followed by the materials and essential consumer groups, both up 0.37%, with significant contributions from GVR (+1.14%), PHR (+1.59%), KSV (+9.32%), DPR (+3.16%); VNM (+0.41%), SAB (+1.05%), HAG and VCF hitting the ceiling…

However, many codes in these groups are still under selling pressure, such as DGC (-0.27%), DCM (-0.54%), NTP (-1.99%), BMP (-1.34%), HSG (-0.48%); MCH (-0.58%), ANV (-1.54%), MPC (-0.6%),…

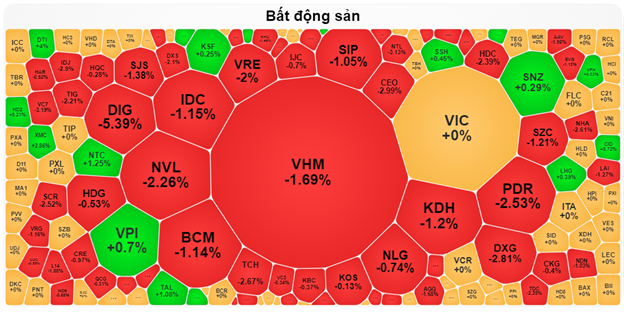

On the downside, the real estate group unexpectedly plunged by nearly 1% in the late morning session. Many stocks fell more than 1%, typically VHM (-1.69%), VRE (-2%), BCM (-1.14%), IDC (-1.15%), KDH (-1.2%), NVL (-2.26%), PDR (-2.53%), DIG (-5.39%),… The non-essential consumer group is also under pressure from many large-cap stocks such as MWG (-1.29%), PNJ (-1.07%), FRT (-1.4%), DGW (-0.82%),…

Source: VietstockFinance

|

Foreigners continued the net selling trend with a value of more than 136 billion VND on the HOSE in the morning session, of which HPG was the most net-sold stock with a value of nearly 65 billion VND. On the contrary, FPT was net bought by this group for the 7th consecutive session with a value of more than 95 billion VND this morning, far exceeding the value of the rest of the net bought stocks.

10:40 am: Investors are cautious, VN-Index continues to fluctuate around 1,280 points

The cautious sentiment of investors caused the main indices to fluctuate inversely with a narrow amplitude around the reference level, accompanied by a decrease in trading volume in the morning session. As of 10:30 am, the VN-Index increased by 1.36 points, trading around 1,282 points. The HNX-Index decreased by 0.75 points, trading around 238 points.

The breadth in the VN30 basket was slightly tilted to the gainers’ side with 13 gainers and 11 losers. Notably, FPT rose 1.47 points, VIC increased by 0.46 points, MSN added 0.32 points, and TCB climbed by 0.23 points. On the flip side, MWG, VHM, VRE, and SSB remained under selling pressure, dragging down the VN30-Index by over 1.5 points.

Source: VietstockFinance

|

Stocks in the information technology industry led the current recovery with a decent gain of 1.1%. Within this sector, buying interest mainly focused on two stocks, FPT, which climbed by 1.36%, and CMG, which rose by 0.95%… The remaining stocks mostly traded at the reference price or slightly below it.

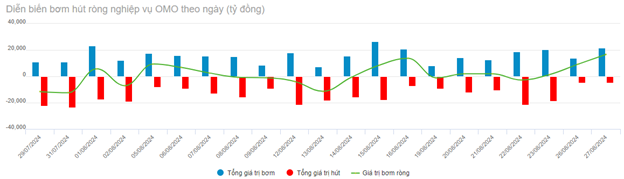

Meanwhile, the financial group continued to witness strong divergence, with the breadth tilting towards the sellers despite the “easing” signals sent by the State Bank of Vietnam (SBV). Specifically, in the past month, the SBV has injected more than 24,500 billion VND into the system through OMO operations.

Source: VietstockFinance

|

On the buying side, stocks that maintained their positive momentum included MSB, which rose by 1.32%, HCM, up by 0.34%, TCB, increasing by 0.22%, and LPB, climbing by 0.32%… Conversely, VIX fell by 0.84%, EVF decreased by 0.41%, ORS dropped by 0.39%, and notably, VCI declined by 0.83% after news that Ms. Truong Nguyen Thien Kim, the wife of Mr. To Hai – Member of the Board of Directors and General Director of VCI, registered to sell 13.2 million shares of Vietcap Securities Joint Stock Company (HOSE: VCI) from September 4th to October 3rd, 2024.

A contrasting performance was observed in the non-essential consumer group, which recorded a slight decline of 0.16%. Within this sector, selling pressure was concentrated in MWG, which fell by 0.72%, GEX, down by 0.23%, TNG, decreasing by 0.71%, and FRT, dropping by 1.23%…

Compared to the beginning of the session, the market remained in a tug-of-war state, with more than 1,000 reference codes and a balanced buying and selling force. Specifically, there were 270 rising codes on the buying side and 265 falling codes on the selling side.

Source: VietstockFinance

|

Opening: Maintaining a slight gain

At the start of the August 28 session, as of 9:40 am, the VN-Index climbed by over 3 points to reach 1,284.24 points. Conversely, the HNX-Index edged slightly lower to 238.8 points.

Green dominated most industry groups, with several large-cap stocks posting positive gains from the beginning of the session, such as GVR, which rose by 2%, VIC, up by 1.88%, PLX, increasing by 1.12%, and HPG, climbing by 0.58%.

Large-cap stocks like VIC, GVR, and FPT were driving the market, contributing a total increase of over 1.5 points. On the opposite side, MWG, VCB, and BCM led the group with the most negative impact on the market, but the decrease was less than 0.5 points.

Energy stocks were leading the market this morning. Notably, stocks in this sector, such as BSR, rose by 1.67%, PVD climbed by 0.18%, and PVS increased by 0.3%…

Additionally, the materials sector maintained stable growth from the beginning of the session, driven by stocks like HPG, which rose by 0.78%, HSG, up by 1.44%, NKG, increasing by 1.61%, KSB, climbing by 1.06%, and KSV, surging by 7.53%…

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.