As a country that relies on exports to drive its economic growth, Vietnam currently boasts 12,254 hectares of industrial land in the North and 28,251 hectares in the South, according to a recent JLL report. This provides ample land supply to cater to future demands. In the North alone, the industrial land market last year welcomed nearly 1,600 hectares of new supply, concentrated in Hanoi, Bac Ninh, Hai Phong, Hung Yen, and Hai Duong provinces.

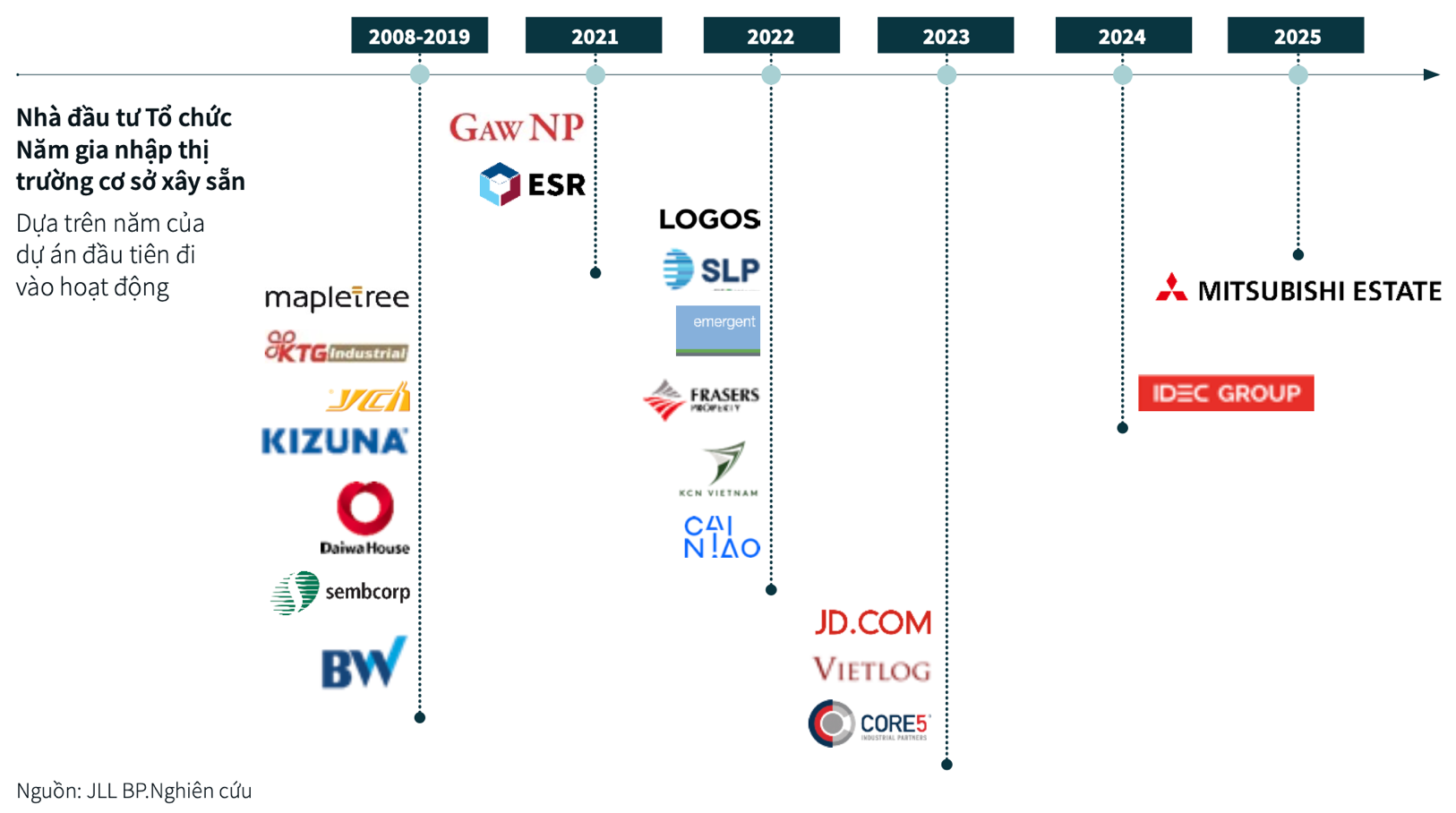

Vietnam’s industrial and supply chain market has become one of the fastest-growing in the region due to the strong presence of institutional investors in recent years. This also reflects the market’s potential for improved stability, standardization, and transparency.

Image: JLL Report

There are six key reasons for the development of Vietnam’s industrial production and supply chain, including:

Firstly, its central geographical location within many regional and global supply chains. Vietnam is in close proximity to China, the international manufacturing hub, and has benefited from the shift in supply chains. Vietnam is also a key member of the Association of Southeast Asian Nations (ASEAN) and has increased trade within the regional market.

Secondly, Vietnam is one of the most integrated and investment-attractive markets in the region. According to JLL, Vietnam has established itself as a country that relies on exports to drive its economic growth. The country has also witnessed continuous FDI growth over the decade, with more than half invested in the processing and manufacturing sectors.

Thirdly, Vietnam is one of the biggest beneficiaries of the “China plus one” strategy and supply chain diversification. FDI inflows into the manufacturing sector have grown at a compound annual growth rate (CAGR) of 10% during 2010–2023, higher than the regional ASEAN average of 7.6% and in contrast to China’s decline of 3.8%.

Fourthly, a well-trained workforce: 87% of the population of working age have a high level of education, the second-highest rate in the region. The average wage for workers in the processing and manufacturing sector is approximately 34% of that in China and is lower than regional competitors such as Thailand and Malaysia.

Fifthly, a solid and rapidly growing demand base: Exports are expected to grow at a CAGR of 6.8% annually (2024F–2030F). Domestic consumption in Vietnam is expected to grow rapidly at a rate of 6.1% CAGR over the same period. Notably, the e-commerce sector grew at a CAGR of 33.8% during 2019–2023, making it one of the fastest-growing markets in the region.

Lastly, Vietnam is still in the early stages of development and has significant room for improvement, particularly in the real estate market, which has more potential compared to other regional markets. Additionally, Vietnam’s industrial development has incorporated lessons from countries like China, adopting a private sector-driven approach rather than relying on state-owned enterprises.

Vietnam to Take a Leading Role in the Region’s Green Transition

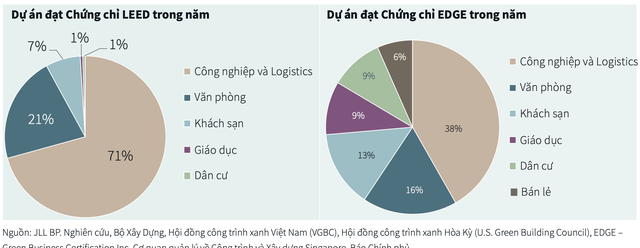

Image: JLL Report

The report also highlights that Vietnam is leading the way in obtaining green building certifications across all stages, from real estate development to operations and production. According to a survey conducted by the Ministry of Construction and the International Finance Corporation (IFC), the majority of green projects are industrial, with 55% of green construction projects in Vietnam belonging to the industrial sector.

Data on projects that obtained LEED certification in 2023 shows that over 70% of certified projects were industrial buildings, including factories and warehouses. Additionally, 38% of projects that obtained EDGE certification in the previous year were also from the industrial sector.

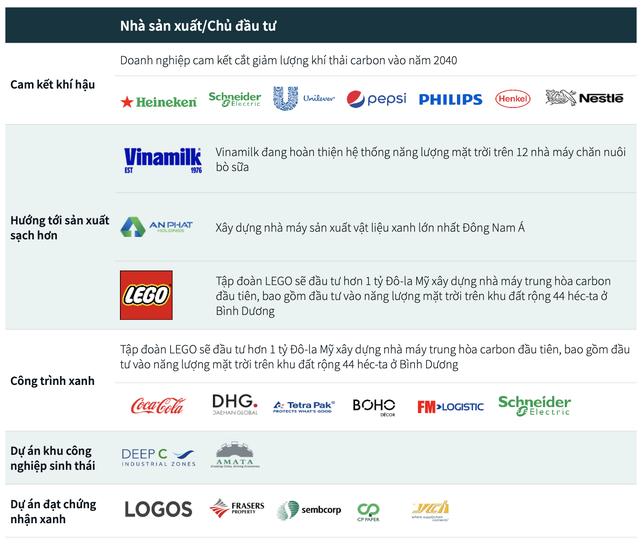

According to JLL, the main driver is the commitment to sustainability made by large corporations such as Unilever, Heineken, Lego, and Coca-Cola when entering the market. For example, Coca-Cola implemented a project using recyclable packaging starting in 2018, with targets of 100% recyclable packaging for its products, at least 50% recycled content in its packaging, and collecting and recycling every bottle or can it sells by 2030. In 2022–2023, the Coca-Cola Fund also contributed $4 million to community activities in Vietnam.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

“Prosecution of government officials, land registration officers, and tax department employees in the largest bribery case ever”

The Thanh Hoa Police Investigative Agency has initiated legal proceedings against 23 individuals involved in the crimes of “Bribery” and “Receiving bribes”. This is the largest bribery case in terms of the number of suspects ever discovered and apprehended by the Thanh Hoa Police.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)