Market liquidity increased compared to the previous trading session, with the matching trading volume of the VN-Index reaching more than 658 million shares, equivalent to a value of more than 14.8 trillion dong; The HNX-Index reached more than 54.1 million shares, equivalent to a value of more than 990 billion dong.

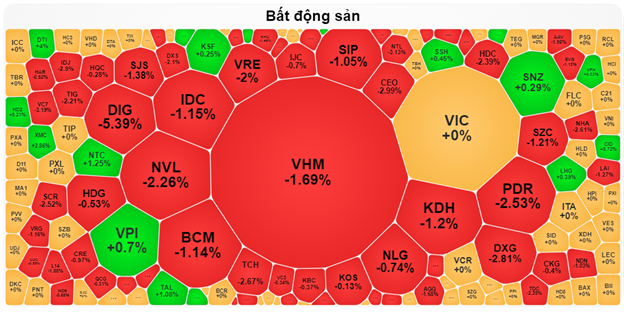

VN-Index opened the afternoon session with buying force returning, helping the index regain the reference level, and the sellers also increased selling pressure, causing the index to fluctuate again, but the green color was still preserved until the end of the session. In terms of impact, GVR, TCB, MBB, and FPT were the codes that had the most positive impact on the VN-Index, with an increase of more than 1.8 points. On the contrary, VIC, VCB, VHM, and VRE were the codes with the most negative impact, with a decrease of more than 1.9 points.

| Top 10 stocks that contributed the most to the VN-Index session on 08/28/2024 |

On the other hand, the HNX-Index had a rather negative trend, with the index being negatively affected by NTP (-2.13%), MBS (-1.05%), CEO (-1.2%), and PRE (-4.12%)…) codes

|

Source: VietstockFinance

|

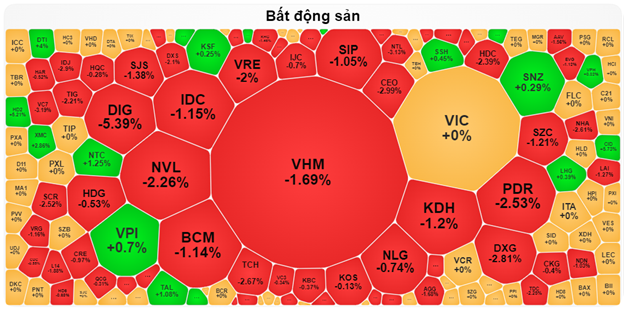

The telecommunications services sector was the group with the strongest increase of 1.37%, mainly from VGI (+1.95%), FOC (+2.63%), TTN (+0.65%), and VNB (+0.87%). This was followed by the materials sector and the information technology sector, with increases of 0.7% and 0.55%, respectively. On the contrary, the real estate sector had the largest decrease in the market at -0.89%, mainly from DIG (-3.99%), VHM (-1.21%), DXG (-0.94%), and VRE (-2.74%).

In terms of foreign trading, they continued to sell a net of more than 91 billion dong on the HOSE, focusing on HPG (177.72 billion), HSG (73.64 billion), VHM (48.96 billion), and HDB (37.36 billion) codes. On the HNX, foreigners sold a net of more than 16 billion dong, focusing on PVI (12.39 billion), LAS (4.95 billion), NTP (3.25 billion), and BVS (2.05 billion) codes.

| Buying and selling movement of foreign investors |

Morning session: Real estate group creates pressure, VN-Index reverses

After a rather dull trading session in the first half of the morning, selling pressure suddenly increased, especially in the real estate stock group, causing the VN-Index to reverse quickly before the lunch break. At the midday break, the VN-Index decreased by 0.21%, stopping at 1,277.92 points; The HNX-Index decreased by 0.64%, to 237.38 points. The market breadth at the end of the morning session leaned entirely towards the sellers, recording 381 codes decreasing and 210 codes increasing.

The trading volume of the VN-Index reached more than 350 million units in the morning session, equivalent to a value of nearly 7.8 trillion dong. The HNX-Index recorded a trading volume of more than 28 million units, with a value of more than 507 billion dong.

In terms of impact, VHM, CTG, MWG, and VCB were the codes that had the most negative impact, taking away more than 1.5 points from the VN-Index. Conversely, GVR, TCB, and FPT are trading positively, helping the index increase by more than 1 point.

The industry groups are still diversifying, with increases and decreases of less than 1%. The information technology group, thanks to the main support of FPT, is currently leading the market, up 0.77%. This was followed by the materials and essential consumer groups, both up 0.37%, with large contributions from GVR (+1.14%), PHR (+1.59%), KSV (+9.32%), DPR (+3.16%); VNM (+0.41%), SAB (+1.05%), HAG, and VCF hitting the ceiling…

However, no codes in these groups are still under selling pressure, such as DGC (-0.27%), DCM (-0.54%), NTP (-1.99%), BMP (-1.34%), HSG (-0.48%); MCH (-0.58%), ANV (-1.54%), MPC (-0.6%),…

On the downside, the real estate group suddenly plunged by nearly 1% at the end of the morning session. Many stocks fell more than 1%, notably VHM (-1.69%), VRE (-2%), BCM (-1.14%), IDC (-1.15%), KDH (-1.2%), NVL (-2.26%), PDR (-2.53%), DIG (-5.39%),… The non-essential consumer group is also under pressure from many large caps such as MWG (-1.29%), PNJ (-1.07%), FRT (-1.4%), DGW (-0.82%),…

Source: VietstockFinance

|

Foreigners continued to sell a net of more than 136 billion dong on the HOSE in the morning session, in which HPG was the stock that was sold the most with a value of nearly 65 billion dong. Conversely, FPT was net bought by this group for the 7th consecutive session with a value of more than 95 billion dong this morning, far exceeding the value of the rest of the net bought stocks.

10:40 am: Investors trade cautiously, VN-Index continues to fluctuate around 1,280 points

The cautious sentiment of investors caused the main indices to fluctuate inversely with a narrow amplitude around the reference level, accompanied by a decrease in trading volume in the morning session. As of 10:30 am, the VN-Index increased by 1.36 points, trading around 1,282 points. The HNX-Index decreased by 0.75 points, trading around 238 points.

The breadth in the VN30 basket was slightly tilted towards the green side with 13 gainers/11 losers. Notably, FPT rose 1.47 points, VIC gained 0.46 points, MSN added 0.32 points, and TCB climbed 0.23 points. Conversely, MWG, VHM, VRE, and SSB were still under selling pressure, taking away more than 1.5 points from the VN30-Index.

Source: VietstockFinance

|

The information technology group of stocks led the current recovery momentum with a decent gain of 1.1%. Notably, buying demand mainly came from two stocks, FPT, up 1.36%, and CMG, up 0.95%… The rest were mostly at the reference level or slightly down.

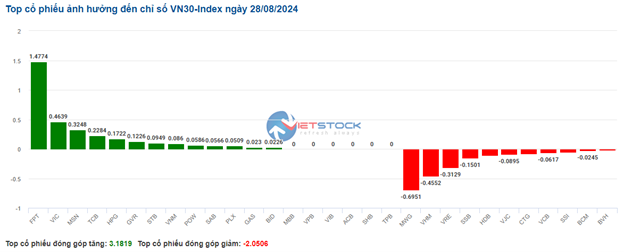

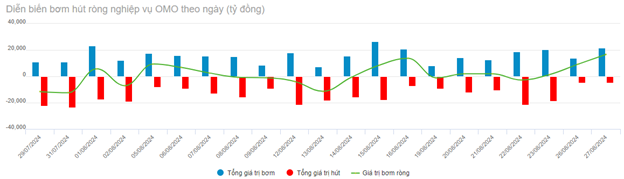

On the other hand, the financial group continued to witness strong divergence with the breadth currently leaning towards the sell-side despite the “easing” signals sent by the State Bank of Vietnam (SBV). Specifically, in the past month, SBV has injected a net amount of more than VND 24,500 billion into the system through the OMO channel.

Source: VietstockFinance

|

On the buying side, stocks that maintained positive momentum included MSB, up 1.32%, HCM, up 0.34%, TCB, up 0.22%, LPB, up 0.32%… Meanwhile, losers included VIX, down 0.84%, EVF, down 0.41%, ORS, down 0.39%, and notably, VCI, down 0.83%, after Ms. Truong Nguyen Thien Kim, wife of Mr. To Hai – Member of the Board of Directors and General Director of VCI, registered to sell 13.2 million shares of Vietcap Securities Joint Stock Company (HOSE: VCI) from 09/04-10/03/2024.

Another contrasting performance was seen in the non-essential consumer group, which fell slightly by 0.16%. Notably, selling pressure mainly came from MWG, down 0.72%, GEX, down 0.23%, TNG, down 0.71%, and FRT, down 1.23%…

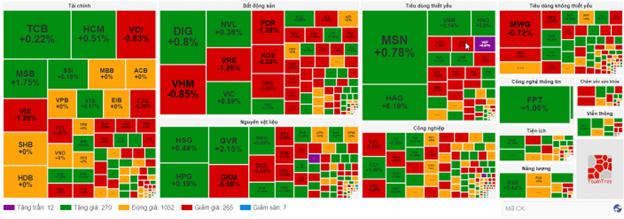

Compared to the beginning of the session, the market remained in a tug-of-war with more than 1,000 reference codes and a balanced buying and selling force. In particular, the buying side had 270 rising codes, while the selling side had 265 falling codes.

Source: VietstockFinance

|

Opening: Maintaining a slight gain

At the beginning of the August 28 session, as of 9:40 am, the VN-Index rose more than 3 points to 1,284.24 points. In contrast, the HNX-Index edged slightly lower to 238.8 points.

The green color dominated most industry groups, with some large-cap stocks rising sharply from the beginning of the session, such as GVR, up 2%, VIC, up 1.88%, PLX, up 1.12%, and HPG, up 0.58%.

Large-cap stocks such as VIC, GVR, and FPT were leading the market with a total increase of more than 1.5 points. Conversely, MWG, VCB, and BCM led the group with the most negative impact on the market, but the decrease was less than 0.5 points.

Energy stocks were driving the market this morning. Notably, BSR rose 1.67%, PVD gained 0.18%, and PVS climbed 0.3%…

In addition, the materials stock group also maintained stable growth from the beginning of the session, with stocks such as HPG, up 0.78%, HSG, up 1.44%, NKG, up 1.61%, KSB, up 1.06%, and KSV, up 7.53%…

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.