The debt obligations of JSC Water and Electrical Equipment Installation and Construction 2 at IVB as of August 6, 2024, amount to over VND 41.5 billion. This includes principal debt of over VND 20 billion, interest within the due date of over VND 1 billion, interest on overdue principal of nearly VND 20 billion, and interest on overdue interest of nearly VND 200 million.

The assets securing this debt include land-use rights for the COWA Tower project at 199 Ho Tung Mau Street, Cau Dien Ward, Nam Tu Liem District, Hanoi. This comprises a 2-story commercial and service area, 2 basements, 1 technical floor, and 5 apartments. Additionally, the collateral includes the 1st and mezzanine floors of unit A102 in the D5 apartment building project in the new Cau Giay urban area, Dich Vong Ward, Cau Giay District, Hanoi; and a house and land at 65 Le Hong Phong Street, Dien Bien Ward, Ba Dinh District, Hanoi.

|

IVB is selling the debt in its current state, including all rights and interests associated with the bank’s debt obligations. This encompasses the right to handle secured assets and other related rights and interests as stipulated by law, which are under IVB’s ownership. The sale also covers any rights and obligations before, during, and after the debt sale.

The debt sale price is equivalent to the total debt obligations of JSC Water and Electrical Equipment Installation and Construction 2 at IVB at the time of signing the debt sale contract, tentatively calculated to be over VND 41.5 billion as of August 6.

IVB will sell the debt without recourse through an agreed debt sale method. Interested organizations and individuals can submit their applications to purchase this debt to Indovina Bank at 97A Nguyen Van Troi, Ward 11, Phu Nhuan District, Ho Chi Minh City, before 5:00 PM on August 30, 2024.

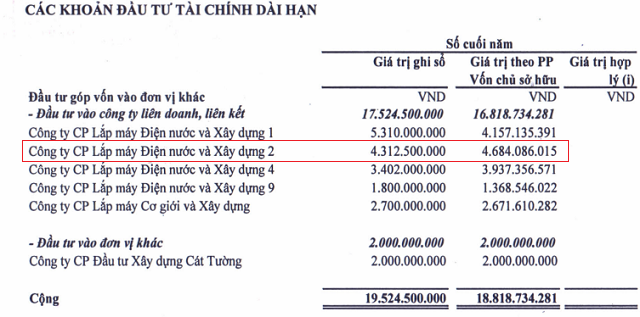

JSC Water and Electrical Equipment Installation and Construction 2 was established in late 2006 and is indirectly related to Hanoi Construction Corporation – JSC (UPCoM: HAN). The 2017 audited financial statements of JSC Water and Electrical Equipment Installation (DNG) recognized Installation and Construction 2 as a joint venture and associate of DNG.

Source: DNG

|

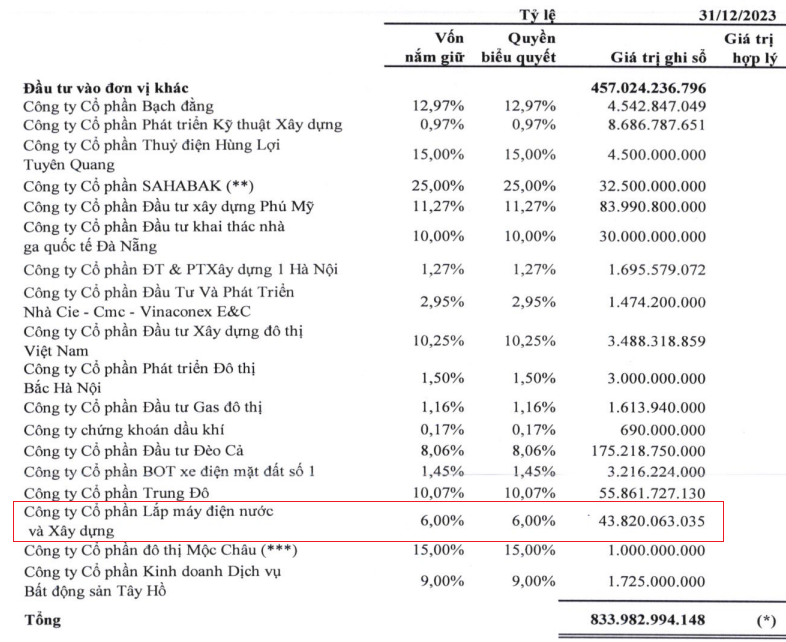

Moreover, the 2023 audited consolidated financial statements of HAN show that Hanoi Construction Corporation invested nearly VND 44 billion in DNG, holding 6% of its capital.

Source: HAN

|

Bank selling hotel in Hoi An, starting from 110 billion VND

Le Pavillon Paradise Hoi An Hotel & Spa, a property owned by Hoang Ngoc Phat Company, is now being offered for sale by a bank in Hoi An. The starting price for this asset is 110 billion Vietnamese dong.