The years 2017-2021 marked a rapid growth period for Vietnam’s corporate bond market, with issuance peaking in 2020-2021. The volume of issuance reached a staggering peak of VND 637 trillion (USD 28 billion) in 2021. However, by mid-2022, fundamental weaknesses in the market began to surface, culminating in criminal proceedings related to violations in 2023-2024.

Information disclosed by the authorities and on the Hanoi Stock Exchange’s website revealed that all legal violations and delays in principal and interest payments involved privately placed corporate bonds.

According to experts, when the supply side (issuing companies) focuses on private placements of corporate bonds, and the demand side (investors) consists predominantly of inexperienced individuals, coupled with inadequate market infrastructure, particularly information infrastructure, and an insufficient supervisory mechanism, it creates a fertile ground for manipulative and fraudulent activities.

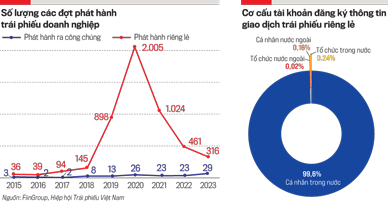

Market analysis reports indicate that during the period of 2019-2023, there were, on average, only 23 public issuances of bonds per year (VND 24 trillion) compared to private placements, which were over 40 times higher, with an average of approximately 938 private placements per year (VND 383 trillion). Before 2023, public issuances of corporate bonds accounted for only 3-5% of the total number of corporate bond issuances. In 2023, this ratio improved significantly, with public issuances constituting 11% of the total.

FILTERING OUT WEAK AND NON-TRANSPARENT ISSUING ORGANIZATIONS

Mr. Ketut Ariadi Kusuma, a senior finance specialist at the World Bank, analyzed: “The nature of the private placement market restricts information disclosure and investor protection, especially for retail investors. Therefore, Vietnam’s Securities Law limits this market to professional investors. In contrast, public offerings of bonds require approval from state management agencies to ensure adequate information disclosure.”

Experts attribute the dominance of private placements of corporate bonds to two main reasons: first, the complex and time-consuming procedures for listing and issuing bonds to the public, which can take anywhere from 6 months to a year; and second, the issuing organizations themselves prefer private placements to avoid information disclosure and transparency.

Following the exposure of violations in the corporate bond market, the Ministry of Finance advised the government to issue Decree No. 65/2022/ND-CP, which imposed stricter conditions and requirements on private placements of corporate bonds, particularly those sold to individual investors, with tighter information disclosure requirements.

Mr. Ketut Ariadi Kusuma considers these steps positive but believes more needs to be done to promote the market’s healthy development. He recommends the following actions: enhancing the criteria for determining professional investors and their application, expanding the use of credit ratings, encouraging the development of public investment funds to aggregate retail investors and promote market professionalism, optimizing the public issuance channel, and enhancing transparency in information disclosure before and after transactions.”

Mr. Do Ngoc Quynh, Secretary-General of the Vietnam Bond Market Association, emphasized that while credit ratings are essential, they are not the sole factor in ensuring transparency in the corporate bond market.

According to experts, the market’s development hinges more on the quality of issuing organizations in terms of corporate governance and information disclosure than on their quantity. A high number of low-quality issuing organizations can be counterproductive to market development, as it increases the risk of manipulation, price distortion, abuse, and loss of trust.

To promote the market’s healthy development, the following actions are recommended: enhancing the criteria for determining professional investors and their application, expanding the use of credit ratings, encouraging the development of public investment funds to aggregate retail investors and promote market professionalism, optimizing the public issuance channel, and enhancing transparency in information disclosure before and after transactions.

Along with measures to enhance information disclosure and independent assessment of enterprises, Mr. Do Ngoc Quynh stressed the need to promptly improve and strengthen the effectiveness of the Bankruptcy Law to allow the bond market to operate based on the principle of natural selection.

In 2023, amidst a crisis of confidence in the corporate bond market and the broader financial market, the government promptly issued Decree No. 08/2023/ND-CP to provide a framework for corporate bond restructuring and prevent more significant disruptions that could affect financial market stability. However, experts believe that this is only a temporary solution, and long-term measures are now necessary for the market’s sustainable development.

According to Mr. Do Ngoc Quynh, individual investors have been forced to accept negotiations for extensions on principal and interest payments because they lack a clear understanding of their legal recourse: “If they do not agree to the extension, how can they take legal action against the enterprise?”

“If we continue to grant extensions to enterprises that cannot recover, the situation may worsen. In other countries, when an enterprise loses its ability to pay, it must be made public, and a creditors’ committee is formed, or an independent organization is hired to assess the enterprise’s difficulties and determine whether to grant protection or allow bankruptcy,” Mr. Quynh explained.

According to the Vietnam Securities Depository (VSDC), as of the end of July 2024, there were 190,862 investor accounts in the secondary market for privately placed corporate bonds. Among these, domestic individual investor accounts accounted for 99.6%, or 190,034 accounts, followed by foreign individuals, while institutional investors (both domestic and foreign) accounted for only 0.26%.

Experts caution that if the market remains predominantly controlled by individual investors, it will be susceptible to significant fluctuations due to three main reasons: (i) investors’ lack of capacity to assess bonds, manage risks, and their vulnerability to exploitation; (ii) short-term investment horizons; and (iii) herd behavior.

THREE CONSIDERATIONS FOR REVISING REGULATIONS ON PROFESSIONAL INVESTORS

Reflecting on the state of the corporate bond market in recent years, analysts assert that numerous individual investors have been taken advantage of by weak and non-transparent issuing organizations, with the complicity of intermediaries such as securities companies and commercial banks.

While the Securities Law restricts access to privately placed bonds, gaps in the definition and practical application of professional investors have allowed a large volume of privately placed bonds to be sold to individual investors who may not fully comprehend the associated risks or have the capacity to absorb potential losses. Consequently, when significant fraud and misconduct were uncovered in mid-2022, investor confidence plummeted, leading to a market downturn.

Individual investors can be categorized into two groups: retail and professional. Vietnamese law currently permits only professional individual investors to purchase privately placed corporate bonds. Therefore, the criteria for classifying professional individual investors need to be clarified to prevent misclassification and protect investors.

The full content of this article was published in the Vietnam Economic Magazine, Issue 36-2024, released on September 2, 2024. We invite our esteemed readers to access the full article at the following link: https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-kinh-te-viet-nam

Corporate Bonds: The Elephant in the Room

An estimated 40% of high-risk corporate bonds defaulted on their principal payments in August 2024. What’s even more notable is that the majority of these bonds were privately issued, and the key investors were credit institutions and securities companies. To achieve the goal of expanding the corporate bond market to 30% of GDP by 2030, certain priorities must be addressed first and foremost.

Corporate Bonds: Back on the ‘Fast Track’

The corporate bond market is finding its feet again, with a surge in capital raising and much-needed debt restructuring from previous issuances. The market supply is heating up with a diverse range of issuances across different corporate structures. However, bond buyers, especially individual investors, still face significant risks.

The Final Word from the Former HOSE Leadership: A Helping Hand for Mr. Trinh Van Quyet?

In the FLC Group scandal, 50 individuals were indicted, including 7 former leaders from Ho Chi Minh City Stock Exchange, the State Securities Commission, and the Vietnam Securities Depository Center. In their final statements, they expressed remorse for their failures to fulfill their duties and for their lack of awareness.

“Police Requested to Verify Accusations of Bond Issuance Fraud Against DXS by DXG.”

Following allegations made by a group of investors accusing the Real Estate Service Joint Stock Company (HOSE: DXS) of violating agreements related to bond issuances, the DXG Corporation (HOSE: DXG), the parent company of DXS, has taken proactive steps by submitting a document to the investigating authorities, requesting a thorough investigation into the matter.