The VN-Index closed the 35th trading week of 2024 at 1,283.87 points, a decrease of 1.45% or -0.11% compared to the previous week, with slightly lower liquidity.

The average trading value of the three exchanges during week 35 reached VND 17,264 billion. The matched orders alone averaged VND 15,532 billion, a decrease of 12% from week 34 and 5.2% lower than the 5-week average.

There was only one losing session last week, but weaker buying interest and more prominent selling pressure caused the VN-Index to close slightly lower, reversing the relatively strong gains of the previous week.

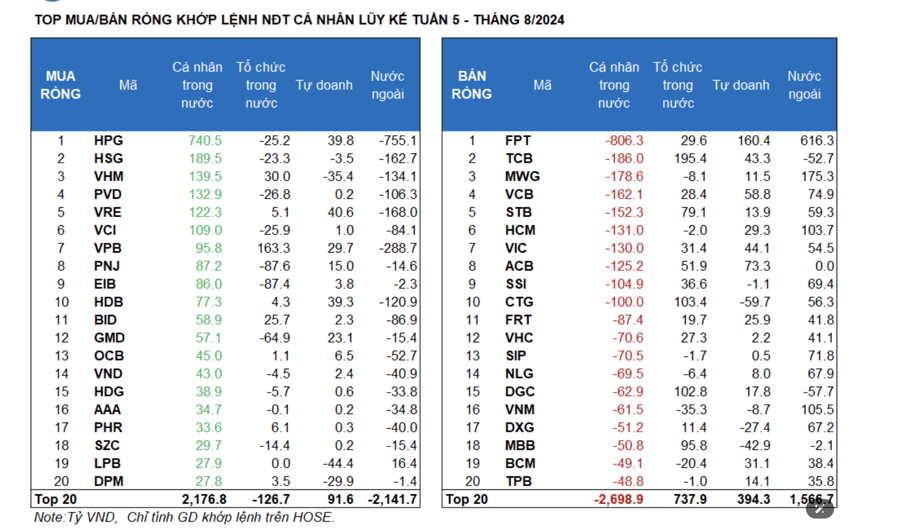

Foreign investors sold a net VND 795.85 billion, and their matched orders showed a net sell of VND 588.9 billion. The main sectors they bought on a matched basis were Information Technology and Retail. The top stocks they bought on a matched basis were FPT, MWG, VNM, HCM, FUEVFVND, VCB, SIP, SSI, NLG, and DXG.

On the selling side, their main sector on a matched basis was Basic Resources. The top stocks they sold on a matched basis were HPG, VPB, VRE, HSG, VHM, PVD, BID, VCI, and DGC.

Individual investors sold a net VND 1,046.3 billion, including a net sell of VND 652.4 billion on a matched basis. On a matched basis, they bought 9 out of 18 sectors, mainly Basic Resources. Their top buys were concentrated in the following stocks: HPG, HSG, VHM, PVD, VRE, VCI, VPB, PNJ, EIB, and HDB.

On the selling side, on a matched basis, they sold 9 out of 18 sectors, mainly Information Technology and Banks. Their top sells included FPT, TCB, MWG, VCB, STB, HCM, ACB, SSI, and CTG.

Domestic institutional investors bought a net VND 504.9 billion, and their matched orders showed a net buy of VND 577.7 billion. On a matched basis, domestic institutions sold 9 out of 18 sectors, with the highest value in the Personal & Household Goods sector. The top sells on a matched basis were PNJ, EIB, GMD, PC1, FUEVFVND, VNM, NAB, PVD, VCI, and HPG.

The sector with the highest net buy value was Banks. The top buys on a matched basis were TCB, VPB, CTG, DGC, MBB, STB, VIX, ACB, SSI, and VIC.

Proprietary trading bought a net VND 1,337.3 billion, and their matched orders showed a net buy of VND 663.6 billion. On a matched basis, proprietary trading bought 14 out of 18 sectors. The sectors with the strongest buys were Banks and Information Technology. The top stocks bought by proprietary trading houses this week on a matched basis included FPT, ACB, VCB, VIC, TCB, PC1, VRE, HPG, HDB, and BCM.

The top sector on the sell side was Chemicals. The top stocks sold on a matched basis included CTG, FUEVFVND, LPB, MBB, VHM, DPM, DXG, NHH, TLG, and VNM.

Looking at the weekly framework, the allocation of money flow ratio increased in all three main sectors (Real Estate, Banks, and Securities) while decreasing in Steel, Food & Beverage, Chemicals, Construction, Agriculture & Seafood, Information Technology, Oil & Gas Production, Textiles, and Electricity.

The sectors with a sharp increase in the money flow ratio, approaching the 10-week high, included Real Estate, Banks, and Securities, but only Real Estate saw gains (driven by the two Vin stocks, VIC and VHM).

The sectors that saw notable lows in the money flow ratio were Steel, Chemicals, Construction, Information Technology, Oil & Gas Production, Textiles, and Electricity. Except for Information Technology, the price indices of these sectors also declined during the week.

Money Flow Strength: Looking at the weekly framework, the money flow ratio in the large-cap VN30 group decreased for the third consecutive week, while it continued to increase in the mid-cap VNMID group. For the small-cap VNSML group, the money flow ratio decreased sharply after a slight increase in the previous week.

In the week, the money flow ratio in the large-cap VN30 group fell to 46.7%, the lowest level in five weeks. In contrast, the mid-cap VNMID group saw its ratio improve for the fourth straight week, reaching 42.7% – the highest level in 12 weeks. For the small-cap VNSML group, the money flow allocation decreased to 8.2% from 10.3% in the previous week, hitting a four-month low.

In terms of price movements, the VN30 index went against the market, gaining +0.78%, with significant contributions from the two Vin stocks (VIC, VHM) and banks (TCB, MBB, STB). Meanwhile, the VNMID and VNSML indices decreased by -1.11% and -1.21%, respectively.