The State Bank of Vietnam (SBV) has recently issued a document to credit institutions, announcing adjustments to credit growth targets based on specific principles. This move ensures transparency and fairness and considers the operational capacity of each credit institution (as per SBV’s ranking). Commercial banks with a credit growth rate of 80% of the target announced at the beginning of 2024 will be allowed to proactively adjust their credit balance based on their 2022 credit rating.

We had a discussion with Mr. Pham Nhu Anh, CEO of Military Commercial Joint Stock Bank (MB, HOSE: MBB), about the credit situation in the first few months of the year.

Mr. Pham Nhu Anh, CEO of MB.

|

Can you tell us about MB’s credit growth in the first eight months of 2024?

Mr. Pham Nhu Anh: In the first seven months of 2024, with a clear business orientation (priority sectors and industries, competitive programs/products/policies…), MB achieved positive credit growth, closely following the target assigned by the SBV at the beginning of the year.

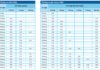

As of August 28, 2024, MB’s credit growth reached 10.44% (equivalent to VND679,593 billion), meeting 65.7% of the growth target set by the SBV. According to the above SBV document on adjusting growth targets, MB is expected to increase by nearly VND14,000 billion. This corresponds to a current growth target of 18.16%. MB is now ready with a credit growth plan of 20-25%, ensuring credit growth while tightly controlling credit quality. We aim to maintain safety, fully comply with SBV regulations, and achieve our business goals.

What is MB’s view on the suggestion to abolish credit growth targets?

MB believes that the SBV’s management of credit growth targets is necessary. Managing growth targets is an effective macroeconomic tool for the Government/SBV to closely monitor the actual capital absorption of the economy and make flexible, timely, and scientific adjustments. It also helps the system of credit institutions manage their credit growth appropriately, providing sufficient credit capital to serve the economy while ensuring the safety of the credit institution system and macroeconomic stability and controlling inflation.

Being assigned a credit growth target by the SBV motivates credit institutions to proactively manage, supervise, and control credit growth to ensure safe and efficient operations. It also helps direct credit to priority sectors and industries that are the driving force for economic growth, in line with the Government and Prime Minister’s directions. Additionally, it enables tight control over potentially risky areas.

What solutions does MB have to promote credit growth from now until the end of the year, sir?

MB has prepared solutions and is on track to boost credit growth rapidly in the final phase of 2024. We are ready with system resources, personnel, and competitive products to stimulate credit demand in the economy.

We are promoting specific solutions to increase credit growth in the last months of the year. First, MB categorizes industries in credit activities (priority/restricted/maintained) to allocate growth room and manage business operations. In 2024, MB focuses on retail growth, implementing solutions to boost credit in priority areas and high-efficiency industries that drive the economy in the current period (export, healthcare, education, renewable energy, manufacturing…).

Second, we strengthen cooperation with large corporations to implement value chain credit programs and linkage models. These initiatives are expected to have many positive impacts and serve as useful products to support timely capital and cash flow for businesses and individuals (targeting diverse sectors such as agriculture, seafood, forestry, construction, and commercial services…).

Third, we develop specific credit policies and design preferential conditions for each key locality based on MB’s business orientation to enhance credit accessibility and absorption.

Fourth, we enhance technology applications to simplify loan procedures and shorten processing time, especially for priority industries and objects as per SBV policies and MB’s business orientation. We also promote the provision of credit services through electronic means on App/Biz platforms, benefiting customers in accessing capital, especially those in agricultural and rural areas.

Finally, credit growth in the remaining months of 2024 and 2025 will closely link credit development with credit quality, aiming for better credit quality than the market average. We will continue to focus on the retail portfolio, lending to production and business, and the manufacturing industry… by leveraging technology to enhance customer experience and optimize customer exploitation.

Thank you, sir.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Accelerating disbursement of the 120 trillion VND credit package for social housing

Deputy Prime Minister Trần Hồng Hà has recently issued directives regarding the implementation of the 120,000 billion VND credit package for investors and buyers of social housing, workers’ housing, and projects for the renovation and construction of apartment buildings.