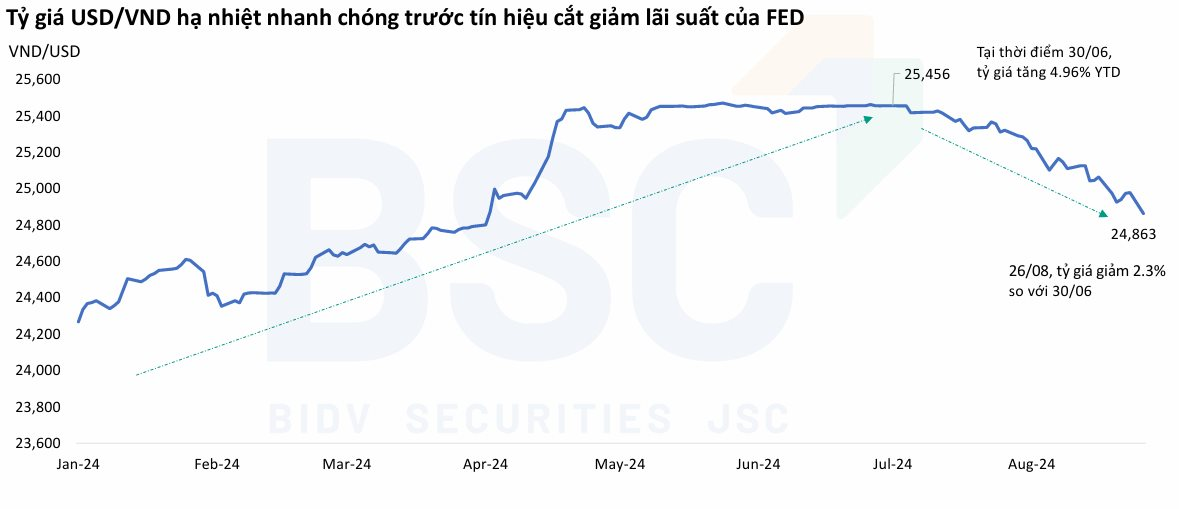

In the first half of 2024, exchange rates posed a challenge for central banks globally. As of June 30, the USD/VND rate in Vietnam had increased by nearly 5% since the beginning of the year, prompting the State Bank to implement measures to stabilize the exchange rate, including absorbing bills, selling foreign currency, and stabilizing the gold market.

However, since the end of July 2024, the exchange rate has been on a downward trend as the US dollar weakened. Additionally, the clear message from the Fed Chair about an interest rate cut in September caused the DXY index to decline further. As of August 26, the exchange rate had decreased by 2.3% compared to June 30, and during the session on August 28, the rate even broke below the 25,000 VND/USD mark.

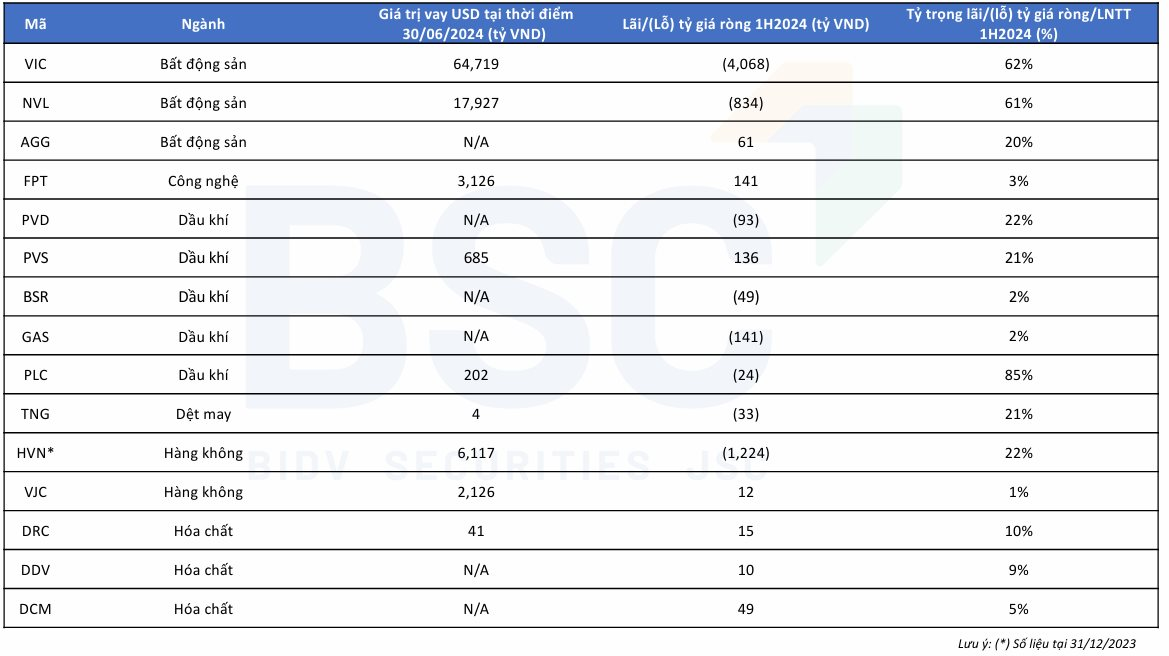

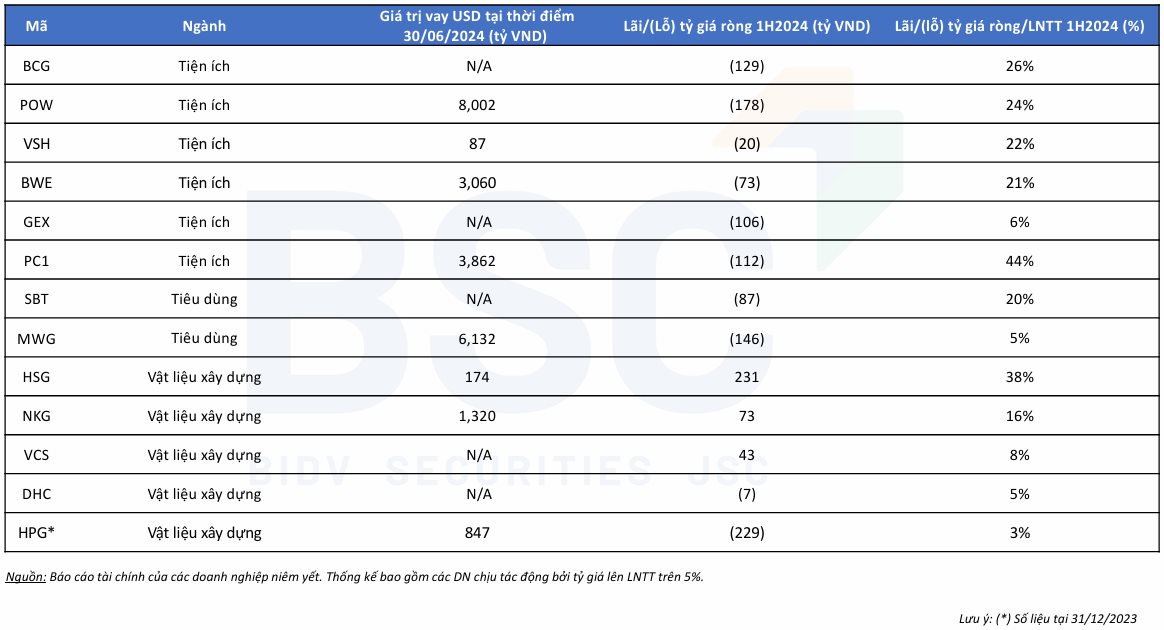

According to statistics from BSC Securities, the pre-tax profits of enterprises in the first half of 2024 were significantly impacted by fluctuations in the USD/VND exchange rate.

Many companies with large US dollar-denominated debts recorded substantial foreign exchange losses during this period.

Specifically, as of June 30, Novaland (NVL) had US dollar-denominated debts of approximately VND 17,927 billion and incurred a foreign exchange loss of VND 834 billion in the first half of the year; HVN, with US dollar debts equivalent to VND 6,117 billion, faced a foreign exchange loss of VND 1,224 billion; POW, with debts of VND 8,002 billion, lost VND 178 billion; MWG, with debts of VND 6,132 billion, lost VND 146 billion; PC1, with debts of VND 3,862 billion, lost VND 112 billion; and HPG, with debts of VND 747 billion, lost VND 229 billion, and so on.

BSC expects the pressure on exchange rates to ease as the Fed cuts interest rates, and profit growth in the second half will be supported by lower borrowing costs, reduced foreign exchange losses, lower selling and management expenses, and a low base in Q3/2023. Therefore, the risk of lower-than-expected profit growth compared to market expectations, as seen in Q3/2023, will be mitigated.

Previously, this securities firm mentioned that in the first half of the year, non-financial groups saw a significant improvement in revenue, with a 14% year-on-year increase in net revenue. This was mainly due to a recovery in sales volume, with a focus on industries such as Aviation & Industrial Services, Retail, and Steel.

The profit margin increased by 20%, mainly due to lower prices of raw materials, which reduced inventory costs, and improved selling prices in the Steel, Retail, Fertilizer – Chemicals, and Telecommunications industries.

While interest expenses decreased significantly, they were offset by foreign exchange losses and other financial costs. BSC believes that the factor of lower interest expenses will continue to be a driver for business results in Q3 and Q4/2024, as the context of foreign exchange losses will decrease with the cooling down of exchange rates.

Income from associates and joint ventures, and other income, contributed about 24.6% to the total pre-tax profit of the non-financial sector. Notably, other income mainly consisted of one-off gains from asset disposals and debt write-offs (MVN, HBC, VST).

“With a 31% increase in pre-tax profit in Q2/2024 for the non-financial group, there are clear signs of economic recovery. Factors related to volume, reduced interest expenses, and exchange rate stability will also drive profit growth in Q3-Q4/2024,” BSC expected.

HDBank Investor Conference: Sustaining High and Stable Growth

On the morning of February 1, 2024, HDBank (HoSE: HDB), a leading commercial bank in Ho Chi Minh City, organized an Investor Conference to provide updates on its business performance in 2023 and share insights on future directions and prospects for 2024.