Uncertainty

Clouds

Hoang Anh Gia Lai Agriculture International JSC (HAGL Agrico – stock code: HNG) has released its reviewed semi-annual financial statement for 2024. The report shows that HAGL Agrico’s revenue was over VND 147 billion, a 47% decrease compared to the same period last year, with a post-tax loss of more than VND 363 billion, while the same period last year saw a loss of VND 247 billion.

HAGL Agrico has incurred a cumulative loss of VND 8,465 billion, and its short-term debt has exceeded its short-term assets.

Ernst & Young Vietnam, HAGL Agrico’s auditing firm, reported that as of June 30, the company had incurred a cumulative loss of VND 8,465 billion, and its short-term debt had exceeded its short-term assets by VND 10,345 billion. The auditors expressed concern about the company’s ability to continue operating due to these factors.

HAGL Agrico attributed the disappointing results for the first half of the year to a decrease in revenue from its fruit tree and rubber tree segments. The fruit tree segment generated only VND 87 billion in revenue, a 54% decrease from the previous year, with a production volume of 7,193 tons. Meanwhile, the rubber tree segment’s revenue was VND 58 billion, with a production volume of 1,721 tons, mainly due to a lack of rubber tappers.

To improve its financial situation, HAGL Agrico is focusing on projects that ensure operational cash flow, restructuring some debts, and negotiating with stakeholders to resolve outstanding payments. The company is also working to regain land-use certificates for projects in Laos and Cambodia to facilitate legal investment procedures and attract capital for its initiatives.

LDG Investment JSC (stock code: LDG) also faced doubts about its ability to continue operating, as indicated in its semi-annual financial statement for 2024, audited by Moore AISC Audit and IT Services Company Limited.

Following the audit, LDG’s reported loss increased by approximately VND 100 billion compared to its self-prepared statement, rising from VND 296 billion to VND 396 billion. This increase in loss was primarily due to a 573% surge in business management expenses, resulting in an additional VND 116 billion in costs.

LDG Investment JSC’s semi-annual financial statement for 2024 highlighted four key issues.

LDG explained that the increase in loss after the audit was due to the auditor’s adjustment for additional provisions for doubtful accounts receivable. Moore AISC Audit and IT Services Company Limited also emphasized several issues in LDG’s semi-annual financial statement for 2024.

Firstly, the Tan Thinh Residential Area project had a balance of nearly VND 517 billion as of June 30. LDG committed to completing the necessary procedures in accordance with the laws on land, real estate business, and construction, based on the conclusion of the inspection on March 23, 2023, regarding the comprehensive inspection of the Tan Thinh Residential Area project, to continue implementing and completing the project.

On July 22, the People’s Court of Dong Nai Province decided to initiate bankruptcy proceedings against LDG.

This case is related to Mr. Nguyen Khanh Hung, the former Chairman of LDG’s Board of Directors, who has been arrested and detained for investigating allegations of “deceiving customers” related to the Tan Thinh Residential Area project.

Furthermore, the auditing firm noted the existence of a material uncertainty that may cast significant doubt on LDG’s ability to continue operating.

In the first half of 2024, LDG recorded a negative revenue of nearly VND 150 billion compared to a positive revenue of VND 1.04 billion in the same period last year. The company’s post-tax profit showed a loss of VND 396 billion, compared to a loss of VND 144 billion in the previous year. As of June 30, LDG’s cumulative profit shifted from a profit of VND 118 billion at the beginning of the year to a loss of VND 278 billion.

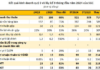

Cumulative Losses in Trillions

Hoang Anh Gia Lai JSC (stock code: HAG) made an additional profit of VND 500 billion in the first half of 2024 but still incurred a cumulative loss and used short-term capital to finance long-term assets.

Hoang Anh Gia Lai JSC is using short-term capital to finance long-term assets.

Ernst & Young Vietnam audited Hoang Anh Gia Lai’s semi-annual financial statement for 2024 and highlighted that as of June 30, HAG had a cumulative loss of VND 957 billion, and its short-term debt exceeded its short-term assets by more than VND 350 billion.

“These conditions, along with other matters described in note 2.6, indicate the existence of a material uncertainty that may cast significant doubt on Hoang Anh Gia Lai’s ability to continue as a going concern,” Ernst & Young Vietnam emphasized.

In the notes to the audited semi-annual financial statement for 2024, as of June 30, Hoang Anh Gia Lai had not repaid the principal and interest payments due on its loans, totaling over VND 789 billion and VND 7.7 billion, respectively. Additionally, the company had not paid the due interest on its bonds, totaling over VND 3,277 billion.

Hoang Anh Gia Lai stated that as of June 30, the company had prepared a business plan for the next 12 months, including expected cash flow from the partial liquidation of financial investments, asset disposals, recovery of loans from partners, borrowing from commercial banks, and cash flow generated from ongoing projects.

HAG is in the process of negotiating with lenders to adjust the terms of its loan and bond agreements and restructure some overdue debts. Meanwhile, its pig and banana businesses continue to generate significant cash flow this year.

In the first half of the year, Hoang Anh Gia Lai recorded a revenue of VND 2,762 billion, a 12% decrease from the previous year, and a post-tax profit of VND 500 billion, a nearly 30% increase compared to the same period last year.

AFC Vietnam Audit Firm identified the existence of material uncertainties that may raise doubts about HBC’s ability to continue operating.

AFC Vietnam Audit Firm audited the semi-annual financial statement for 2024 of Hoa Binh Construction Group Joint Stock Company (stock code: HBC) and emphasized that while HBC returned to profitability with a profit of nearly VND 897 billion in the first half of 2024, it still had a cumulative loss of VND 1,504 billion and some overdue debts.

“These signs indicate the existence of material uncertainties that may raise doubts about the ability of Hoa Binh Construction Group to continue as a going concern,” AFC Vietnam Audit Firm stated.

In the first half of 2024, HBC recorded a revenue of VND 3,606 billion, a 6% increase from the previous year, and a post-tax profit of nearly VND 897 billion. However, the significant profit was mainly due to a surge in financial revenue, a negative business management expense, and a substantial increase in other income.

“Dragon Village Announces Net Profit of Over VND 68.8 Billion for the First Half of 2024; Debt Stands at 6.7 Times Equity”

In the first half of 2024, Dragon Village reported a net profit of over VND 68.8 billion, almost 3.9 times higher than the same period last year. This impressive growth showcases the village’s thriving economy and promising future prospects.