Illustrative image

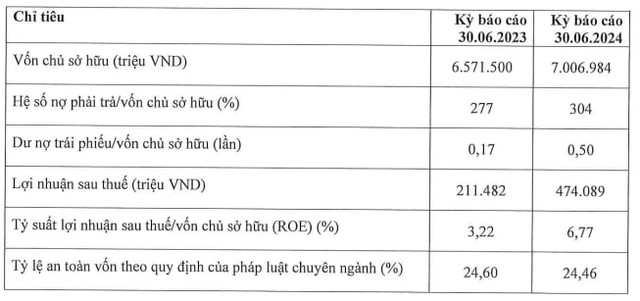

Home Credit Vietnam, a leading consumer finance company, has announced its financial results for the first half of 2024, reporting a remarkable 125% year-on-year increase in profit after tax, amounting to over VND 474 billion. This outstanding performance resulted in a significant boost to the return on equity (ROE), surging from 3.22% in the first half of 2023 to 6.77%.

As of June 2023, Home Credit Vietnam’s equity capital stood at VND 7,007 billion, reflecting a 6.6% increase since the beginning of the year. The debt-to-equity ratio was 304%, corresponding to approximately VND 21,292 billion in debt, which marked a notable increase compared to the 277% ratio recorded as of June 30, 2023. Additionally, the company’s bond debt exceeded VND 3,500 billion.

By the end of the second quarter, Home Credit’s total assets reached nearly VND 28,308 billion, representing a 14.3% year-over-year growth. The company maintained a healthy capital adequacy ratio of 24.46%, as per regulations.

Source: Home Credit Vietnam

Home Credit Vietnam, one of the earliest foreign-invested consumer finance companies in the country, commenced operations in 2008 with an initial chartered capital of VND 550 billion.

In September 2022, the company significantly increased its chartered capital from VND 550 billion to VND 2,050 billion. The entirety of Home Credit’s capital contribution is owned by PPF Group, a conglomerate controlled by the estate of the late Czech billionaire, Petr Kellner.

Lacking the backing of domestic bank parents (unlike competitors such as FE Credit and VPBank, or HD Saison and HDBank), Home Credit does not benefit from an extensive customer ecosystem or preferential loan capital. Nonetheless, according to market research firms, the company maintains its position as the second-largest consumer lender in Vietnam, following FE Credit, thanks to its long-standing expertise in the industry.

According to Home Credit Vietnam’s official website, the company employs approximately 6,000 staff and serves 16 million customers. Its services encompass providing cash loans as well as installment loans for purchasing motorcycles and consumer goods. Home Credit’s extensive reach includes 16,000 sales points across Vietnam.

On February 28, 2024, Home Credit Group announced the transfer of 100% of its capital contribution in Home Credit Vietnam to The Siam Commercial Bank Public Company Limited (SCB), a member of SCBX Public Company Limited (“SCBX”).

The transfer agreement is valued at approximately EUR 800 million (equivalent to USD 875 million), and the transaction is expected to be finalized in the first half of 2025, pending approvals from relevant authorities in Vietnam and Thailand. This transaction marks the second-largest M&A deal in the Vietnamese consumer finance market, following SMBC’s acquisition of a 49% stake in FE Credit for USD 1.37 billion in 2021.