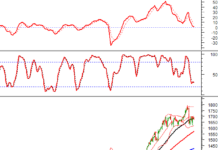

The VN-Index ended August 2024 at 1,283.87, a rise of 32.36 points or 2.59% from July, while market liquidity slightly decreased. The average trading value of the three exchanges reached VND 18,580 billion in August. For matching transactions, the average trading value was VND 16,516 billion, down 4.4% from the July average and 25.6% from the 5-month average.

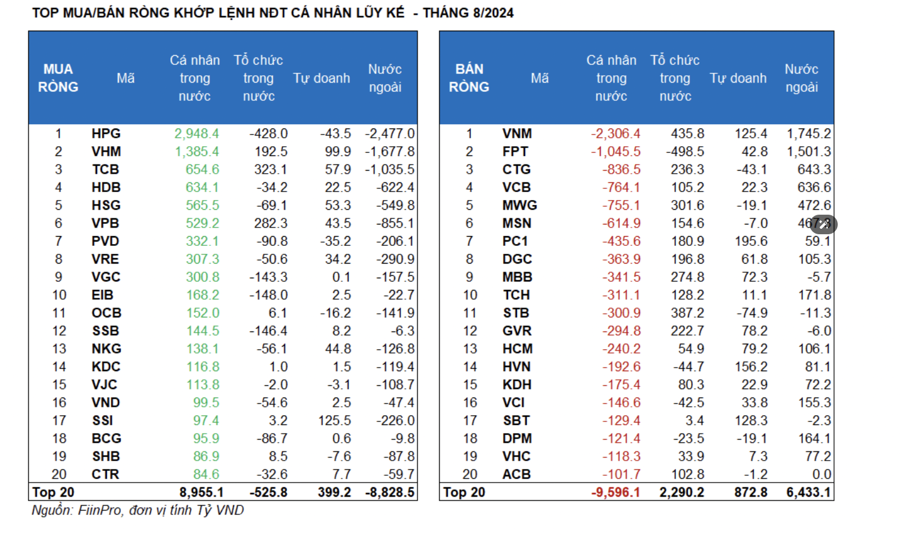

Foreign investors sold a net of VND 3,611.2 billion, and for matching transactions, they sold a net of VND 3,087.8 billion. Their main net buy by matching was in the Food & Beverage and Information Technology sectors. The top net buys by foreign investors by matching included VNM, FPT, CTG, VCB, MWG, MSN, TCH, DPM, VCI, and PLX.

On the net sell side for matching transactions were the Basic Resources group. The top net sells by foreign investors by matching included HPG, VHM, TCB, VPB, HDB, VRE, SSI, PVD, and VIX.

Individual investors sold a net of VND 3,627.6 billion after six consecutive months of net buying, including a net sell of VND 1,128.1 billion for matching transactions. For matching transactions, they net bought 6/18 sectors, mainly Basic Resources. The top net buys by individual investors included HPG, VHM, TCB, HDB, HSG, VPB, PVD, VRE, VGC, and EIB.

On the net sell side for matching transactions, they net sold 12/18 sectors, mainly Food & Beverage and Information Technology. The top net sells included VNM, FPT, CTG, VCB, MWG, MSN, DGC, MBB, and TCH.

Proprietary trading bought a net of VND 1,836.3 billion, and for matching transactions, they bought a net of VND 1,941.5 billion. For matching transactions, proprietary trading net bought 14/18 sectors. The top net buys by proprietary trading for the day included PC1, PNJ, HVN, SBT, SSI, VNM, VHM, FUESSVFL, HCM, and GVR.

The top net sells were in the Oil & Gas sector. The top net sells included STB, HPG, CTG, POW, NHH, APH, PVD, PLX, VIB, and FUEVFVND.

Domestic institutional investors bought a net of VND 5,402.4 billion, and for matching transactions, they bought a net of VND 2,274.4 billion. For matching transactions, domestic institutions net sold 8/18 sectors, with the largest value in Basic Resources. The top net sells included FPT, HPG, EIB, SSB, VGC, PVD, BCG, PNJ, HSG, and BAF.

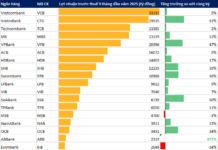

The largest net buy value was in the Banking sector. The top net buys included VNM, STB, TCB, MWG, VPB, MBB, CTG, GVR, DGC, and VHM.

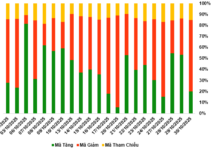

Looking at the time frame, the money flow rate decreased in Banking, Steel, Retail, Chemicals, Construction, Information Technology, Agro-Forestry-Fishery, Textile & Garment, and Electricity while increasing in Real Estate, Securities, Food, Oil & Gas Production, and Personal Items.

Real Estate, Banking, and Securities remained the top three sectors attracting money flow with good price increases in August. However, the money flow rate is recovering from the bottom in Real Estate and Securities, while there is a slight dip in Banking. Retail also had a similar trend to Banking, with a decrease in money flow rate and price increase.

On the other hand, Steel, Construction, Agro-Forestry-Fishery, Textile & Garment, and Electricity recorded a decrease in money flow rate along with price declines. Notably, Construction reached a 15-month low in money flow rate (since June 2023).

In terms of capitalization, the money flow rate improved for the fourth consecutive month in the large-cap group VN30 and slightly increased in the mid-cap group VNMID. In contrast, it decreased sharply in the small-cap group VNSML.

The money flow rate in the large-cap group VN30 reached 49.6% in August 2024, the highest monthly level since January 2022. However, there is a gradual downward trend when looking at the weekly frame. The mid-cap group VNMID saw a slight improvement from 37.2% in July to 38.4% in August. Conversely, the money flow rate in the small-cap group VNSML dropped significantly to 9.4%, compared to 11.7% in the previous month.

Regarding the size of the money flow, the average trading value decreased sharply in the small-cap group VNSML (-VND 428 billion/-21.5%) while increasing slightly in the large-cap group VN30 (+VND 370 billion/+4.7%) and the mid-cap group VNMID (+VND 50 billion/+0.8%).

In terms of price movements, the VN30 and VNMID indices rose by 2.5% and 2.21% in August, respectively, while the VNSML index went against the market, falling by 1.79%.

The Stock Market Sheds its ‘Green on the Outside, Red on the Inside’ Complex

Closing out the final week of August, the VN-Index ended on a positive note, painted in green. The market lacked a strong, leading sector to push it forward, and thus, it missed the old peak of 1,300 points as we entered the 2nd of September holiday period.