Vietnam’s stock market traded positively during the final session before a long holiday break. The main index, VN-Index, maintained its upward trajectory throughout the day, closing 2.4 points higher at 1,283.87. However, there was a downside as liquidity declined, with the trading value on the HoSE floor reaching only VND 13,500 billion. Surprisingly, foreign trading became a bright spot as it turned to net buying, with a net purchase value of about VND 58 billion in the market.

In the same vein, securities companies’ proprietary trading also witnessed a remarkable net buying spike, with a net buying value of VND 1,012 billion on the three exchanges.

On the HoSE exchange, securities firms’ proprietary trading net bought VND 1,064 billion, of which VND 517 billion was net bought on the matching channel, and VND 547 billion was net bought on the negotiated channel.

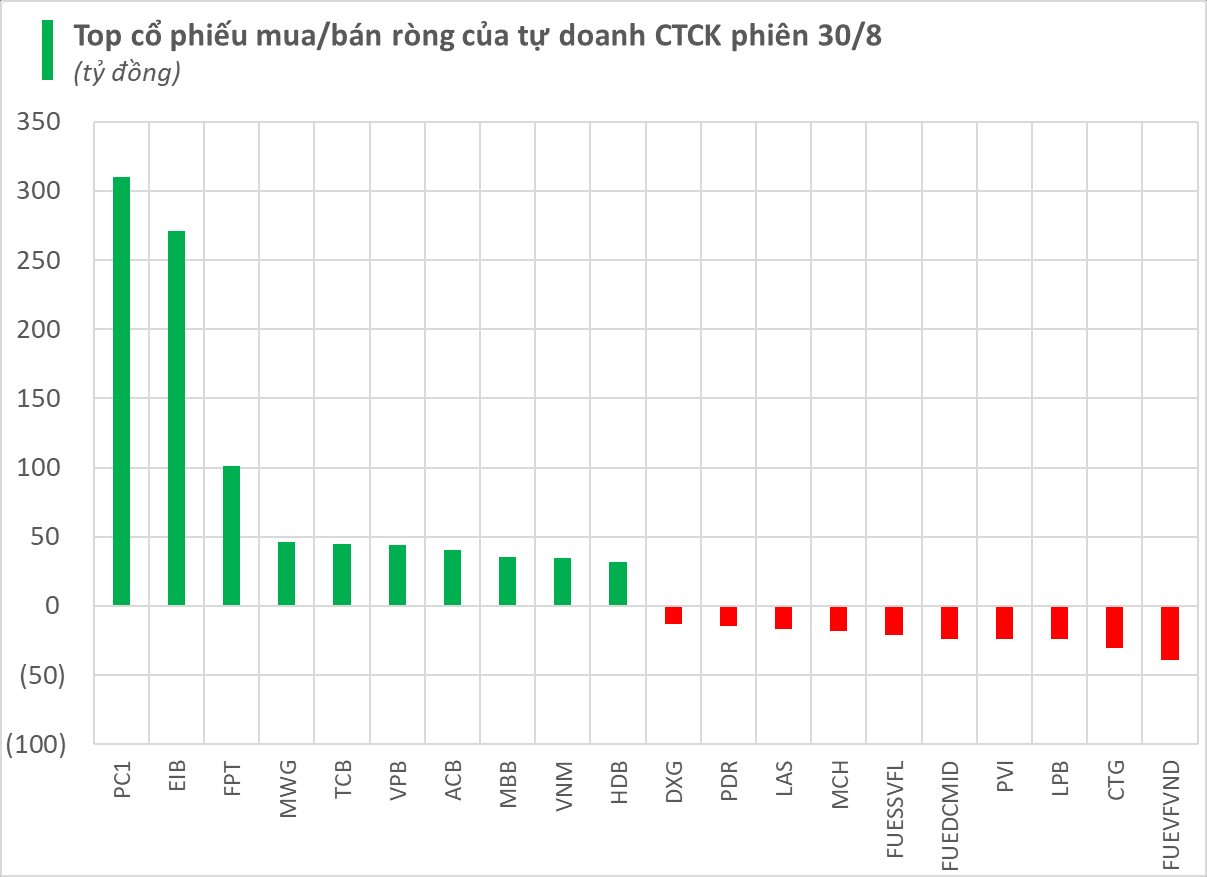

Specifically, the securities companies with the highest net buying were PC1 and EIB, with respective values of VND 310 billion and VND 271 billion. Additionally, stocks such as FPT, MWG, TCB, VPB, and others were also net bought during the August 30 session.

Conversely, the securities companies with the highest net selling were FUEVFVND and CTG, with respective values of VND 39 billion and VND 30 billion. Other stocks that experienced net selling during this session included LPB, FUEDCMID, and FUESSVFL.

On the HNX exchange, securities firms’ proprietary trading net sold VND 37 billion, with PVI being net sold for more than VND 24 billion and LAS for VND 17 billion. In contrast, TNG and PVS were net bought for VND 3 billion and VND 2 billion, respectively.

On the UPCoM exchange, securities firms’ proprietary trading net sold nearly VND 15 billion. MCH experienced a net sell-off of nearly VND 18 billion, while AFX was net bought for VND 3 billion.

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”