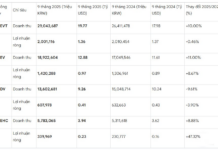

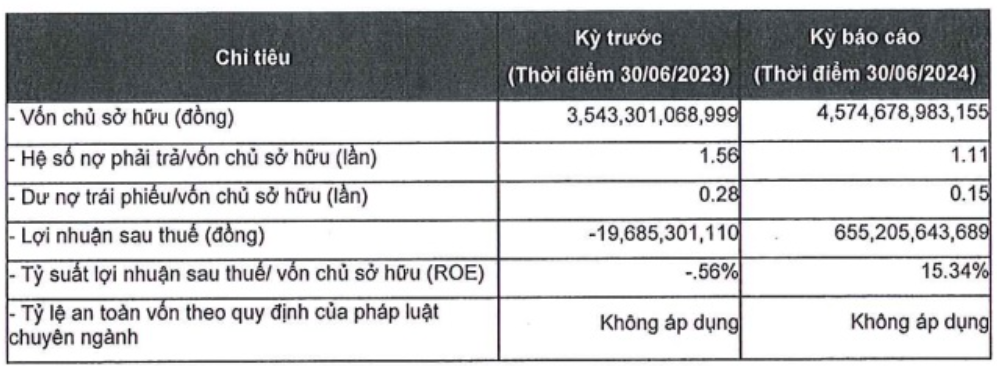

GreenFeed Vietnam announces its semi-annual financial report for 2024, reporting a remarkable turnaround with a profit of over 655 billion VND, a significant improvement from the 20 billion VND loss in the same period last year. This figure even surpasses the company’s full-year profits for 2023 (438 billion VND) and 2022 (419 billion VND).

As of the end of Q2 2024, GreenFeed Vietnam’s equity capital stood at 4,574 billion VND, an increase of over 1,000 billion VND from the previous year, mainly due to improved profitability. The debt-to-equity ratio was 1.11, corresponding to total liabilities of nearly 5,100 billion VND. Total assets amounted to nearly 9,700 billion VND.

Of this, the bond debt stood at 700 billion VND for the GFVCH212800 bond series (with a total value of 1,000 billion VND, a term of 84 months, and a maturity date of June 15, 2028).

Image: GreenFeed’s surprising turnaround in the first half of 2024.

In the market, while not as prominent or expansive as C.P. Group or Masan MEATLife, GreenFeed has a long-standing presence in the animal feed industry and has been operationally efficient. The company was founded by entrepreneur Ly Anh Dung.

Established in 2003, GreenFeed specializes in animal feed, producing feed for livestock, poultry, and aquaculture. Today, GreenFeed operates 10 factories in Vietnam, Cambodia, Myanmar, and Laos, with a total capacity of over 2 million tons of products per year.

In addition to its feed business, the company has ventured into livestock farming and invested $50 million in building a network of pig breeding farms. To complete the 3F chain, in 2018, GreenFeed inaugurated the Dong Nai Food Processing Factory, officially closing the loop on its clean food chain.

Also, in 2018, GreenFeed founded the food company Feddy, introducing the G brand of chilled meat products. Within a year, Feddy launched over 90 chilled meat and processed food products, available in more than 3,000 outlets nationwide and through e-commerce channels.

The G Kitchen brand, in particular, has made its mark in the market and is now present in 38,000 outlets, including supermarkets, convenience stores, and e-commerce platforms. In early 2021, GreenFeed introduced another pork brand, Mamachoice, followed by the WYN food brand.

GreenFeed Vietnam currently owns a system of 10 modern animal feed factories in Vietnam, Laos, Cambodia, and Myanmar, enabling the company to supply millions of tons of animal feed to the market annually.

In 2021, GreenFeed Vietnam ranked among the top 100 largest animal feed producers globally by WATT Global Media and was among the top 5 in Vietnam in 2023, according to Vietnam Report, with a capacity to supply 2.5 million tons of animal feed to the market yearly. The company manages a pig herd of up to 120,000 sows and is the only Vietnamese representative in the World Mega Producer ranking of the top 49 global pig producers (ranked 37th).

Also, in 2021, the company successfully raised 1,000 billion VND in bonds from the International Finance Corporation (IFC). The collateral included 100% of the charter capital of GreenFarm Co., Ltd. and LinkFarm Co., Ltd. (both owned by GreenFeed), along with all related or generated rights and benefits.

Before June 2022, GreenFeed Vietnam had a charter capital of 1,000 billion VND. The list of shareholders included: Oriental Ford Holding Co., Ltd. (Hong Kong, China), contributing 176.3 billion VND and holding 50.6% of the shares; and GreenFeed (Thailand) contributing 9.5 billion VND, holding 2.7% of the shares. The remaining shares were not disclosed.

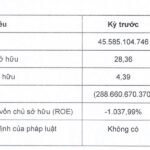

“Struggling Cinema Chain: Galaxy Cinema’s Losses Continue in First Half of 2024, Leaving Only $77,000 in Shareholder Equity”

In the first half of 2024, Galaxy Entertainment and Education Joint Stock Company (Galaxy EE) continued to incur losses. However, what’s noteworthy is the company’s equity position.